Smart home company SmartRent (NYSE: SMRT) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 30.3% year on year to $40.51 million. Its GAAP loss of $0.05 per share was also 150% below analysts’ consensus estimates.

Is now the time to buy SmartRent? Find out by accessing our full research report, it’s free.

SmartRent (SMRT) Q3 CY2024 Highlights:

- Revenue: $40.51 million vs analyst estimates of $45.94 million (11.8% miss)

- EPS: -$0.05 vs analyst estimates of -$0.02 (-$0.03 miss)

- EBITDA: -$3.82 million vs analyst estimates of -$1.77 million ($2 million miss)

- Gross Margin (GAAP): 33.2%, up from 23.3% in the same quarter last year

- Operating Margin: -29%, down from -17.1% in the same quarter last year

- EBITDA Margin: -9.4%, in line with the same quarter last year

- Free Cash Flow was -$6.71 million, down from $14.25 million in the same quarter last year

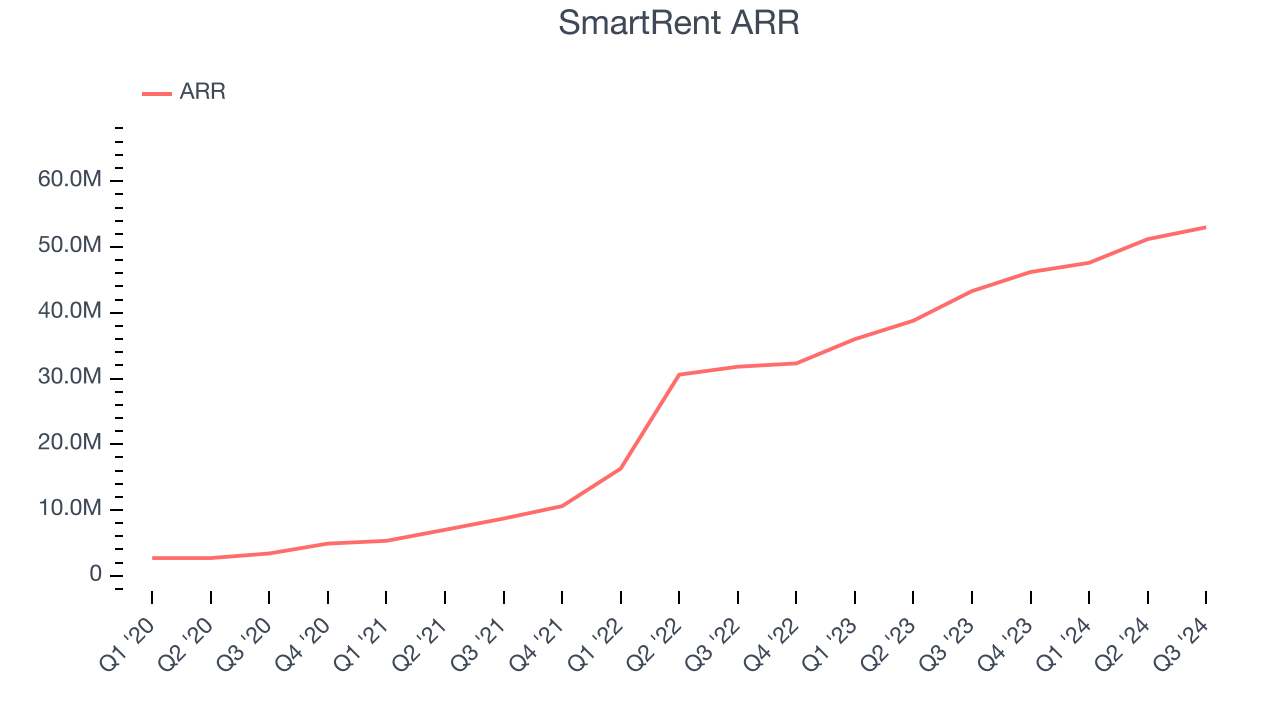

- Annual Recurring Revenue: $53 million at quarter end, up 22.4% year on year

- Market Capitalization: $356.2 million

"In the third quarter, SmartRent demonstrated remarkable resilience and strategic focus amid a series of market headwinds and operational transitions," stated John Dorman, Chairman of the Board.

Company Overview

Founded by an employee at a real estate rental company, SmartRent (NYSE: SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

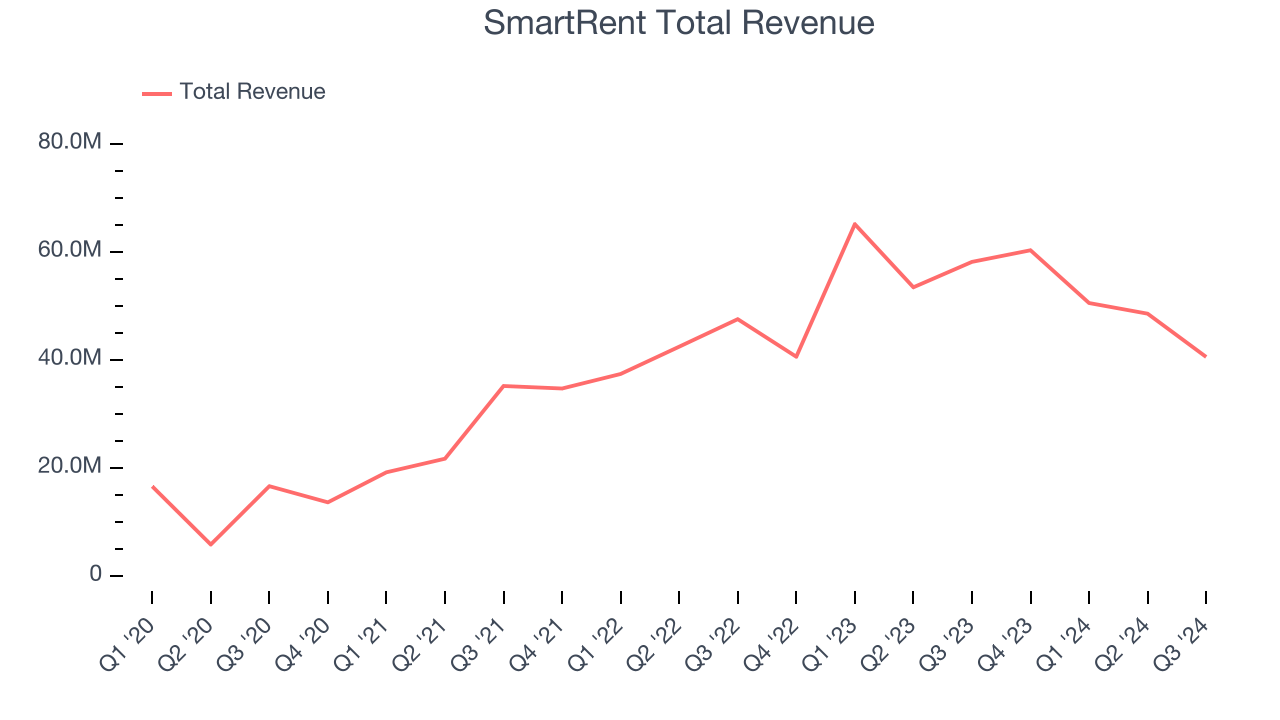

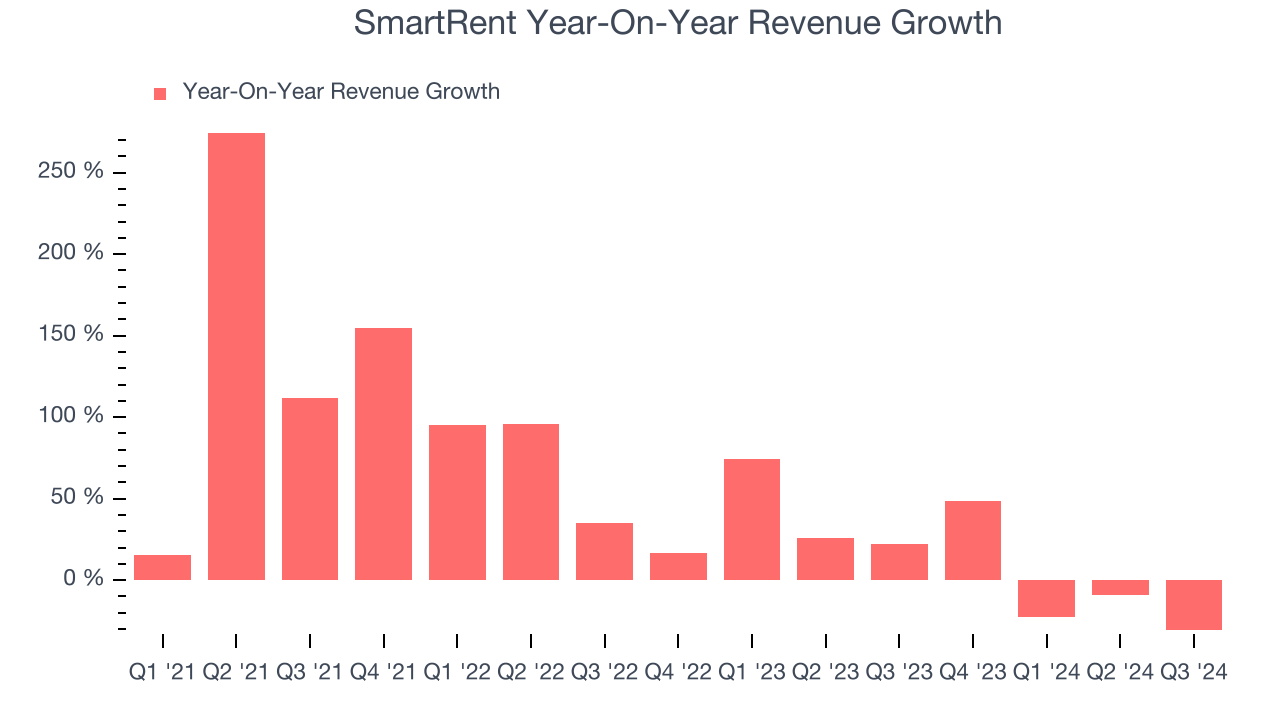

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, SmartRent’s sales grew at an incredible 37.6% compounded annual growth rate over the last four years. This is encouraging because it shows SmartRent’s offerings resonate with customers, a helpful starting point.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SmartRent’s annualized revenue growth of 11.1% over the last two years is below its four-year trend, but we still think the results were good and suggest demand was strong.

We can better understand the company’s sales dynamics by analyzing its annual recurring revenue (ARR), or the revenue it expects to generate from its existing customer base in the next 12 months. SmartRent’s ARR reached $53 million in the latest quarter and averaged 64.8% year-on-year growth over the last two years. Because this performance is better than its normal revenue growth, we can see the company generated more revenue from its existing customers than new customers. Holding everything else constant, this is a positive sign as it should lead to lower sales and marketing expenses.

This quarter, SmartRent missed Wall Street’s estimates and reported a rather uninspiring 30.3% year-on-year revenue decline, generating $40.51 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and illustrates the market thinks its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

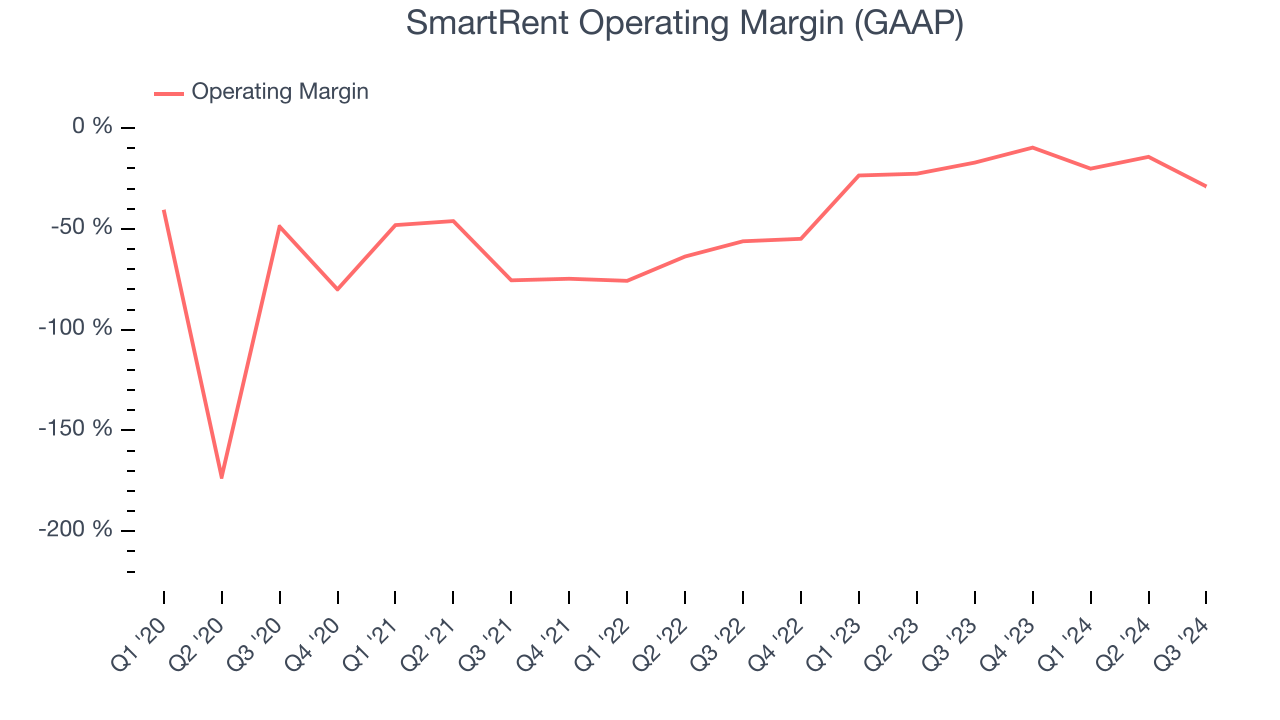

Operating Margin

SmartRent’s high expenses have contributed to an average operating margin of negative 40.1% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, SmartRent’s annual operating margin rose by 43.1 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

SmartRent’s operating margin was negative 29% this quarter. The company's lack of profits raise a flag.

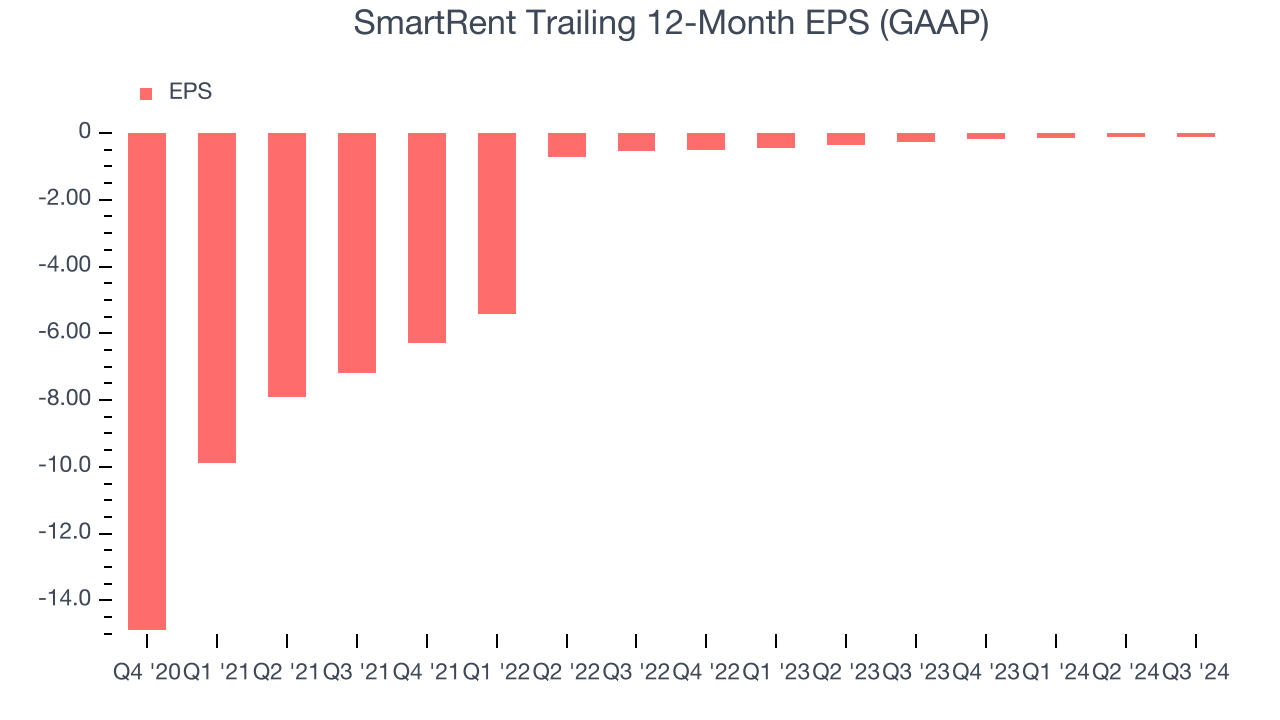

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Although SmartRent’s full-year earnings are still negative, it reduced its losses and improved its EPS by 70.1% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For SmartRent, its two-year annual EPS growth of 50.9% was lower than its four-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, SmartRent reported EPS at negative $0.05, down from negative $0.04 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast SmartRent’s full-year EPS of negative $0.13 will reach break even.

Key Takeaways from SmartRent’s Q3 Results

SmartRent's revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $1.77 immediately after reporting.

Big picture, is SmartRent a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.