Energy drink company Celsius (NASDAQ: CELH) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 30.9% year on year to $265.7 million. Its GAAP loss of $0 per share was 100% below analysts’ consensus estimates.

Is now the time to buy Celsius? Find out by accessing our full research report, it’s free.

Celsius (CELH) Q3 CY2024 Highlights:

- Revenue: $265.7 million vs analyst estimates of $267.5 million (in line)

- EPS: $0 vs analyst estimates of $0.03 (-$0.03 miss)

- EBITDA: $4.40 million vs analyst estimates of $13.28 million (66.8% miss)

- Gross Margin (GAAP): 46%, down from 50.4% in the same quarter last year

- Operating Margin: -1.2%, down from 25.4% in the same quarter last year

- EBITDA Margin: 1.7%, down from 26.9% in the same quarter last year

- Market Capitalization: $7.40 billion

John Fieldly, Chairman and CEO of Celsius Holdings, Inc., said: “Celsius continued to drive energy drink category growth at retail in the third quarter and outpaced the category in dollar and volume sales gains despite overall category softness. Pronounced supply chain optimization by our largest distributor, which we believe has largely stabilized, had an outsized and adverse impact on our operating results during an otherwise solid quarter. We remain focused on our long-term growth strategy of expanding our consumer base, broadening our availability, and being the preferred beverage for more occasions.”

Company Overview

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ: CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Beverages, Alcohol and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Celsius is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

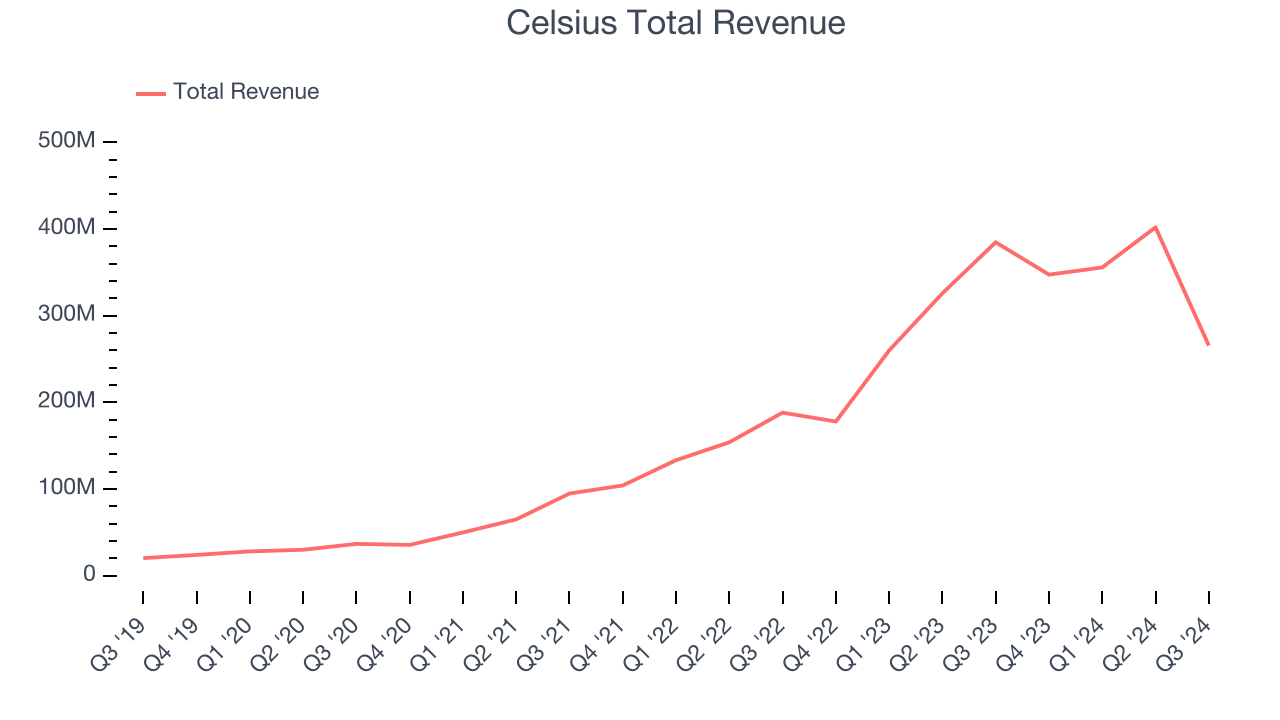

As you can see below, Celsius’s 77.4% annualized revenue growth over the last three years was incredible. This is encouraging because it shows Celsius’s had strong demand, a helpful starting point.

This quarter, Celsius reported a rather uninspiring 30.9% year-on-year revenue decline to $265.7 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 14.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is admirable and shows the market is factoring in success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

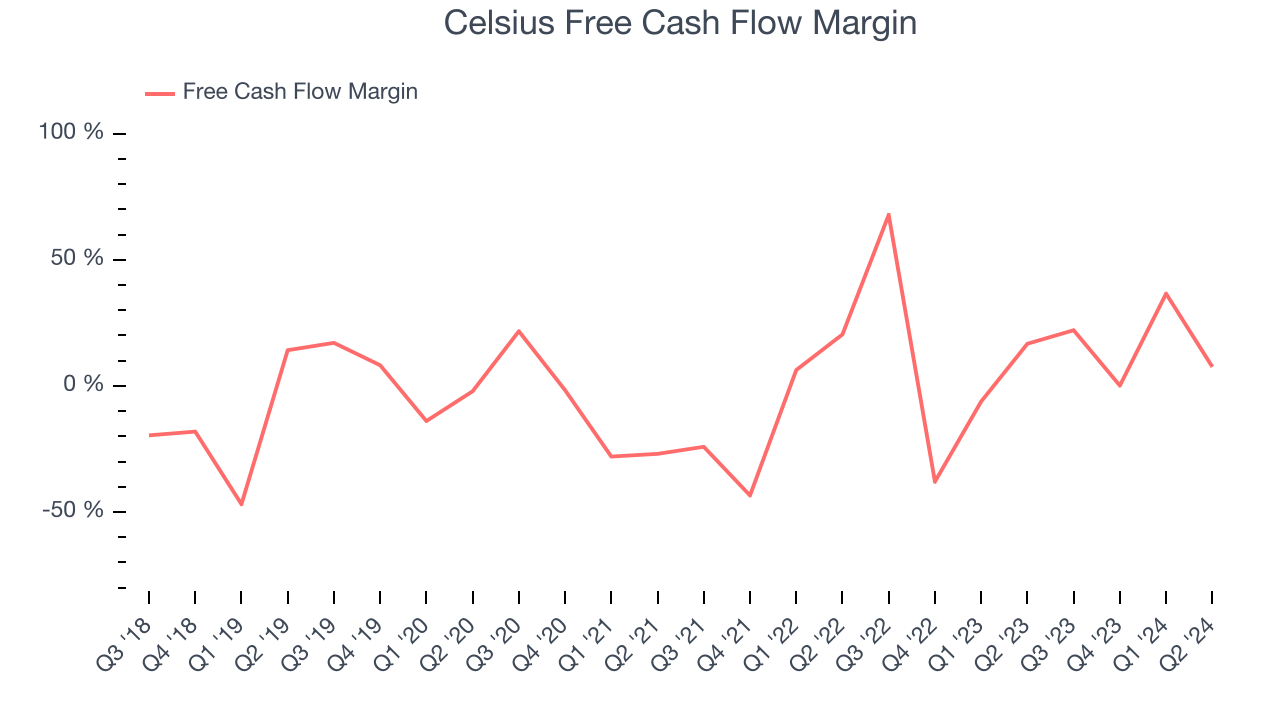

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Celsius has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.6% over the last two years, quite impressive for a consumer staples business.

Key Takeaways from Celsius’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA missed and its EPS missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $31.73 immediately following the results.

Celsius’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.