Online fashion resale marketplace ThredUp (NASDAQ: TDUP) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales fell 11% year on year to $73.02 million. On the other hand, next quarter’s revenue guidance of $68.2 million was less impressive, coming in 3.7% below analysts’ estimates. Its GAAP loss of $0.22 per share was 57.1% below analysts’ consensus estimates.

Is now the time to buy ThredUp? Find out by accessing our full research report, it’s free.

ThredUp (TDUP) Q3 CY2024 Highlights:

- Revenue: $73.02 million vs analyst estimates of $70.37 million (3.8% beat)

- EPS: -$0.22 vs analyst estimates of -$0.14 (-$0.08 miss)

- EBITDA: -$2.46 million vs analyst estimates of -$3.8 million (35.3% beat)

- Revenue Guidance for Q4 CY2024 is $68.2 million at the midpoint, below analyst estimates of $70.83 million

- Gross Margin (GAAP): 71.2%, up from 69% in the same quarter last year

- Operating Margin: -34.1%, down from -22.2% in the same quarter last year

- EBITDA Margin: -3.4%, up from -4.4% in the same quarter last year

- Free Cash Flow was $774,000, up from -$1.26 million in the same quarter last year

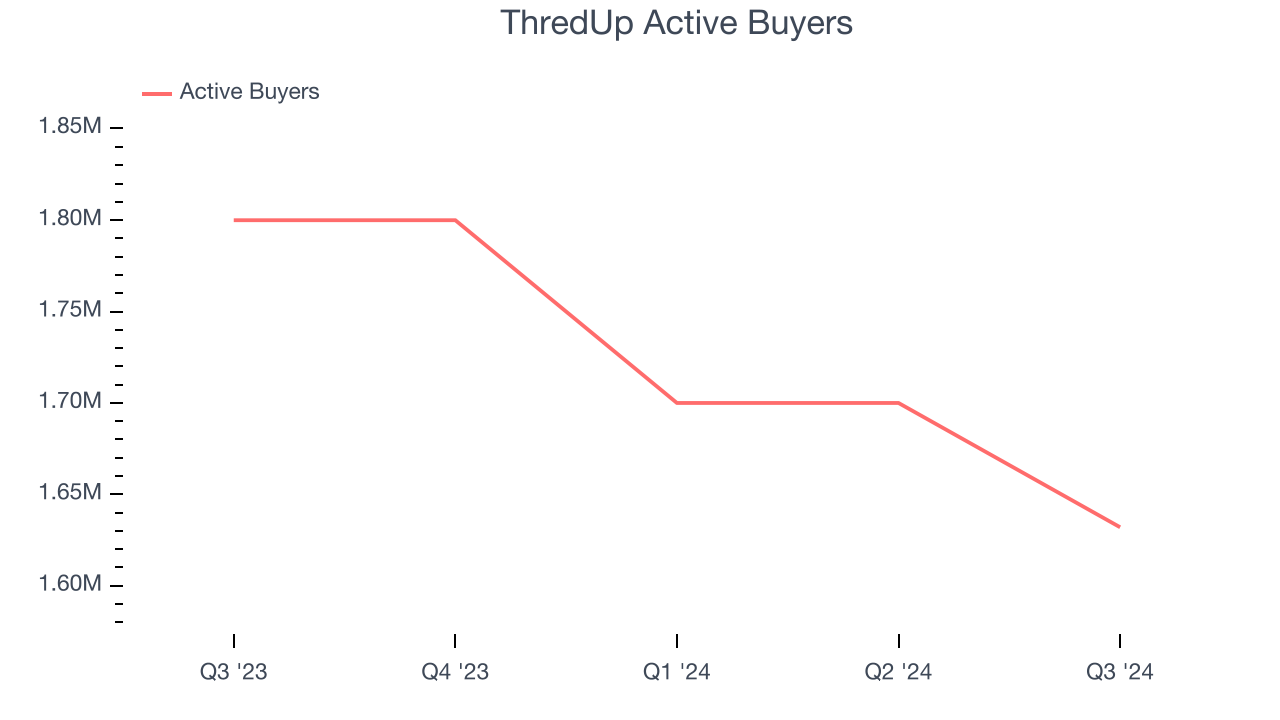

- Active Buyers: 1.63 million, down 168,000 year on year

- Market Capitalization: $62.2 million

“Though we know there is still work ahead, we have made clear progress in course-correcting in the U.S. since last quarter,” said ThredUp CEO and co-founder James Reinhart.

Company Overview

Founded to revolutionize thrifting, ThredUp (NASDAQ: TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

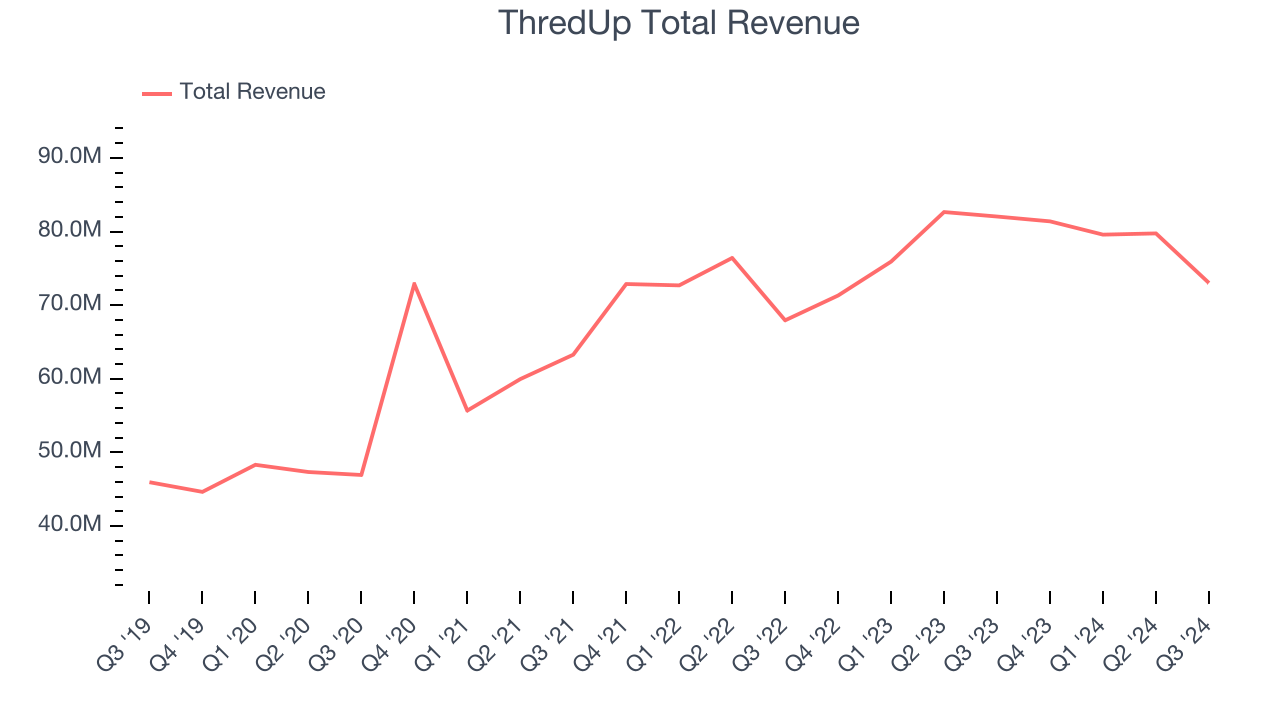

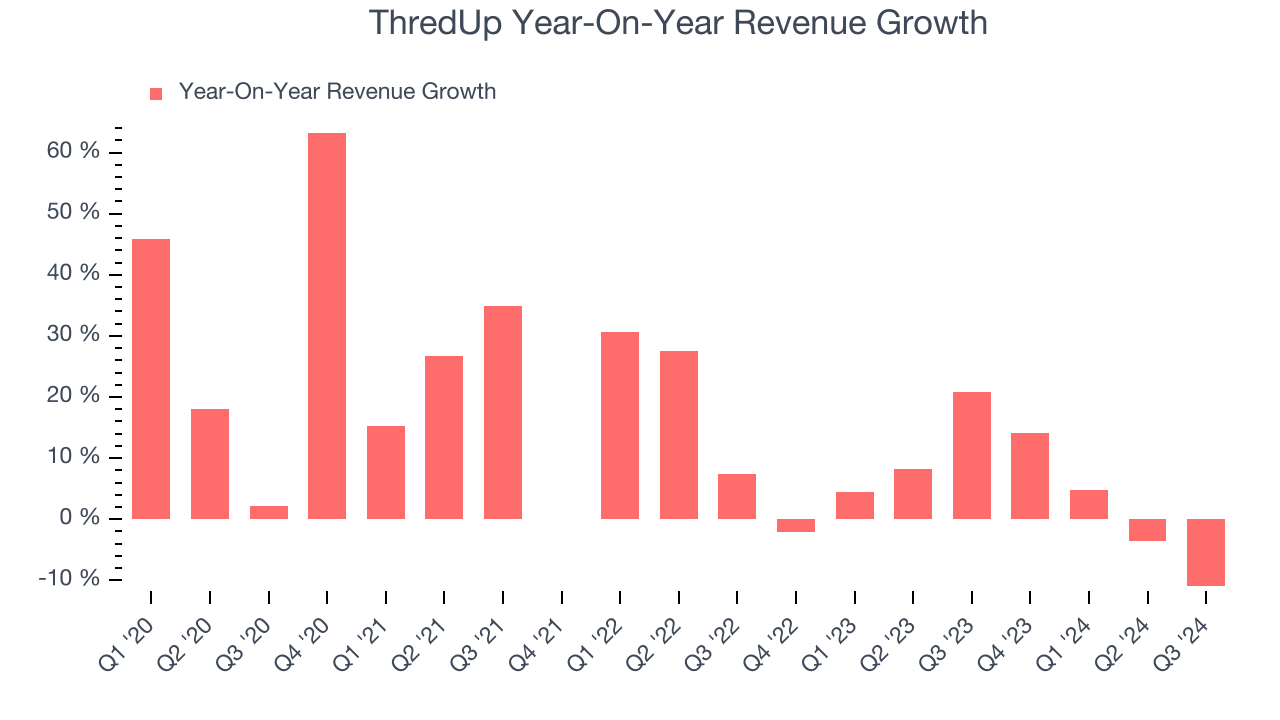

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, ThredUp grew its sales at a mediocre 14.3% compounded annual growth rate. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. ThredUp’s recent history shows its demand slowed as its annualized revenue growth of 4% over the last two years is below its five-year trend.

ThredUp also discloses its number of active buyers, which reached 1.63 million in the latest quarter. Over the last two years, ThredUp’s active buyers averaged 9.3% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, ThredUp’s revenue fell 11% year on year to $73.02 million but beat Wall Street’s estimates by 3.8%. Management is currently guiding for a 16.2% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 5.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market thinks its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

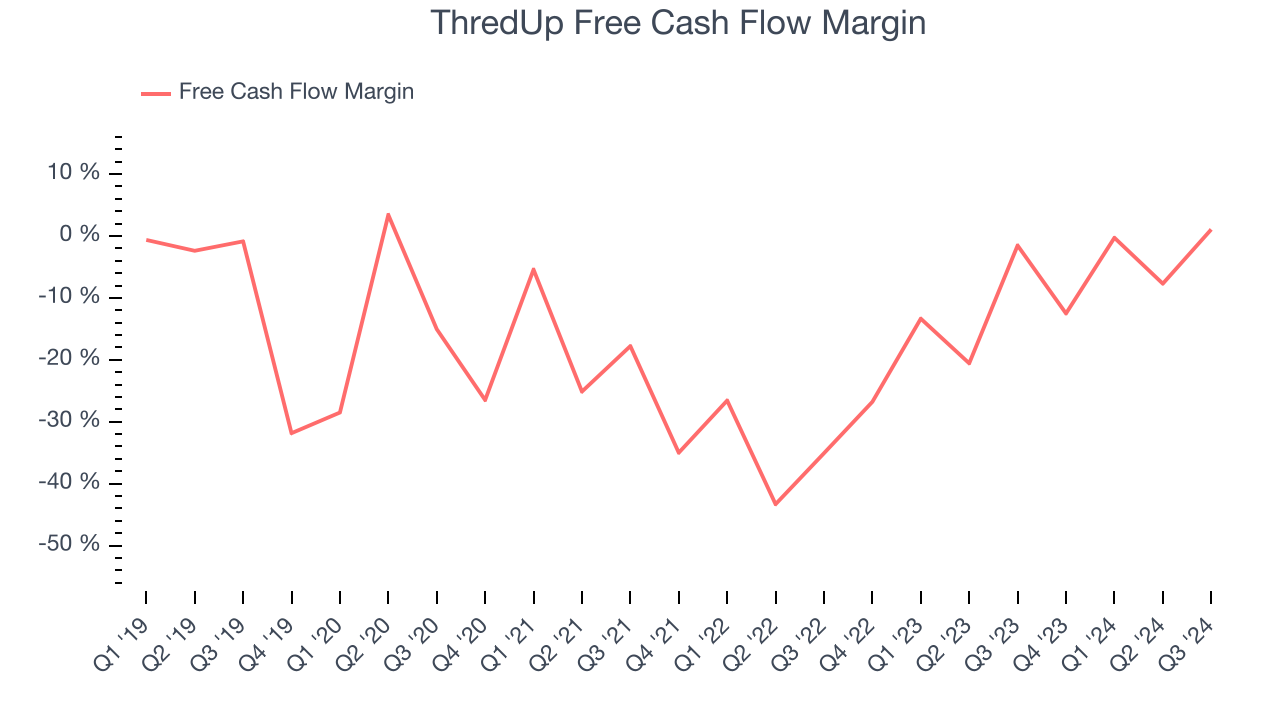

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

While ThredUp posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, ThredUp’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 10.1%, meaning it lit $10.11 of cash on fire for every $100 in revenue.

ThredUp’s free cash flow clocked in at $774,000 in Q3, equivalent to a 1.1% margin. Its cash flow turned positive after being negative in the same quarter last year

Key Takeaways from ThredUp’s Q3 Results

We were impressed by how significantly ThredUp blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed and its revenue guidance for next quarter came in slightly below Wall Street’s estimates. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 6% to $0.56 immediately after reporting due to the positives and likely low expectations for a company that has had inconsistent quarter earnings performance as well.

Is ThredUp an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.