Theme park operator United Parks & Resorts (NYSE: PRKS) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $545.9 million. Its GAAP profit of $2.08 per share was 6.5% below analysts’ consensus estimates.

Is now the time to buy United Parks & Resorts? Find out by accessing our full research report, it’s free.

United Parks & Resorts (PRKS) Q3 CY2024 Highlights:

- Revenue: $545.9 million vs analyst estimates of $550.5 million (in line)

- EPS: $2.08 vs analyst expectations of $2.22 (6.5% miss)

- EBITDA: $258.4 million vs analyst estimates of $266.4 million (3% miss)

- Gross Margin (GAAP): 54.6%, in line with the same quarter last year

- Operating Margin: 36.8%, in line with the same quarter last year

- EBITDA Margin: 47.3%, down from 48.6% in the same quarter last year

- Free Cash Flow Margin: 12.4%, down from 13.7% in the same quarter last year

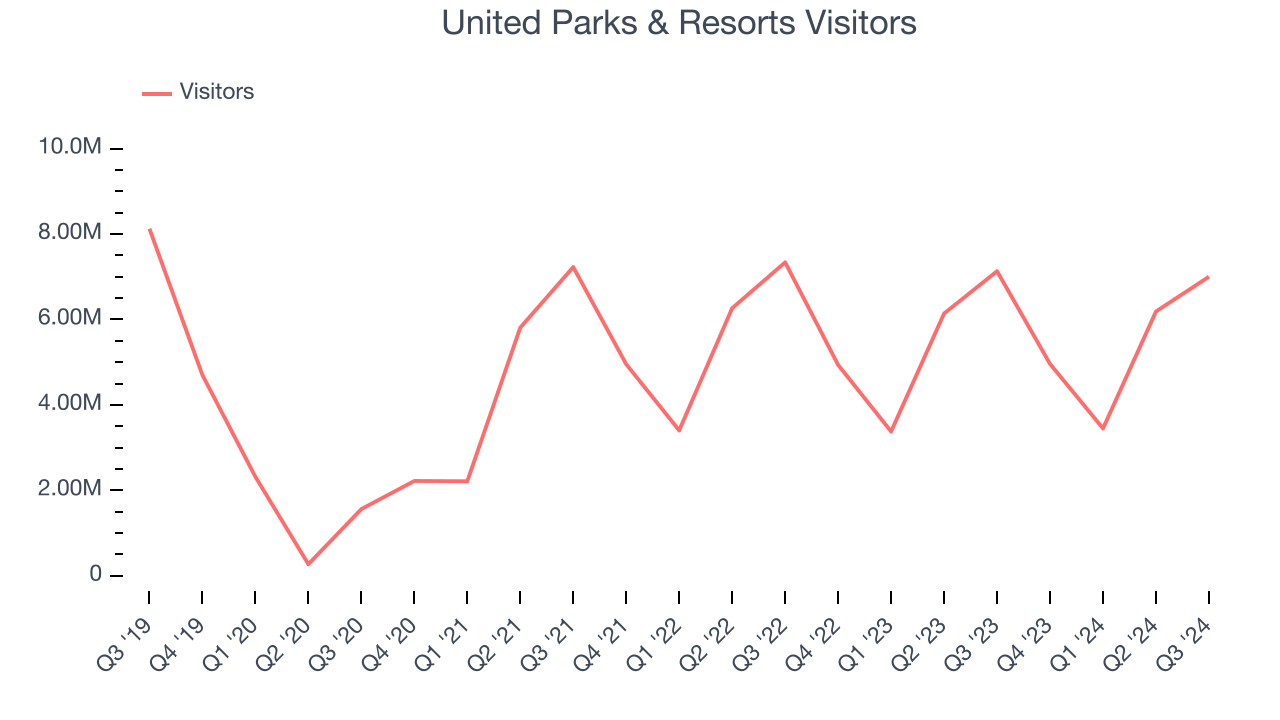

- Visitors: 7 million, down 129,000 year on year

- Market Capitalization: $3.29 billion

"We are pleased to report another quarter of solid financial results, said Marc Swanson, Chief Executive Officer of United Parks & Resorts Inc. "Third quarter results were impacted by both a negative calendar shift and meaningfully worse weather, including Hurricane Debby in August and Hurricane Helene in September.

Company Overview

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE: PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

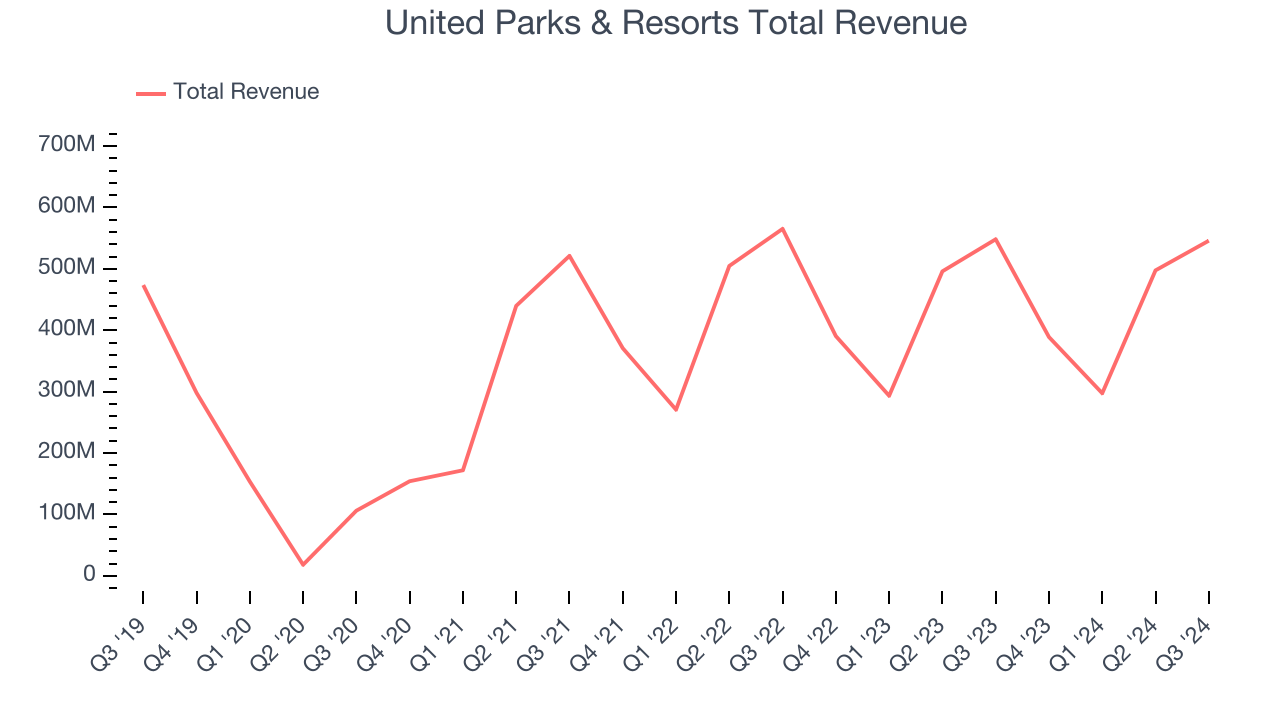

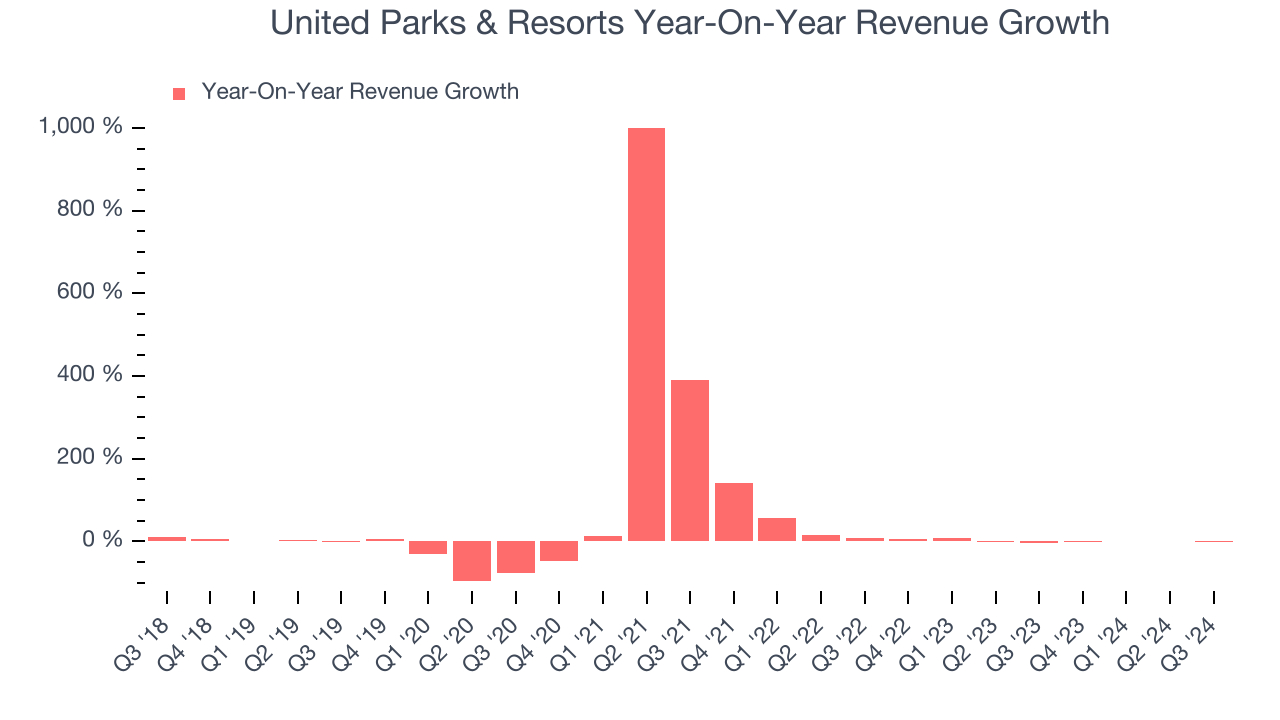

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, United Parks & Resorts grew its sales at a sluggish 4.6% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. United Parks & Resorts’s recent history shows its demand slowed as its revenue was flat over the last two years. Note that COVID hurt United Parks & Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its number of visitors, which reached 7 million in the latest quarter. Over the last two years, United Parks & Resorts’s visitors were flat. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, United Parks & Resorts’s $545.9 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, an improvement versus the last two years. Although this projection shows the market thinks its newer products and services will spur better performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

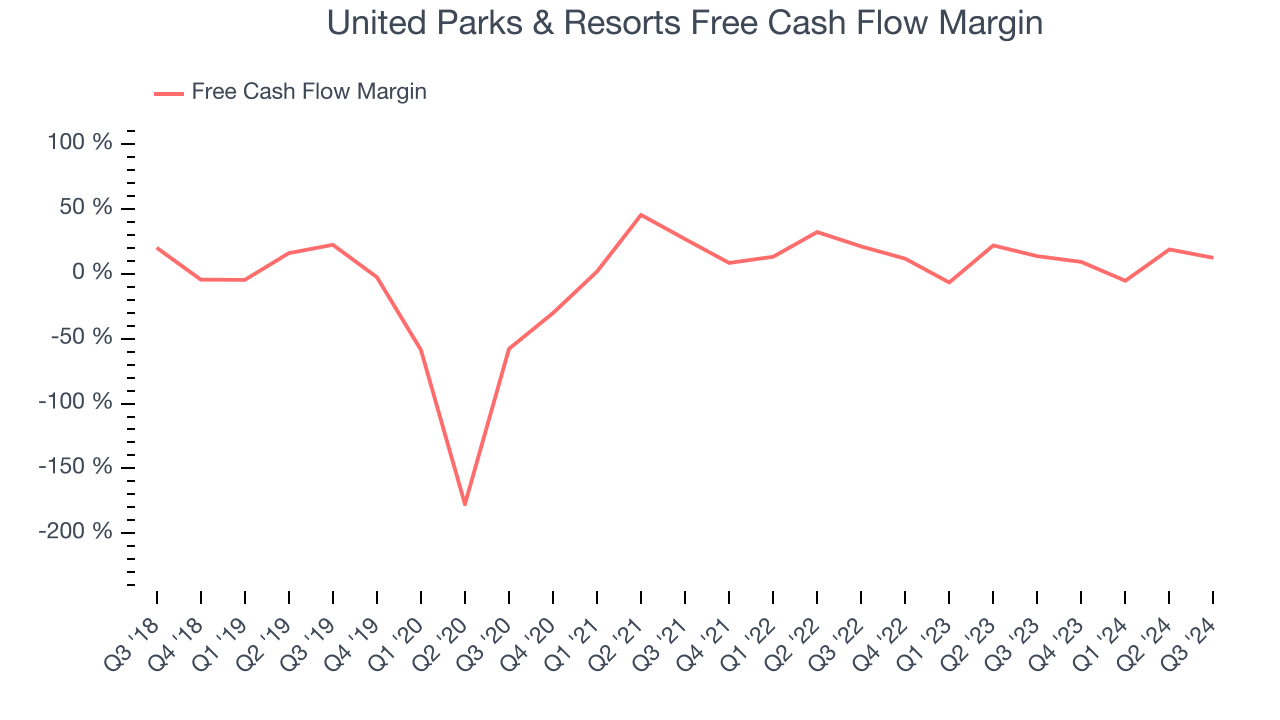

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

United Parks & Resorts has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.3% over the last two years, slightly better than the broader consumer discretionary sector.

United Parks & Resorts’s free cash flow clocked in at $67.61 million in Q3, equivalent to a 12.4% margin. The company’s cash profitability regressed as it was 1.3 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Key Takeaways from United Parks & Resorts’s Q3 Results

We struggled to find many strong positives in these results as its number of visitors, EBITDA, and EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.2% to $55.57 immediately following the results.

United Parks & Resorts’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.