Shoe and apparel company Steven Madden (NASDAQ: SHOO) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 13% year on year to $624.7 million. Its non-GAAP profit of $0.91 per share was also 2.8% above analysts’ consensus estimates.

Is now the time to buy Steven Madden? Find out by accessing our full research report, it’s free.

Steven Madden (SHOO) Q3 CY2024 Highlights:

- Revenue: $624.7 million vs analyst estimates of $614.4 million (1.7% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.89 (2.8% beat)

- EBITDA: $79.75 million vs analyst estimates of $87.59 million (9% miss)

- Management raised its full-year Adjusted EPS guidance to $2.65 at the midpoint, a 1.7% increase

- Gross Margin (GAAP): 41.5%, in line with the same quarter last year

- Operating Margin: 11.9%, down from 15% in the same quarter last year

- EBITDA Margin: 12.8%, down from 15.8% in the same quarter last year

- Free Cash Flow was -$6.93 million compared to -$10.61 million in the same quarter last year

- Market Capitalization: $3.21 billion

Edward Rosenfeld, Chairman and Chief Executive Officer, commented, “We delivered strong results in the third quarter, with revenue and Adjusted earnings exceeding expectations. This performance was driven by outstanding growth in the accessories and apparel categories – including another quarter of exceptional performance in Steve Madden handbags and a strong contribution from newly acquired Almost Famous – and robust top line gains in international markets and direct-to-consumer channels, demonstrating our team’s strong execution of our key strategic initiatives. Based on these results, we are raising our guidance for 2024 revenue and Adjusted earnings.”

Company Overview

As seen in the infamous Wolf of Wall Street movie, Steven Madden (NASDAQ: SHOO) is a fashion brand famous for its trendy and innovative footwear, appealing to a young and style-conscious audience.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

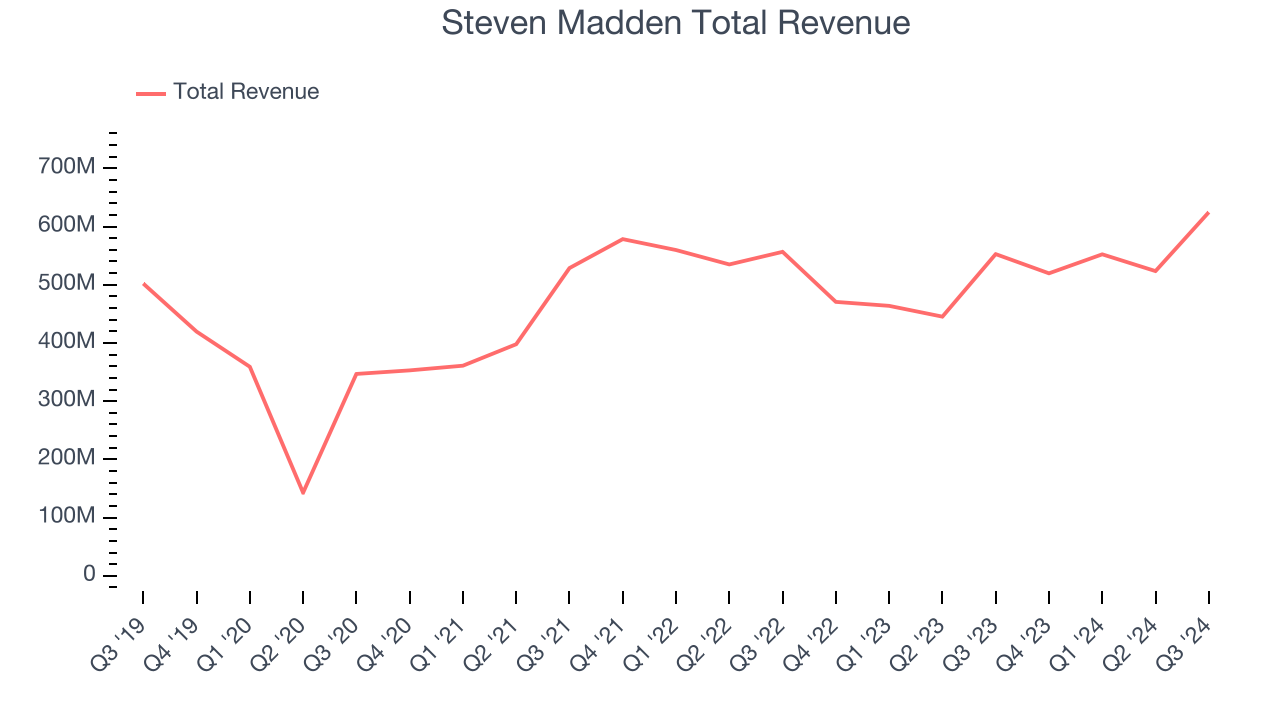

Sales Growth

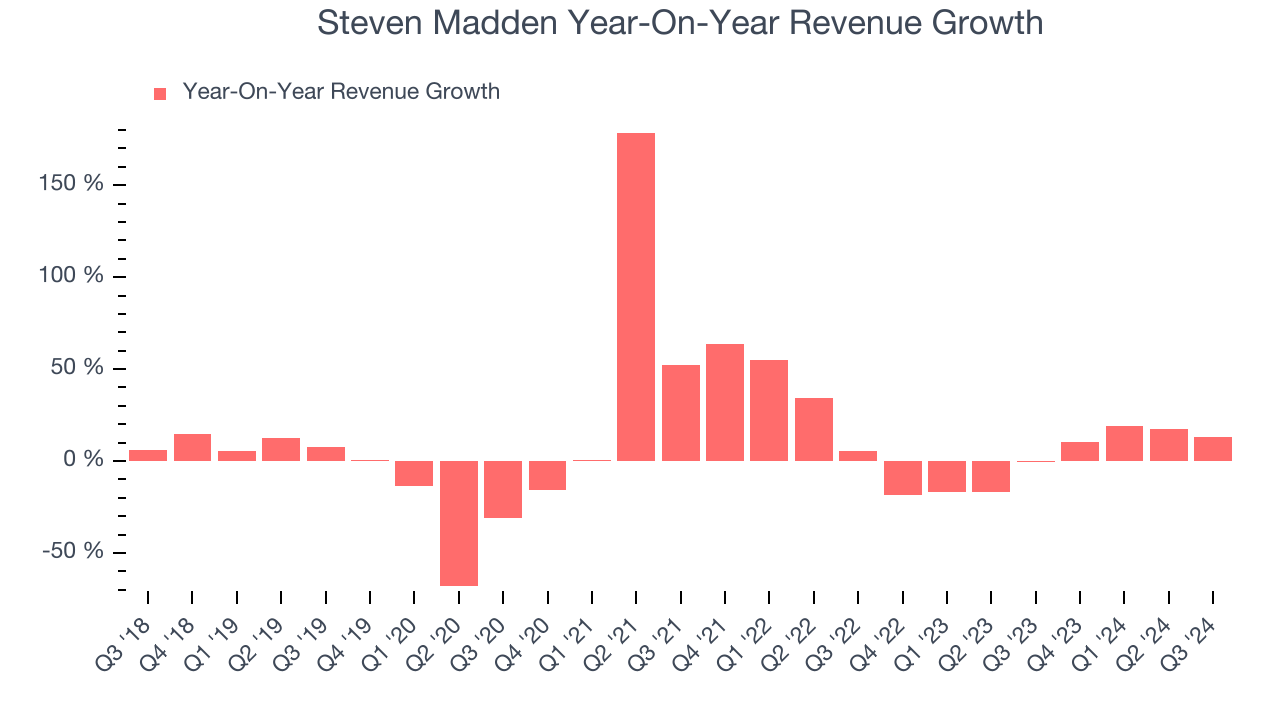

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Steven Madden’s 4.5% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Steven Madden’s recent history shows its demand slowed as its revenue was flat over the last two years.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 79.4% and 20.1% of revenue. Over the last two years, Steven Madden’s Wholesale revenue (sales to retailers) was flat while its Retail revenue (direct sales to consumers) averaged 1.3% year-on-year growth.

This quarter, Steven Madden reported year-on-year revenue growth of 13%, and its $624.7 million of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, an improvement versus the last two years. Although this projection indicates the market thinks its newer products and services will catalyze better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

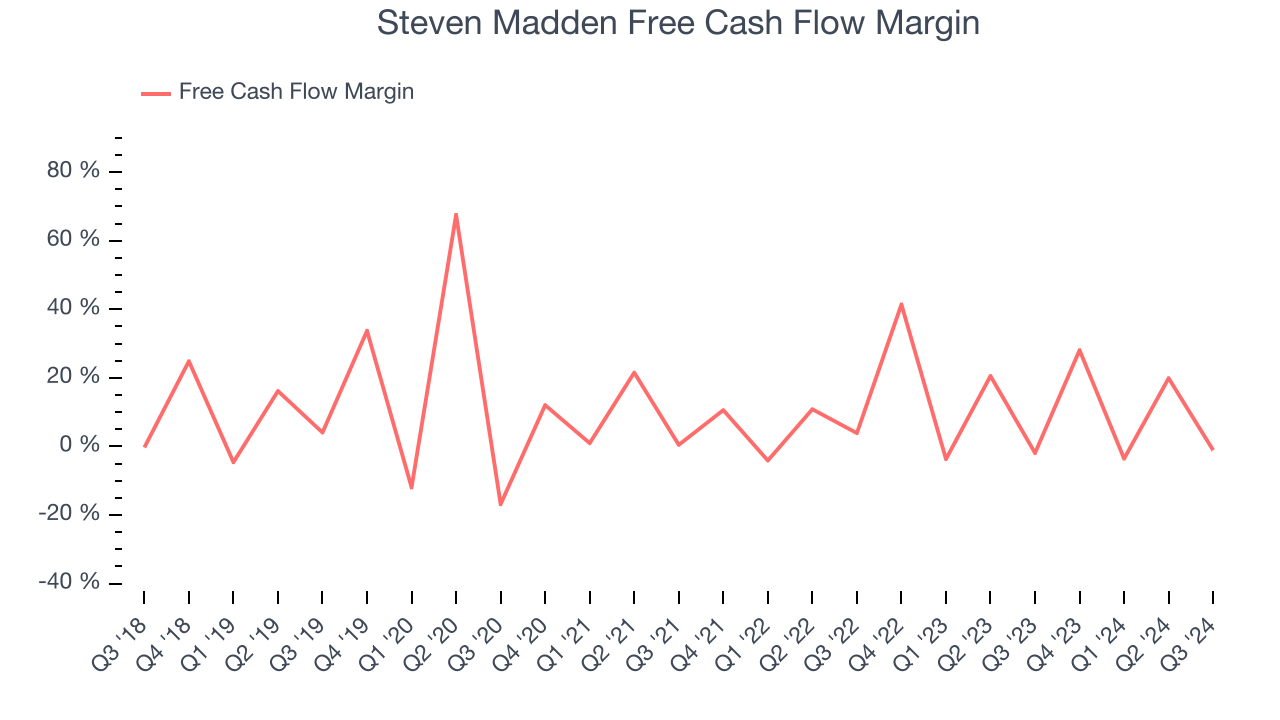

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Steven Madden has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.6% over the last two years, slightly better than the broader consumer discretionary sector.

Steven Madden burned through $6.93 million of cash in Q3, equivalent to a negative 1.1% margin. The company’s cash burn was similar to its $10.61 million of lost cash in the same quarter last year . These numbers deviate from its longer-term margin, raising some eyebrows.

Over the next year, analysts predict Steven Madden’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 10.1% for the last 12 months will increase to 14.3%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Steven Madden’s Q3 Results

It was good to see Steven Madden beat analysts’ revenue and EPS expectations this quarter. We were also glad it raised its full-year EPS guidance On the other hand, its EBITDA missed. Overall, this was a mixed quarter. The stock remained flat at $44.20 immediately following the results.

So do we think Steven Madden is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.