Television broadcasting and production company AMC Networks (NASDAQ: AMCX) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales fell 5.9% year on year to $599.6 million. Its non-GAAP profit of $0.91 per share was also 41.1% above analysts’ consensus estimates.

Is now the time to buy AMC Networks? Find out by accessing our full research report, it’s free.

AMC Networks (AMCX) Q3 CY2024 Highlights:

- Revenue: $599.6 million vs analyst estimates of $587.1 million (2.1% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.64 (41.1% beat)

- EBITDA: $103.3 million vs analyst estimates of $91.87 million (12.4% beat)

- Gross Margin (GAAP): 52%, down from 55.3% in the same quarter last year

- Operating Margin: 0%, down from 19% in the same quarter last year

- EBITDA Margin: 17.2%, down from 25.9% in the same quarter last year

- Free Cash Flow Margin: 9%, down from 15.6% in the same quarter last year

- Market Capitalization: $368.2 million

Chief Executive Officer Kristin Dolan said: "As we manage this business within a complex and changing environment, we remain focused on our key strategic pillars - programming, partnerships and profitability. During the quarter, we made significant advancements across all three areas. We have generated $293 million of free cash flow year to date and are well on our way to delivering our stated goal of approximately half a billion dollars in cumulative free cash over two years. We also entered into new and enhanced partnerships with major companies like Charter, Netflix, Amazon and others which are driving our company forward as we continue to provide distinctive, high-quality programming to customers across an expanding array of platforms."

Company Overview

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ: AMCX) is a broadcaster producing a diverse range of television shows and movies.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Sales Growth

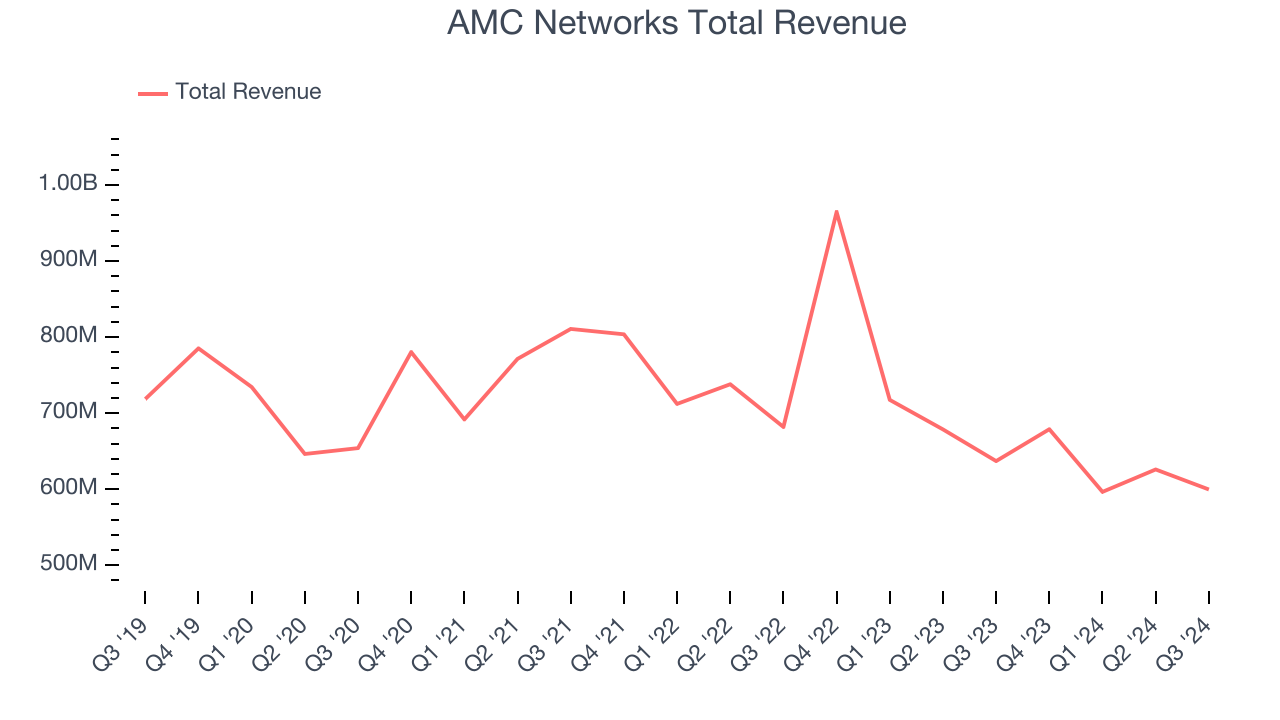

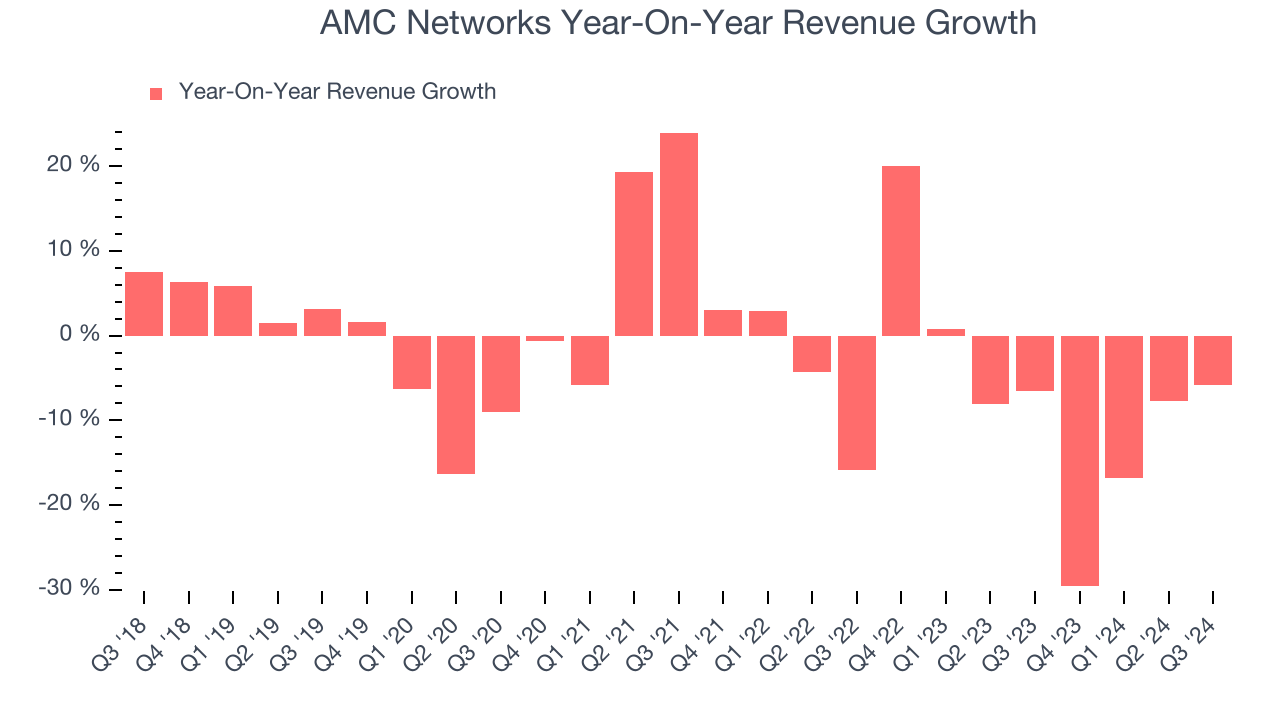

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. AMC Networks struggled to generate demand over the last five years as its sales dropped by 3.9% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. AMC Networks’s recent history shows its demand has stayed suppressed as its revenue has declined by 7.7% annually over the last two years.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Affiliate and Advertising, which are 27.4% and 22.2% of revenue. Over the last two years, AMC Networks’s Affiliate revenue (retransmission and licensing fees) averaged 12.1% year-on-year declines while its Advertising revenue (marketing services) averaged 15.4% declines.

This quarter, AMC Networks’s revenue fell 5.9% year on year to $599.6 million but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to decline 2.6% over the next 12 months. Although this projection is better than its two-year trend it's tough to feel optimistic about a company facing demand difficulties.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

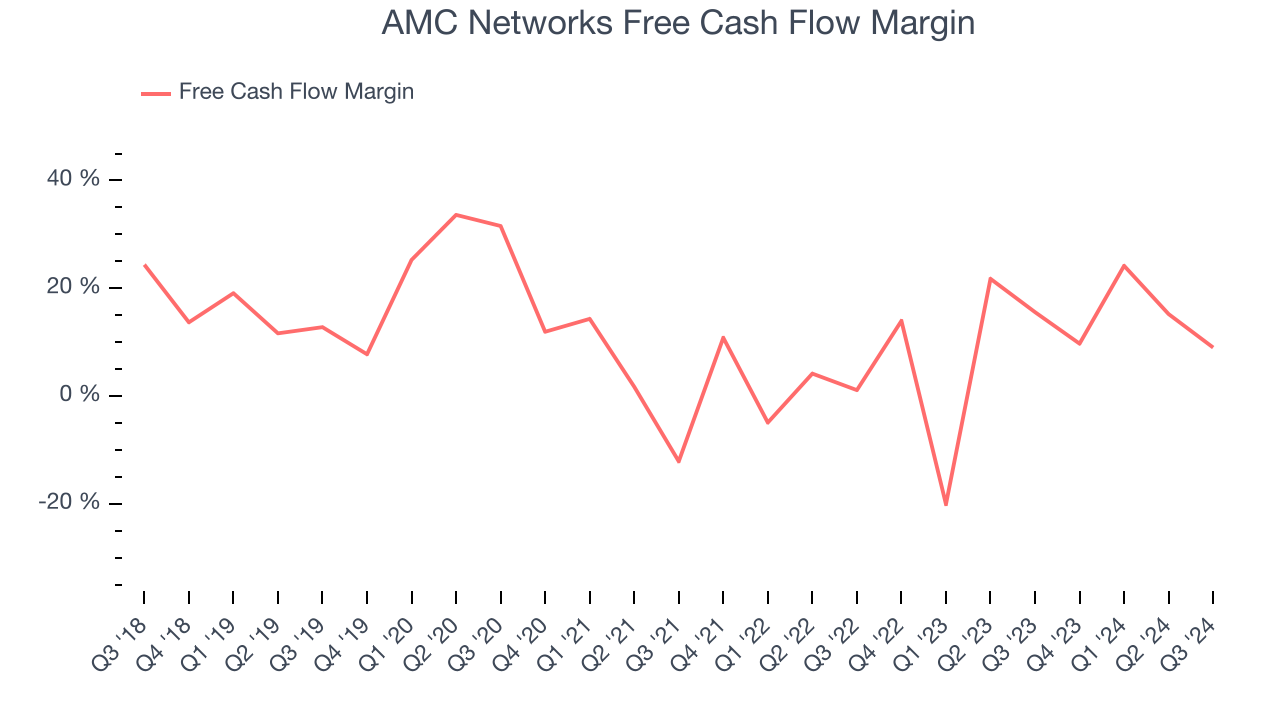

AMC Networks has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.8% over the last two years, slightly better than the broader consumer discretionary sector.

AMC Networks’s free cash flow clocked in at $53.94 million in Q3, equivalent to a 9% margin. The company’s cash profitability regressed as it was 6.6 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict AMC Networks’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.4% for the last 12 months will decrease to 10.7%.

Key Takeaways from AMC Networks’s Q3 Results

We were impressed by how significantly AMC Networks blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this print featured some important positives. The stock traded up 4.7% to $8.75 immediately after reporting.

AMC Networks put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.