Aerospace and defense company Cadre (NYSE: CDRE) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 12.6% year on year to $109.4 million. The company’s full-year revenue guidance of $565.5 million at the midpoint came in 1.4% below analysts’ estimates. Its GAAP profit of $0.09 per share was 45.9% above analysts’ consensus estimates.

Is now the time to buy Cadre? Find out by accessing our full research report, it’s free.

Cadre (CDRE) Q3 CY2024 Highlights:

- Revenue: $109.4 million vs analyst estimates of $126.3 million (13.4% miss)

- EPS: $0.09 vs analyst estimates of $0.06 (45.9% beat)

- EBITDA: $13.53 million vs analyst estimates of $13.57 million (small miss)

- The company dropped its revenue guidance for the full year to $565.5 million at the midpoint from $576.5 million, a 1.9% decrease

- EBITDA guidance for the full year is $104 million at the midpoint, below analyst estimates of $105.3 million

- Gross Margin (GAAP): 36.6%, down from 42.8% in the same quarter last year

- Operating Margin: 5%, down from 13.4% in the same quarter last year

- EBITDA Margin: 12.4%, down from 19% in the same quarter last year

- Free Cash Flow was -$6.23 million, down from $16.15 million in the same quarter last year

- Market Capitalization: $1.44 billion

“During the third quarter we continued to see strong and recurring demand for Cadre’s best-in-class, mission-critical safety equipment,” said Warren Kanders, CEO and Chairman.

Company Overview

Originally known as Safariland, Cadre (NYSE: CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

Sales Growth

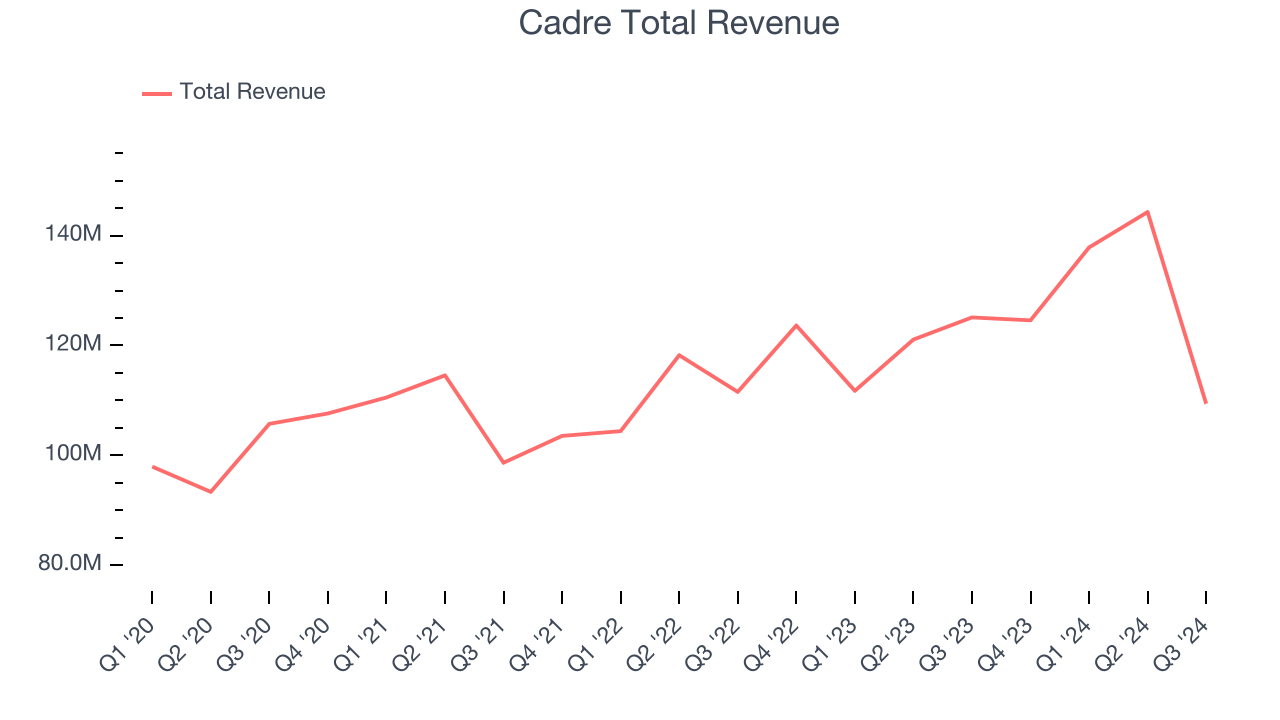

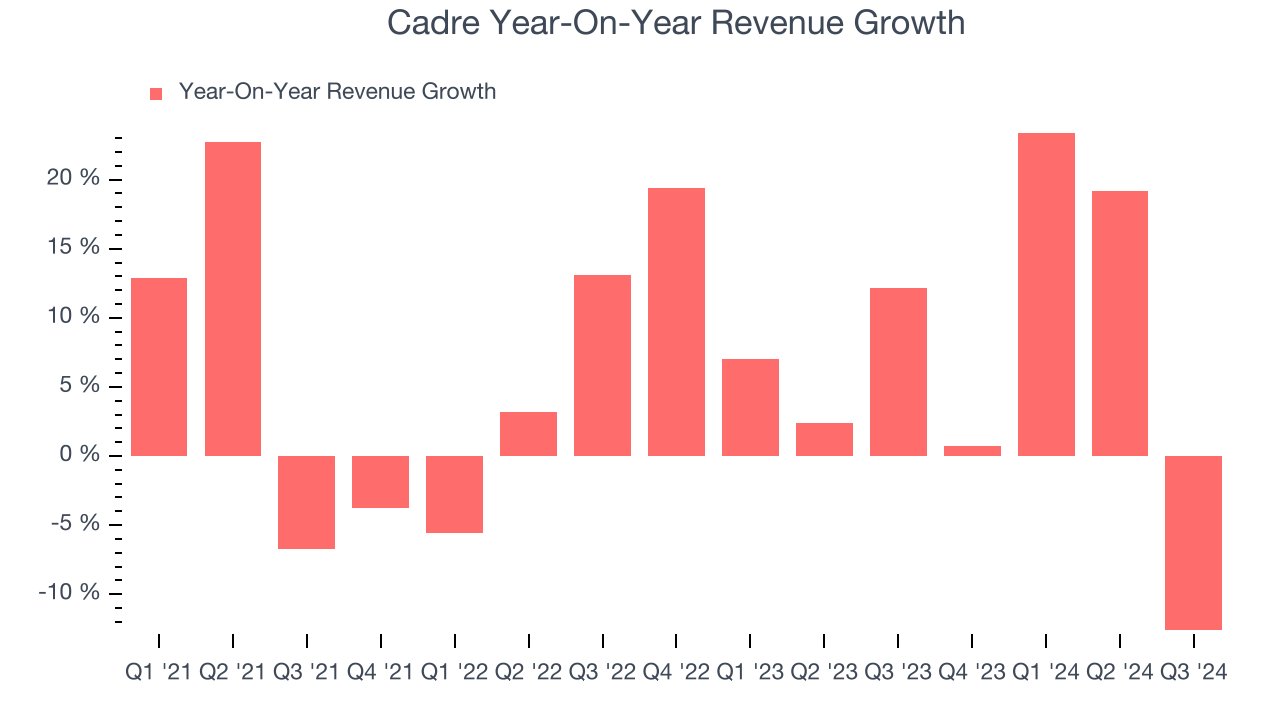

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Cadre’s 7.2% annualized revenue growth over the last four years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Cadre’s annualized revenue growth of 8.6% over the last two years is above its four-year trend, suggesting some bright spots.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Products. Over the last two years, Cadre’s Products revenue (body armor, corrections tools, sensors) averaged 11.3% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Cadre missed Wall Street’s estimates and reported a rather uninspiring 12.6% year-on-year revenue decline, generating $109.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 18.8% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and illustrates the market believes its newer products and services will fuel higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

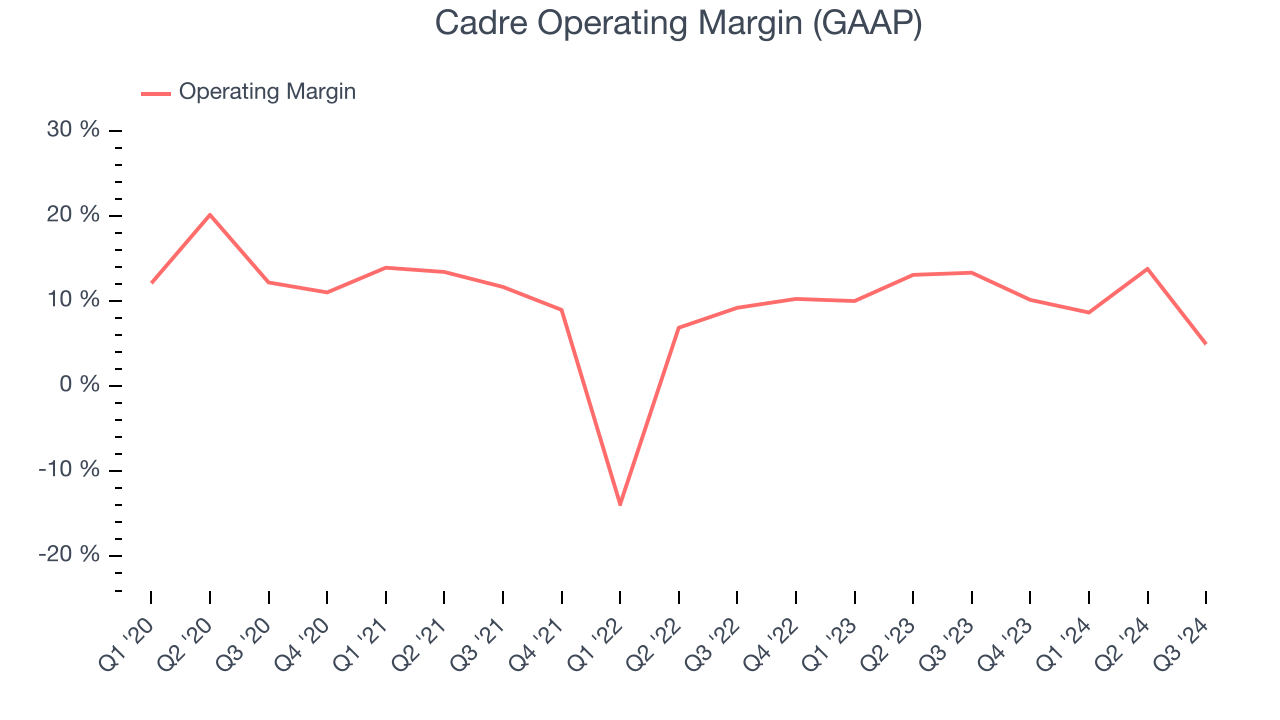

Cadre has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.1%.

Analyzing the trend in its profitability, Cadre’s annual operating margin decreased by 5.2 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Cadre become more profitable in the future.

In Q3, Cadre generated an operating profit margin of 5%, down 8.4 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

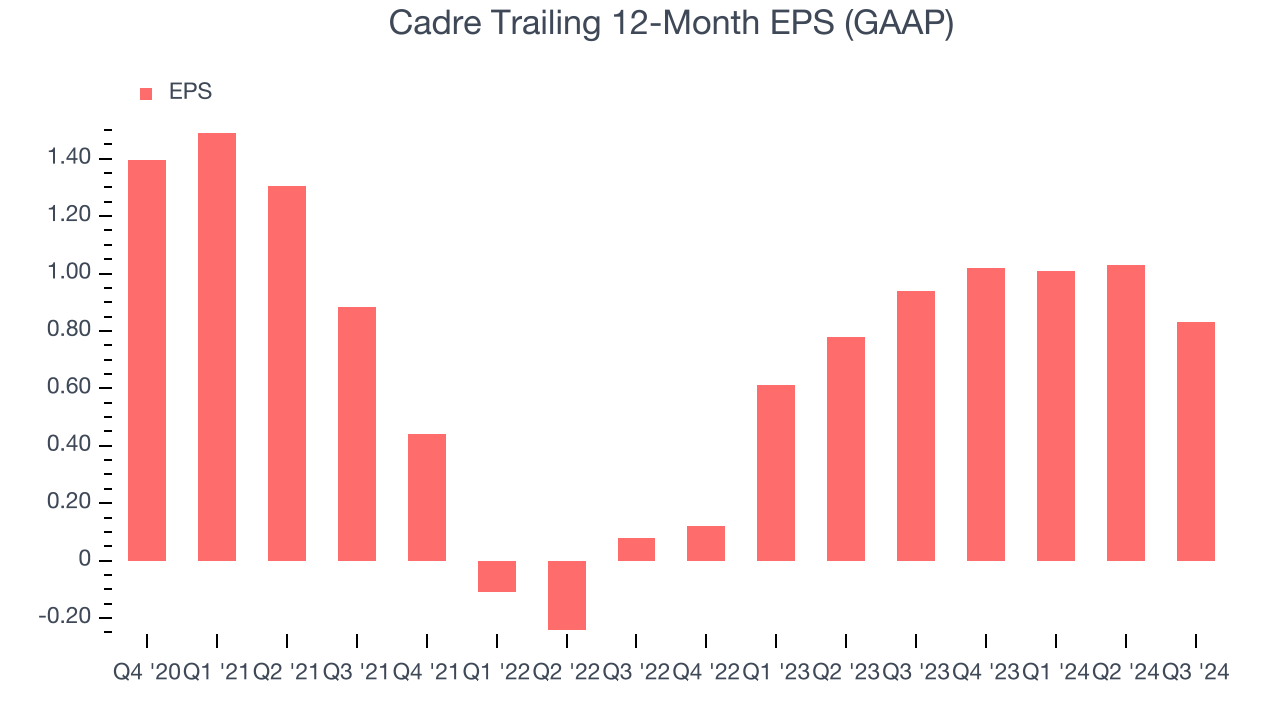

Sadly for Cadre, its EPS declined by 8.3% annually over the last four years while its revenue grew by 7.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Cadre, its two-year annual EPS growth of 222% was higher than its four-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Cadre reported EPS at $0.09, down from $0.29 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Cadre’s full-year EPS of $0.83 to grow by 76.1%.

Key Takeaways from Cadre’s Q3 Results

We were impressed by how significantly Cadre blew past analysts’ EPS expectations this quarter. On the other hand, its revenue missed due to weaker performance in its Products segment. It also lowered its full-year revenue guidance. Overall, this quarter could have been better, but the stock traded up 5% to $39.02 immediately after reporting.

So should you invest in Cadre right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.