Advertising data platform LiveRamp (NYSE: RAMP) announced better-than-expected revenue in Q3 CY2024, with sales up 16% year on year to $185.5 million. The company expects next quarter’s revenue to be around $191 million, close to analysts’ estimates. Its non-GAAP profit of $0.51 per share was also 41.5% above analysts’ consensus estimates.

Is now the time to buy LiveRamp? Find out by accessing our full research report, it’s free.

LiveRamp (RAMP) Q3 CY2024 Highlights:

- Revenue: $185.5 million vs analyst estimates of $176.2 million (5.3% beat)

- Adjusted EPS: $0.51 vs analyst estimates of $0.36 (41.5% beat)

- EBITDA: $41.4 million vs analyst estimates of $31.72 million (30.5% beat)

- The company lifted its revenue guidance for the full year to $738 million at the midpoint from $725 million, a 1.8% increase

- Gross Margin (GAAP): 72.4%, down from 74.2% in the same quarter last year

- Operating Margin: 4%, down from 5.1% in the same quarter last year

- EBITDA Margin: 22.3%, up from 20.3% in the same quarter last year

- Free Cash Flow was $55.36 million, up from -$10 million in the previous quarter

- Net Revenue Retention Rate: 107%, up from 105% in the previous quarter

- Customers: 885, down from 900 in the previous quarter

- Market Capitalization: $1.68 billion

Company Overview

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE: RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

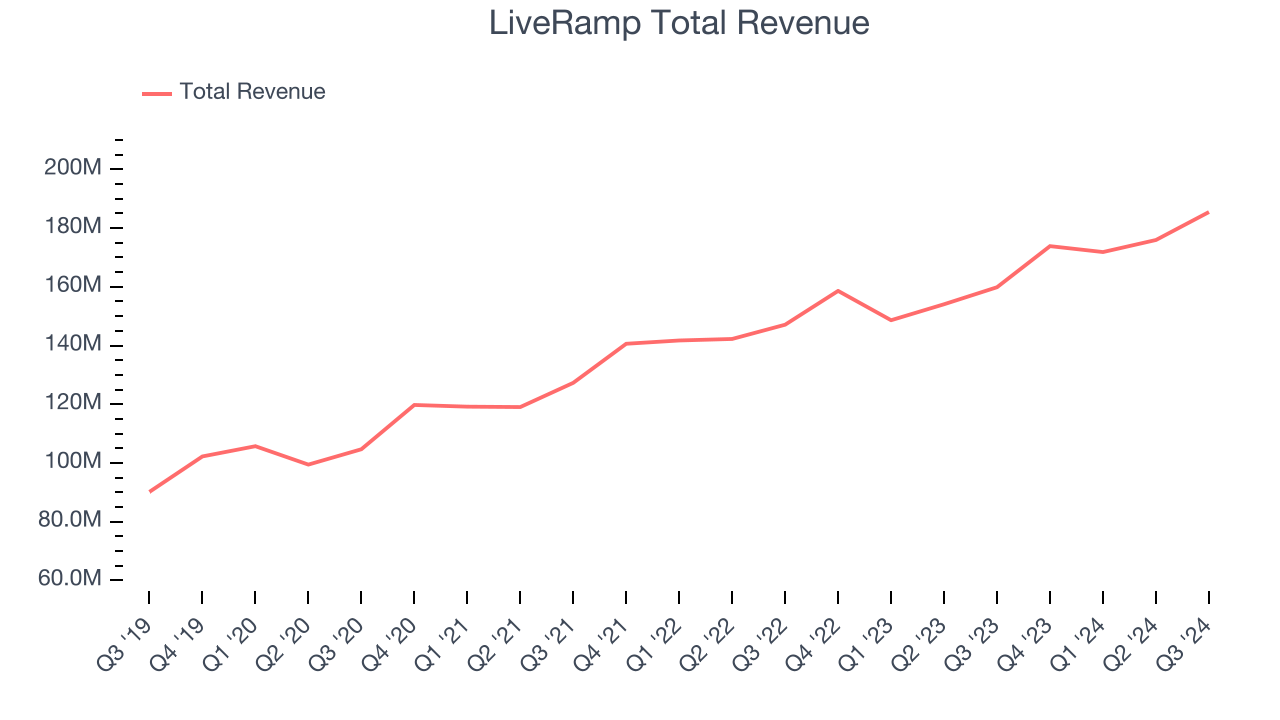

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, LiveRamp grew its sales at a sluggish 13.4% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, LiveRamp reported year-on-year revenue growth of 16%, and its $185.5 million of revenue exceeded Wall Street’s estimates by 5.3%. Management is currently guiding for a 9.9% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and illustrates the market believes its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

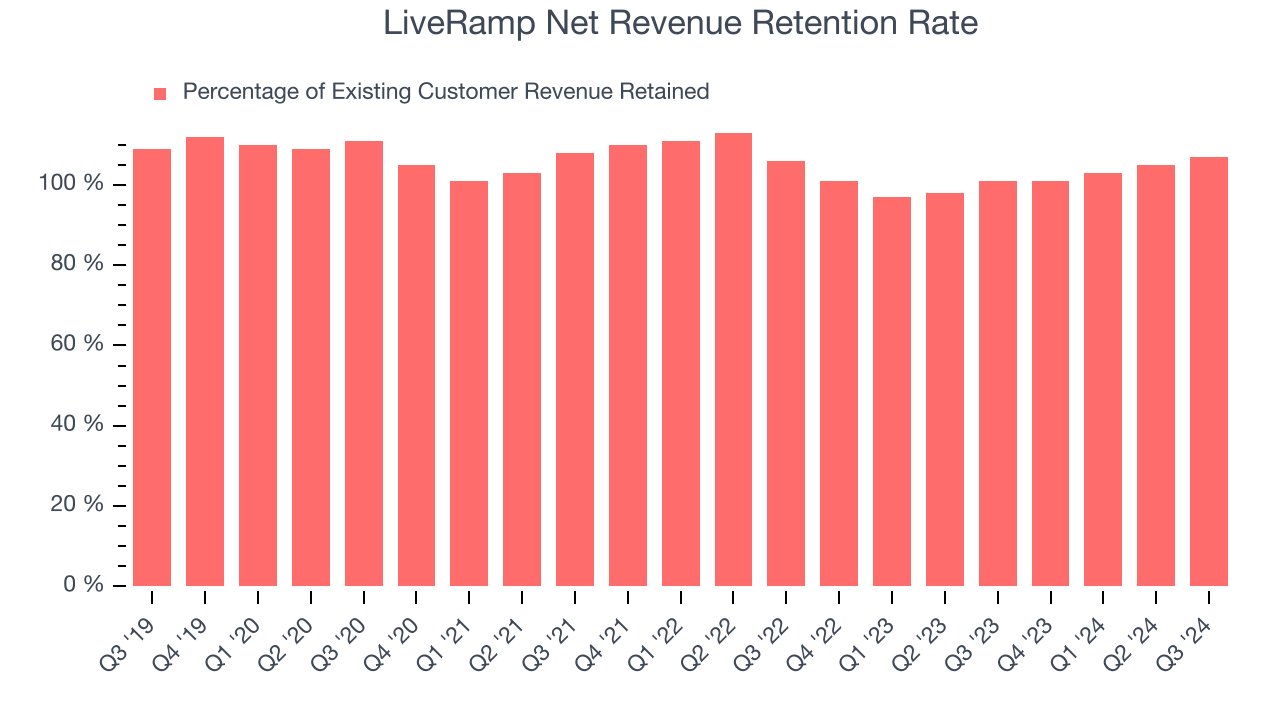

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

LiveRamp’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 104% in Q3. This means that even if LiveRamp didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 4%.

Trending up over the last year, LiveRamp has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from LiveRamp’s Q3 Results

We were impressed by how significantly LiveRamp blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $26.32 immediately following the results.

Is LiveRamp an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.