Data and analytics software provider Teradata (NYSE: TDC) beat Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $440 million. Its non-GAAP profit of $0.69 per share was also 22.9% above analysts’ consensus estimates.

Is now the time to buy Teradata? Find out by accessing our full research report, it’s free.

Teradata (TDC) Q3 CY2024 Highlights:

- Revenue: $440 million vs analyst estimates of $417.7 million (5.3% beat)

- Adjusted EPS: $0.69 vs analyst estimates of $0.56 (22.9% beat)

- Adjusted Operating Income: $99 million vs analyst estimates of $83.77 million (18.2% beat)

- Management raised its full-year Adjusted EPS guidance to $2.32 at the midpoint, a 4% increase

- Gross Margin (GAAP): 61.6%, up from 59.4% in the same quarter last year

- Operating Margin: 12.7%, up from 6.2% in the same quarter last year

- Free Cash Flow Margin: 15.7%, up from 8.9% in the previous quarter

- Annual Recurring Revenue: $1.48 billion at quarter end, down 2.8% year on year

- Market Capitalization: $3.19 billion

“In the third quarter, we grew our cloud business, delivered innovations that strengthen our market position, and added new customers and partners. We are seeing customers increasingly leverage our hybrid capabilities as they transform and commit to Teradata for the long term,” said Steve McMillan, President and Chief Executive Officer, Teradata.

Company Overview

Part of point-of-sale and ATM company NCR from 1991 to 2007, Teradata (NYSE: TDC) offers a software-as-service platform that helps organizations manage their data across multiple storages and analyze it.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

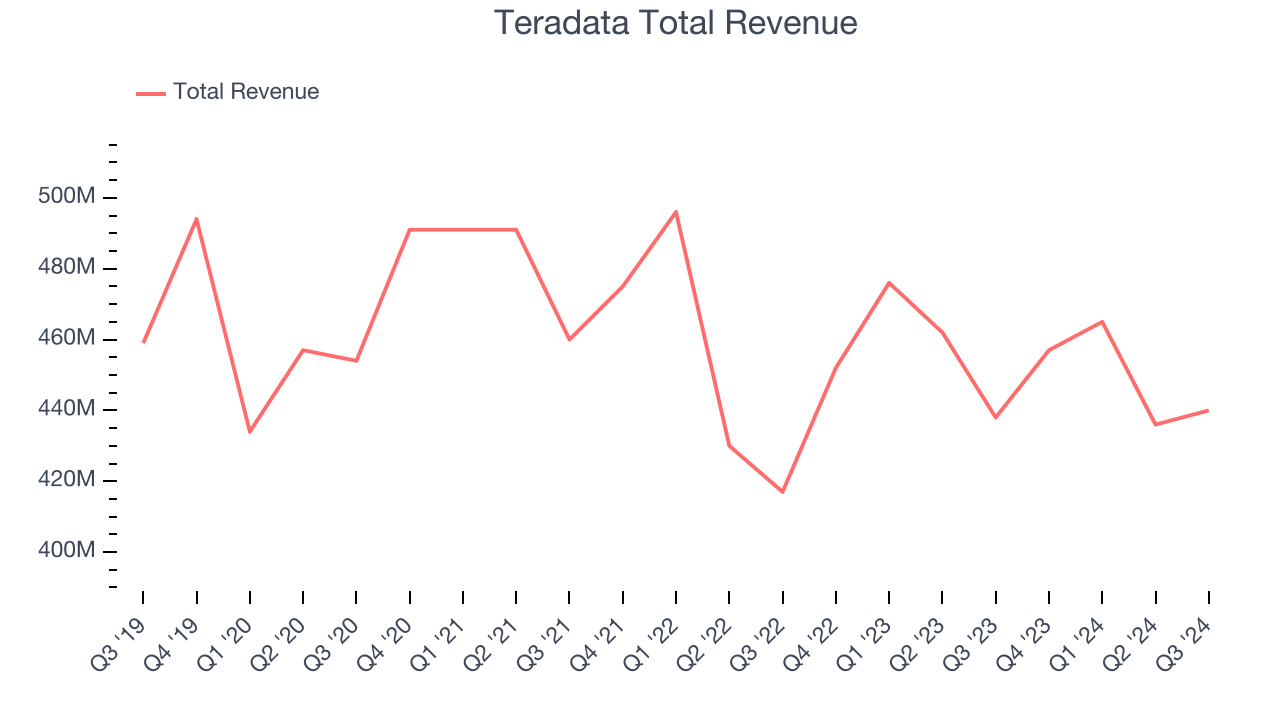

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Teradata struggled to generate demand over the last three years as its sales dropped by 2.4% annually, a rough starting point for our analysis.

This quarter, Teradata’s $440 million of revenue was flat year on year but beat Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to decline 4.1% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and indicates the market thinks its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

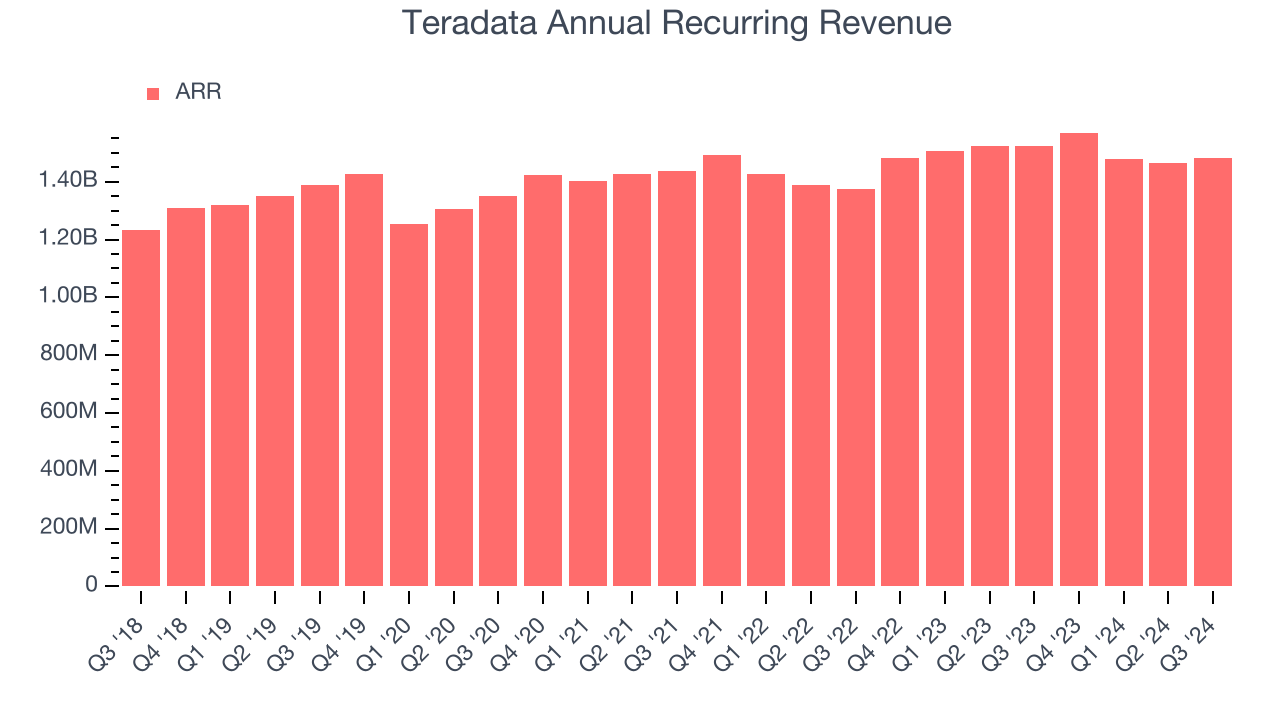

Annual Recurring Revenue

Investors interested in Teradata should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Teradata failed to grow its ARR, which came in at $1.48 billion in the latest quarter. This performance mirrored its revenue and shows the company faced challenges in customer acquisition and retention. It also suggests there may be increasing competition or market saturation. If Teradata wants to become a more predictable business and boost its valuation, ARR growth must accelerate.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Teradata to acquire new customers as its CAC payback period checked in at 67.7 months this quarter. The company’s performance indicates that it operates in a competitive market and must continue investing to maintain its growth trajectory.

Key Takeaways from Teradata’s Q3 Results

We were impressed by Teradata’s optimistic full-year EPS forecast, which blew past analysts’ expectations. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its EPS forecast for next quarter missed. Overall, this quarter was mixed. Shares traded down 1.9% to $32.75 immediately following the results.

Big picture, is Teradata a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.