Platform capabilities include multi-source data orchestration, embedded analytics across Nova Credit’s three flagship products, flexible deployment, and end-to-end compliance framework

Nova Credit, the leading credit infrastructure and analytics company, today announced the launch of the Nova Credit Platform, a unified integration to quickly onboard, orchestrate, and analyze consumer credit data from a range of alternative sources, all within a consumer reporting agency compliant framework. The Nova Credit Platform is a foundational layer designed for lending institutions to grow responsibly by streamlining onboarding, verification, and underwriting processes of credit data.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240301901038/en/

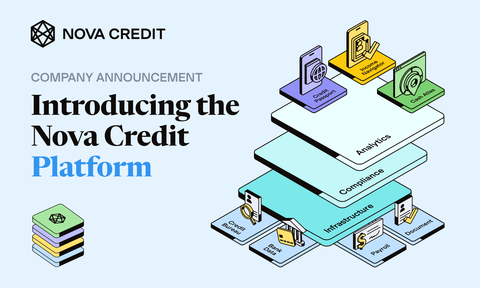

The Nova Credit Platform is a unified integration to quickly onboard, orchestrate, and analyze consumer credit data from a range of alternative sources, all within a consumer reporting agency compliant framework (Graphic: Business Wire)

With the CFPB's proposed 1033 rule, the U.S. is ushering in open banking, which involves enabling consumers to securely share their financial data with third-party providers to improve access to financial products and services. Financial institutions and fintechs recognize the value this consumer-permissioned data brings to drive growth and support safety and soundness. However, they are challenged by effectively scaling access and seamlessly deploying this data into actionable credit risk insights. Of particular concern, companies have struggled to seamlessly embed these workflows to drive conversion and navigate a range of analytical and compliance questions. Resolving these issues is crucial in order to benefit from capabilities like cash flow underwriting, automated income verification, risk monitoring, cross-border credit, and more.

“Data is not enough,” said Brian Hughes, Former Chief Risk Officer at Discover. “The best credit solutions and opportunities can only be unlocked by the combination of resilient infrastructure, best in class data science, and reliable compliance. This allows lenders to focus their energy on what they already do best.”

Customers and partners have relied on Nova Credit for years to unlock the value of alternative credit data with deep analytics expertise and its comprehensive compliance framework. The launch of the Nova Credit Platform is the next step in providing the market with a suite of solutions built on a unified, flexible platform infrastructure designed to help lenders and companies better understand a growing base of underserved consumers.

“Some of the bureaus will tell you that the reason that ~100 million Americans struggle with financial access is that there simply isn’t enough data on them. Our view is the opposite. There is an abundance of consumer data, but lenders don’t have a seamless and compliant way to access it,” said Misha Esipov, CEO and co-founder of Nova Credit. “After enabling some of the world’s largest banks and issuers with alternative data, the Nova Credit Platform emerged to solve that problem. We’re giving companies the infrastructure and analytics foundation they need to grow responsibly, deliver on their missions, and stay competitive in the market.”

The Nova Credit Platform combines:

(i) Robust infrastructure with multi-source data onboarding and orchestration with industry-leading coverage and uptime

(ii) Embedded analytics for direct insertion into decisioning and verification workflows

(iii) End-to-end compliance and fit-for-purpose credit expertise

(iv) Flexible deployment (no-code, embedded module, hosted flows, and pure API) across use cases, credit processes, and organization size

The Platform strengthens Nova Credit’s existing product offerings in cash flow underwriting (Cash Atlas™), income verification (Income Navigator), and cross-border credit (Credit Passport®), delivering access to enriched consumer-permissioned credit data and analytics at any stage of the credit workflow. In conjunction with the products, the Platform ensures enterprise-grade reliability for institutional coverage, maximum uptime, and latency optimization. As population segments evolve and more credit data emerges, this unified integration continuously helps paint a more complete picture, assess risk, and identify opportunities within a growing base of applicants and existing customers.

“As the use of alternative credit data continues to mature, ensuring the data is trustworthy, compliant, and accurate must be a top priority for lenders who look to incorporate it into their underwriting practices,” said Yacine Azmi, CTO at Nova Credit. “In addition to reliable data, the ability to assess credit risk accurately and within one, easy-to-integrate platform is paramount, but working with an experienced partner who understands both the credit analytics and compliance is what will separate the best lenders from the pack.”

The Nova Credit Platform is live and used by leading companies such as American Express, HSBC, Scotiabank, Verizon, SoFi, and Yardi. To learn how to scale onboarding, underwriting, and verification processes, reach out to connect@novacredit.com or learn more at www.novacredit.com/platform.

About Nova Credit

Nova Credit is a credit infrastructure and analytics company that enables businesses to grow responsibly by harnessing alternative credit data. The company is a consumer reporting agency (CRA) that leverages its unique set of data sources, bank-grade infrastructure and compliance framework, and proprietary credit expertise to help lenders fill the gaps that exist in traditional credit analytics. Nova Credit serves as the bridge between data and credit excellence, providing a comprehensive suite of solutions designed to give lenders across various industries - including finance, fintech, property management, telecom, and automotive - a competitive edge in the open finance era. Its cross-border credit product, Credit Passport®, cash flow underwriting product, Cash Atlas™, and income verification product, Income Navigator, are used by leading organizations like American Express, Verizon, HSBC, SoFi, Scotiabank, and Yardi. Nova Credit is backed by investors including Kleiner Perkins, General Catalyst, Index Ventures, and Canapi Ventures.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240301901038/en/

Contacts

V2 Communications on behalf of Nova Credit

Rachel Levy

novacredit@v2comms.com