Residential swimming pool manufacturer Latham (NASDAQ: SWIM) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 6.4% year on year to $150.5 million. The company’s full-year revenue guidance of $505 million at the midpoint came in 1.4% below analysts’ estimates. Its GAAP profit of $0.05 per share was 1.1% above analysts’ consensus estimates.

Is now the time to buy Latham? Find out by accessing our full research report, it’s free.

Latham (SWIM) Q3 CY2024 Highlights:

- Revenue: $150.5 million vs analyst estimates of $152.1 million (1.1% miss)

- EPS (GAAP): $0.05 vs analyst estimates of $0.05 (beat by $0)

- EBITDA: $29.83 million vs analyst estimates of $27.88 million (7% beat)

- The company dropped its revenue guidance for the full year to $505 million at the midpoint from $510 million, a 1% decrease

- EBITDA guidance for the full year is $80 million at the midpoint, below analyst estimates of $82.13 million

- Gross Margin (GAAP): 32.4%, up from 29.9% in the same quarter last year

- Operating Margin: 8.9%, down from 11.2% in the same quarter last year

- EBITDA Margin: 19.8%, down from 22.4% in the same quarter last year

- Free Cash Flow Margin: 22.1%, down from 29.2% in the same quarter last year

- Market Capitalization: $737.4 million

Commenting on the results, Scott Rajeski, President and CEO, said, “We continued to execute well within a difficult industry environment, increasing awareness and adoption of fiberglass pools and automatic safety covers, gaining production efficiencies, and controlling costs, while investing in initiatives to drive future growth. Third quarter sales performance benefited from our leadership in fiberglass pools, which have been gaining share in the in-ground pool market and are increasingly recognized by consumers for their superior quality and cost benefits, fast and easy installation and eco-friendly attributes compared to concrete pools. Our year-to-date fiberglass pool sales are tracking to reach approximately 75% of our total in-ground pool sales in 2024, in line with our expectations. Third quarter results included an approximate two-month contribution from the acquisition of our exclusive dealer for automatic safety covers in 29 states, Coverstar Central, which closed in early August. With key integration activities completed, we are moving forward with a unified sales and marketing strategy designed to accelerate the sales growth of this product line, which provides unparalleled safety and offers significant operating cost savings to the homeowners.

Company Overview

Started as a family business, Latham (NASDAQ: SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

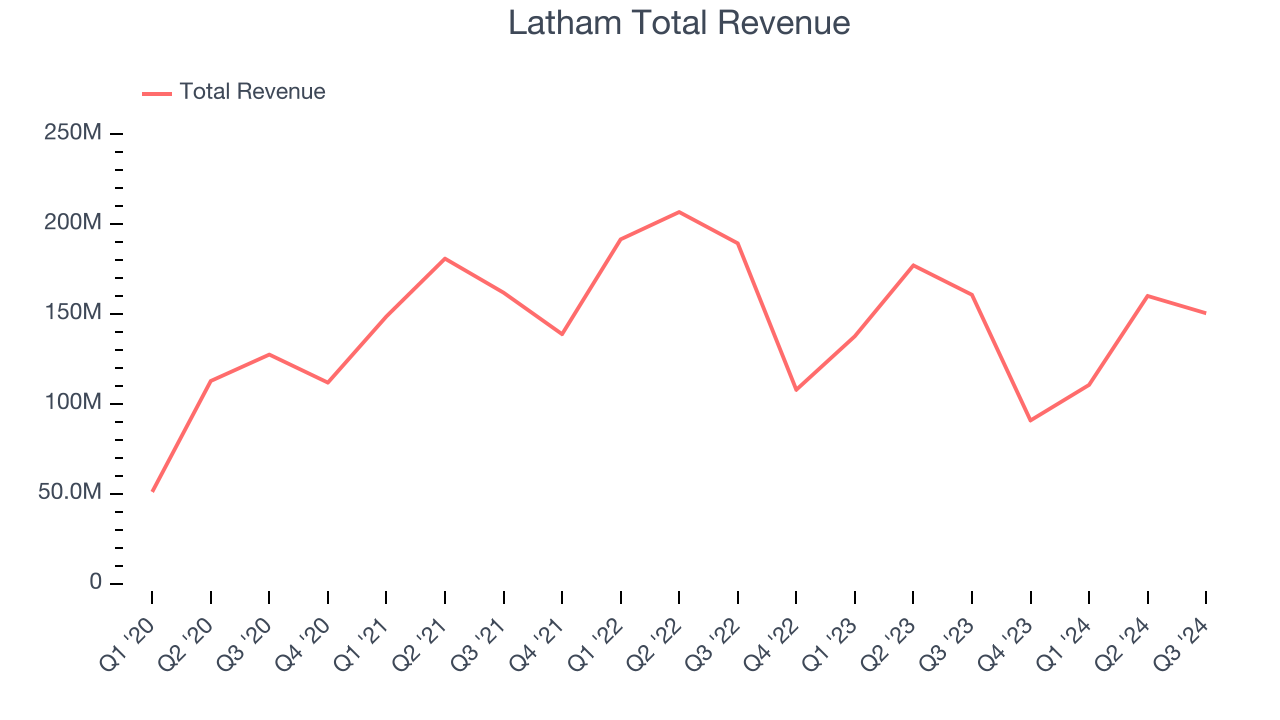

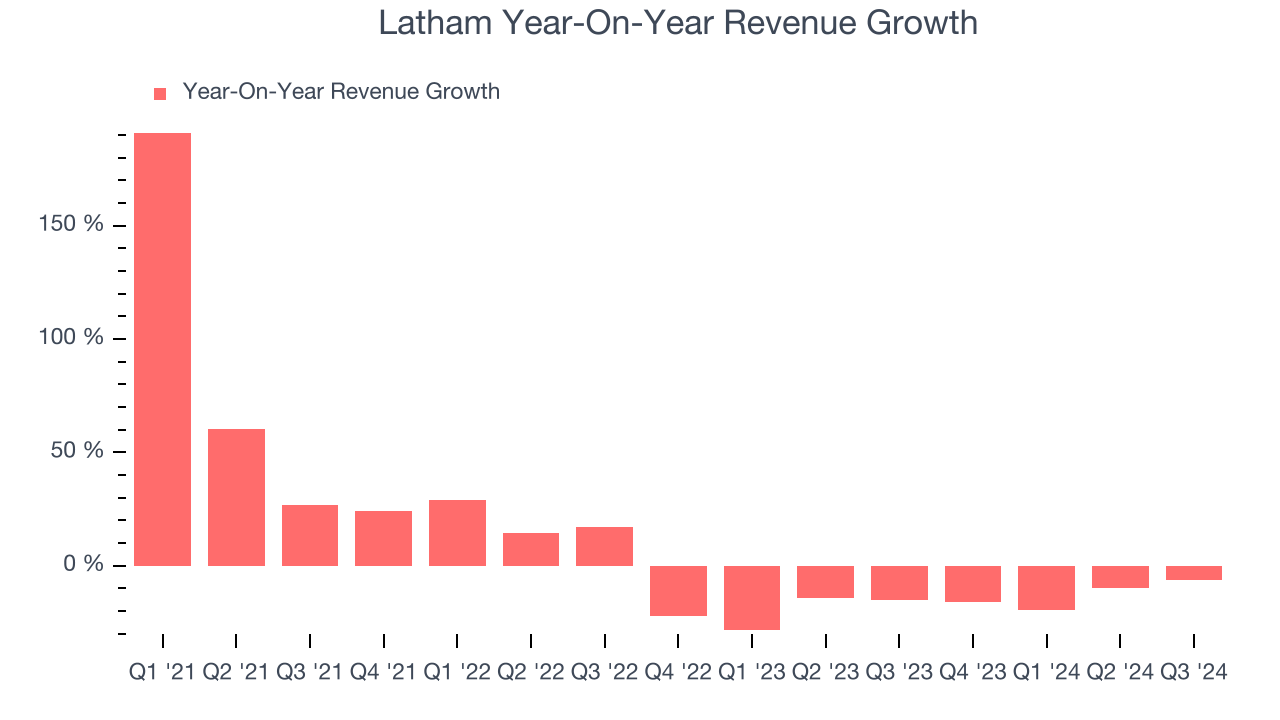

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Latham’s 9.6% annualized revenue growth over the last four years was tepid. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Latham’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 16.1% annually.

This quarter, Latham missed Wall Street’s estimates and reported a rather uninspiring 6.4% year-on-year revenue decline, generating $150.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, an improvement versus the last two years. While this projection illustrates the market believes its newer products and services will catalyze better performance, it is still below average for the sector.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

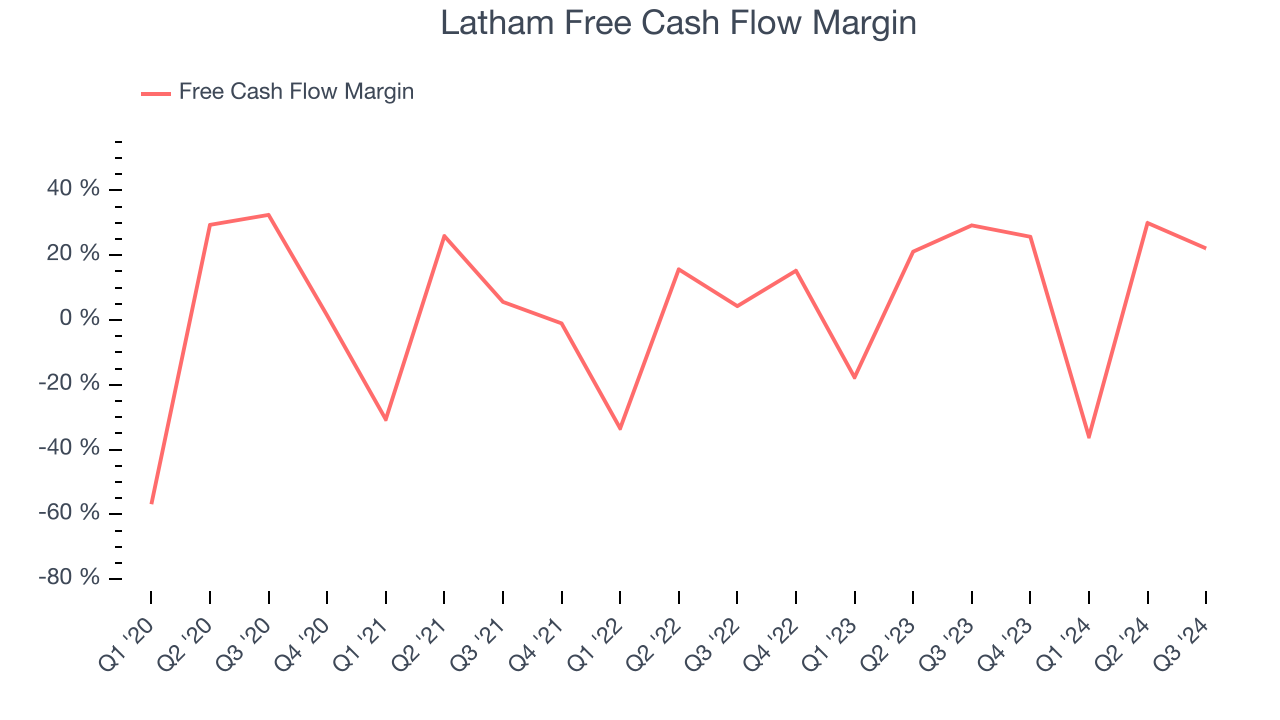

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Latham has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.9% over the last two years, slightly better than the broader consumer discretionary sector.

Latham’s free cash flow clocked in at $33.21 million in Q3, equivalent to a 22.1% margin. The company’s cash profitability regressed as it was 7.1 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Latham’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 12.6% for the last 12 months will decrease to 8.8%.

Key Takeaways from Latham’s Q3 Results

It was good to see Latham beat analysts’ EBITDA expectations this quarter. On the other hand, its full-year revenue guidance was underwhelming and its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 8.7% to $6 immediately following the results.

Latham didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.