Building and construction materials manufacturer Owens Corning (NYSE: OC) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 22.9% year on year to $3.05 billion. Its non-GAAP profit of $4.38 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy Owens Corning? Find out by accessing our full research report, it’s free.

Owens Corning (OC) Q3 CY2024 Highlights:

- Revenue: $3.05 billion vs analyst estimates of $3.04 billion (in line)

- Adjusted EPS: $4.38 vs analyst estimates of $4.05 (8.1% beat)

- EBITDA: $766 million vs analyst estimates of $722.9 million (6% beat)

- Gross Margin (GAAP): 29.8%, in line with the same quarter last year

- Operating Margin: 16.7%, down from 18.6% in the same quarter last year

- EBITDA Margin: 25.1%, in line with the same quarter last year

- Free Cash Flow Margin: 18.3%, down from 23.4% in the same quarter last year

- Market Capitalization: $15.87 billion

"Our third-quarter results demonstrate the impact of the strategic choices and structural improvements we have made to strengthen Owens Corning and build a company that continues to deliver strong free cash flow and sustainably higher margins despite a challenging market environment. The strong execution of our team, combined with the key initiatives and investments we are undertaking, is accelerating our growth, strengthening our earnings power, and reshaping the company,” said Chair and Chief Executive Officer Brian Chambers.

Company Overview

Credited with the discovery of fiberglass, Owens Corning (NYSE: OC) supplies building and construction materials to the United States and international markets.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

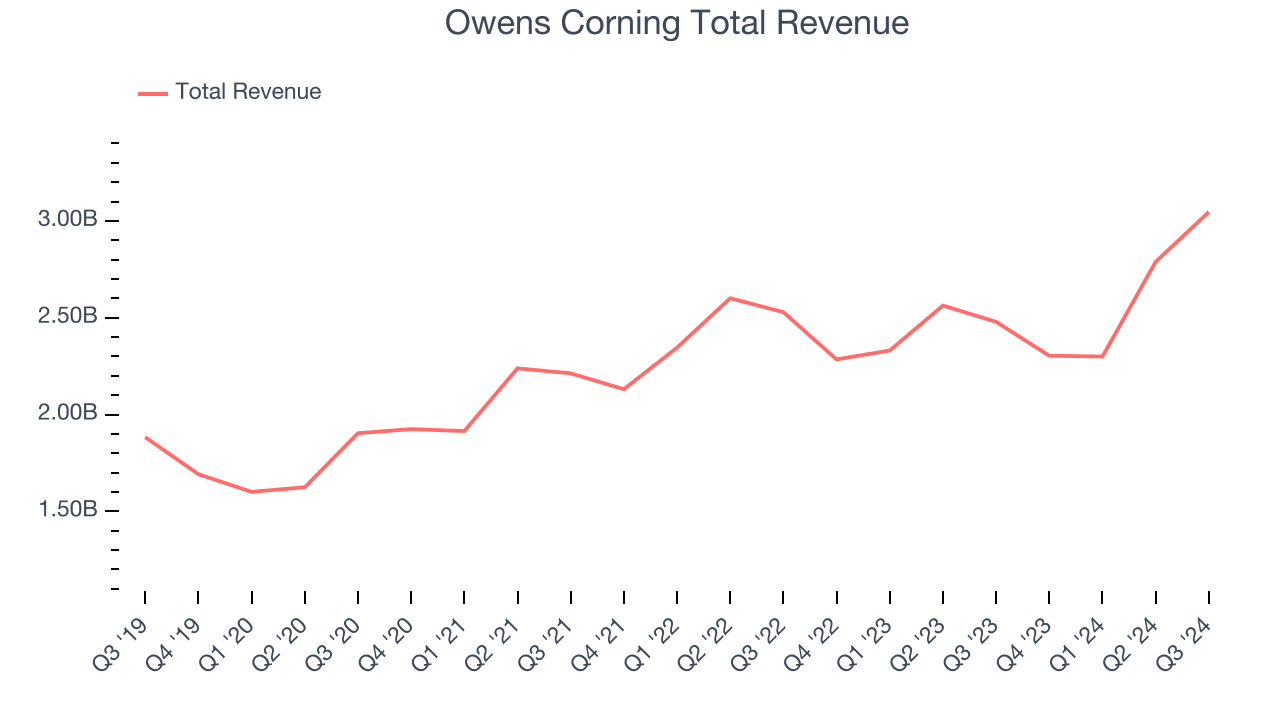

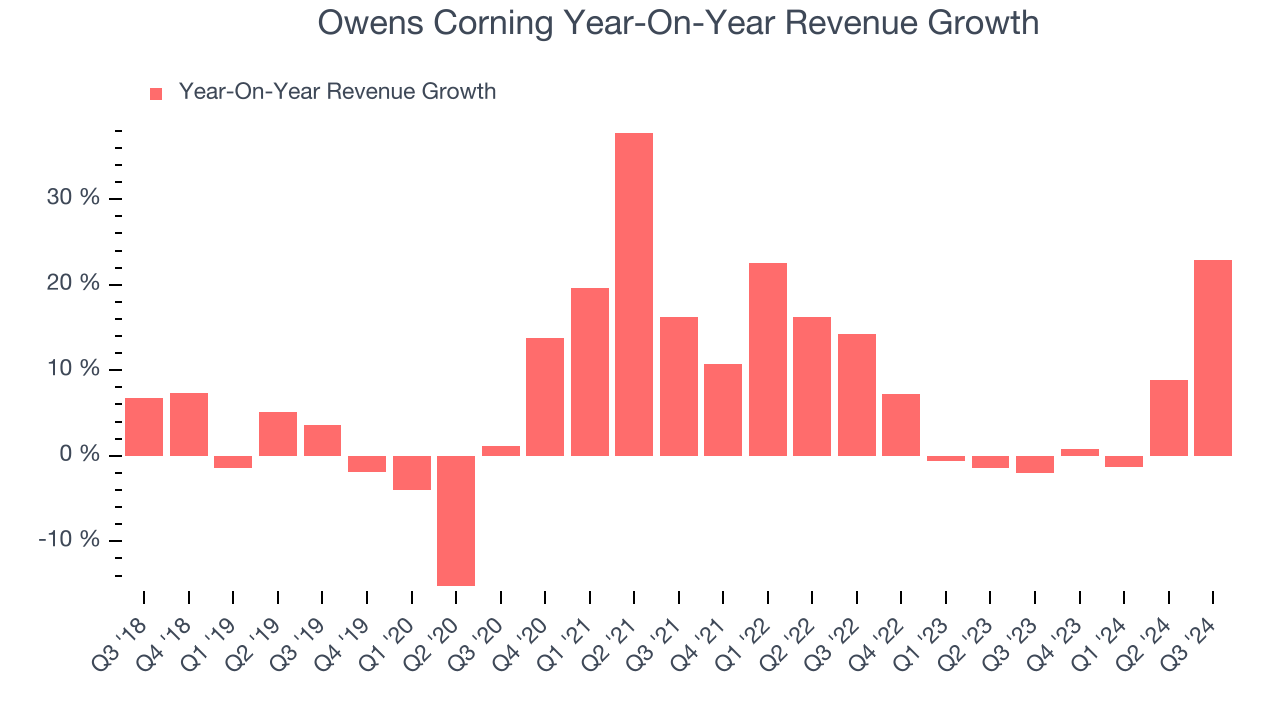

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Owens Corning’s sales grew at a decent 7.7% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Owens Corning’s recent history shows its demand slowed as its annualized revenue growth of 4.2% over the last two years is below its five-year trend.

This quarter, Owens Corning’s year-on-year revenue growth of 22.9% was excellent, and its $3.05 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 16% over the next 12 months, an improvement versus the last two years. This projection is healthy and illustrates the market thinks its newer products and services will fuel higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

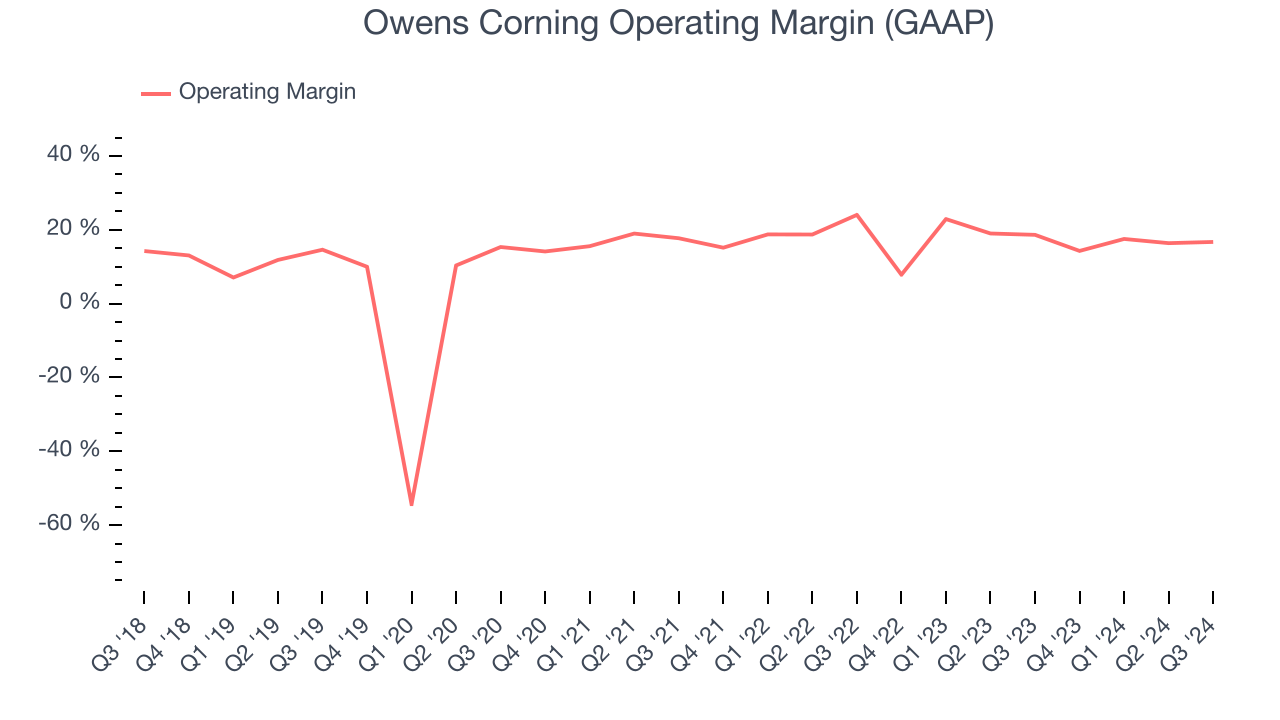

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Owens Corning has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Owens Corning’s annual operating margin rose by 19.8 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, Owens Corning generated an operating profit margin of 16.7%, down 1.9 percentage points year on year. Since Owens Corning’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

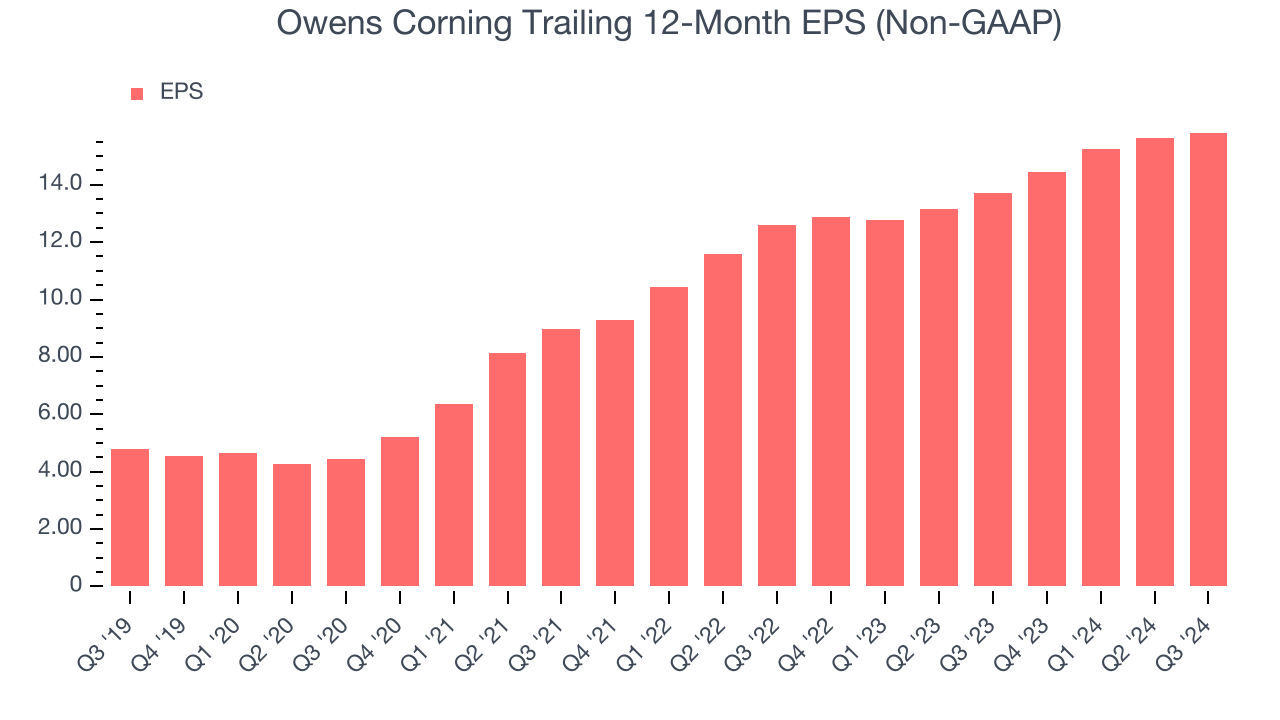

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Owens Corning’s EPS grew at an astounding 27% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. This tells us the company became more profitable as it expanded.

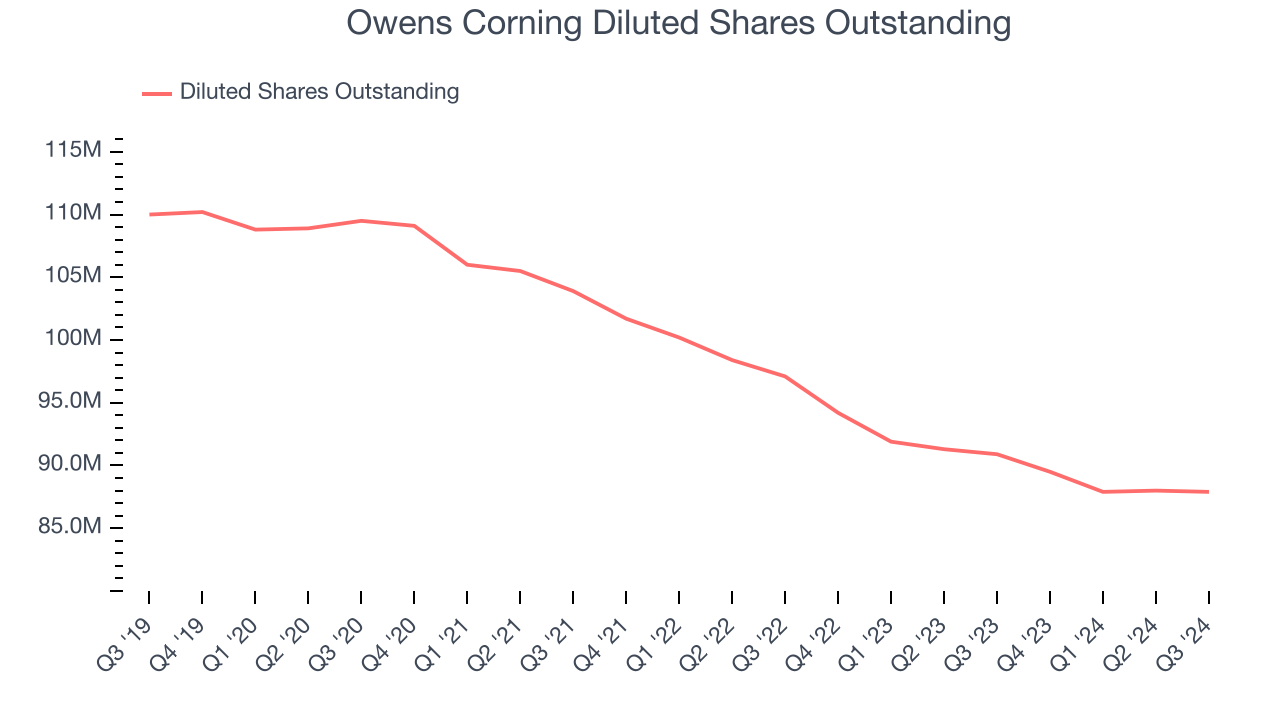

Diving into the nuances of Owens Corning’s earnings can give us a better understanding of its performance. As we mentioned earlier, Owens Corning’s operating margin declined this quarter but expanded by 19.8 percentage points over the last five years. Its share count also shrank by 20.1%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Owens Corning, its two-year annual EPS growth of 12.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Owens Corning reported EPS at $4.38, up from $4.18 in the same quarter last year. This print beat analysts’ estimates by 8.1%. Over the next 12 months, Wall Street expects Owens Corning’s full-year EPS of $15.82 to stay about the same.

Key Takeaways from Owens Corning’s Q3 Results

We were impressed by how significantly Owens Corning blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4.3% to $190.54 immediately following the results.

Sure, Owens Corning had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.