Financial and compliance reporting software company Workiva (NYSE: WK) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 17.4% year on year to $185.6 million. Guidance for next quarter’s revenue was better than expected at $195 million at the midpoint, 1.4% above analysts’ estimates. Its non-GAAP profit of $0.21 per share was 9.1% below analysts’ consensus estimates.

Is now the time to buy Workiva? Find out by accessing our full research report, it’s free.

Workiva (WK) Q3 CY2024 Highlights:

- Revenue: $185.6 million vs analyst estimates of $182.6 million (1.7% beat)

- Adjusted EPS: $0.21 vs analyst expectations of $0.23 (9.1% miss)

- Adjusted Operating Income: $7.58 million vs analyst estimates of $7.06 million (7.3% beat)

- Revenue Guidance for Q4 CY2024 is $195 million at the midpoint, above analyst estimates of $192.4 million

- Adjusted EPS guidance for the full year is $0.95 at the midpoint, missing analyst estimates by 1.5%

- Gross Margin (GAAP): 76.5%, in line with the same quarter last year

- Operating Margin: -11.7%, down from -9.8% in the same quarter last year

- Free Cash Flow was $18.66 million, up from -$122,000 in the previous quarter

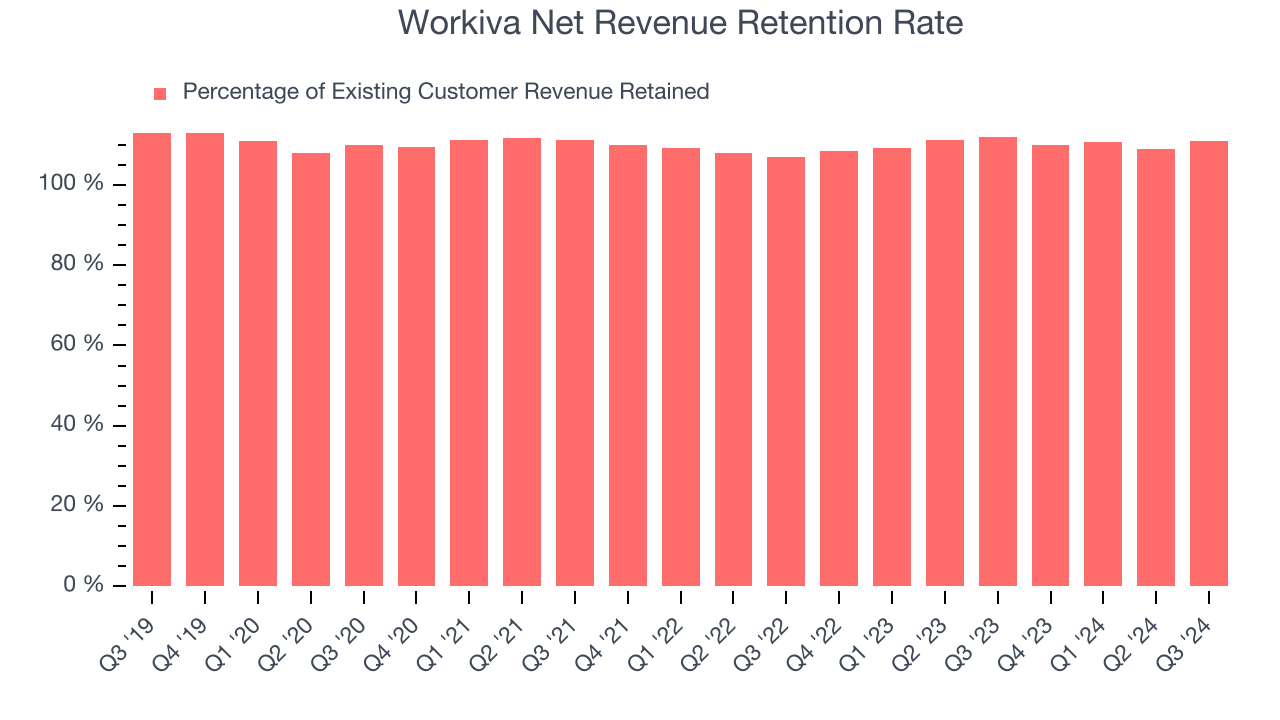

- Net Revenue Retention Rate: 111%, up from 109% in the previous quarter

- Customers: 6,237, up from 6,147 in the previous quarter

- Market Capitalization: $4.56 billion

"Workiva is once again in a beat and raise position. Our results highlight an acceleration of our growth and improved operating leverage," said Julie Iskow, President & Chief Executive Officer.

Company Overview

Founded in 2010, Workiva (NYSE: WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Compliance Software

The demand for software platforms that automate compliances processes is rising as keeping up with the latest financial reporting regulations and standards is difficult and expensive, especially as companies increasingly operate across several geographical regions with varying rules.

Sales Growth

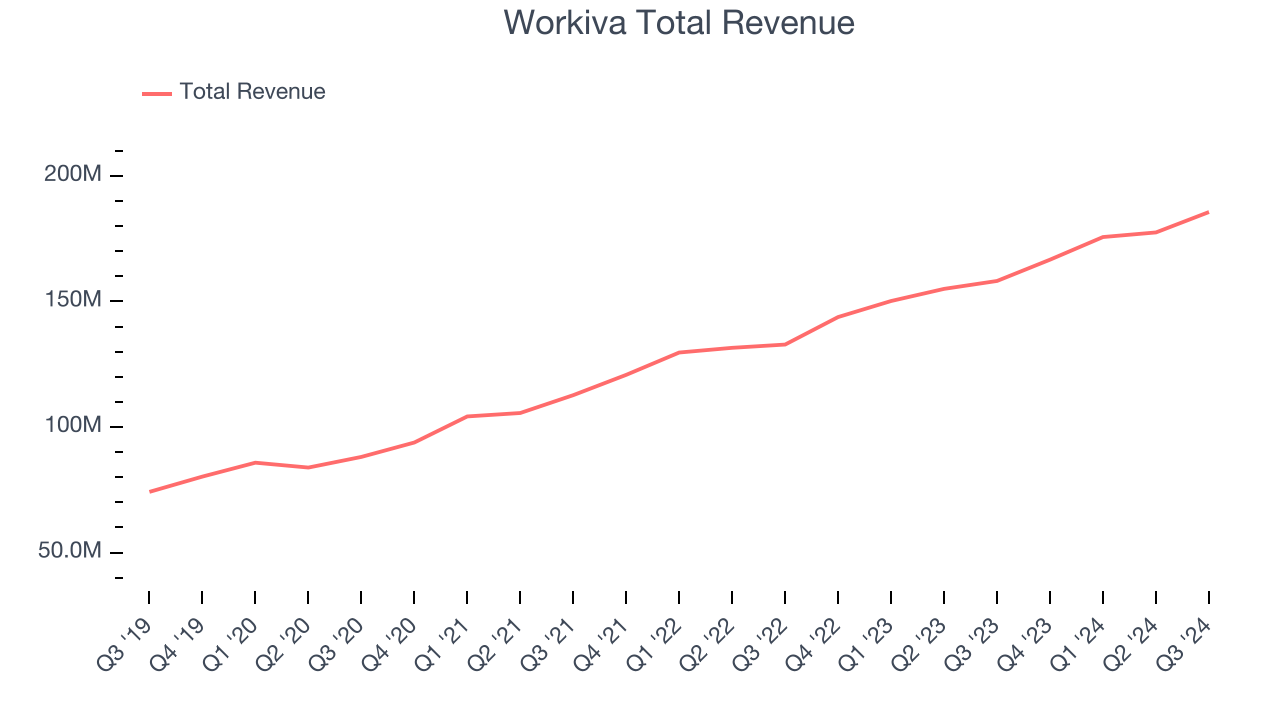

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Workiva grew its sales at a mediocre 19.2% compounded annual growth rate. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

This quarter, Workiva reported year-on-year revenue growth of 17.4%, and its $185.6 million of revenue exceeded Wall Street’s estimates by 1.7%. Management is currently guiding for a 17% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.9% over the next 12 months, a deceleration versus the last three years. Still, this projection is commendable and illustrates the market is factoring in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Workiva’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 110% in Q3. This means that even if Workiva didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 10%.

Workiva has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Workiva’s Q3 Results

It was great to see Workiva grow its customers this quarter. We were also glad its net revenue retention grew. On the other hand, its EPS forecast for next quarter missed and its EPS guidance for the full year fell short of Wall Street’s estimates. Overall, this quarter could have been better. Overall, the market focused more on the positives and the stock traded up 8.3% to $95 immediately after reporting.

Big picture, is Workiva a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.