Younger Investors Highly Receptive but Firms Failing to Effectively Convey Benefits that Can Drive Wider Adoption

After the past few years of digital transformation and a do-it-yourself investing revolution that saw the rise and fall of meme stocks, crypto and virtually every other asset class, younger investors are at a crossroads. While many want guidance and the vast majority are open to digital advice from their brokerage firms, few understand how technology manages their portfolio. According to the J.D. Power 2023 U.S. Self-Directed Investor Satisfaction Study,SM released today, that lack of understanding could pose challenges for firms trying to establish longer-term relationships with younger, do-it-yourself investors.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230413005109/en/

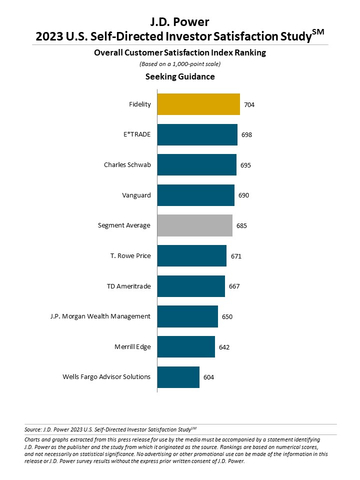

J.D. Power 2023 U.S. Self-Directed Investor Satisfaction Study (Graphic: Business Wire)

“With most trading fees now eliminated and the core capabilities most consumers need being universally available, brokerage firms are challenged to demonstrate a value proposition that stands out from the crowd,” said Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power. “Digital, or robo-advice, presents an ideal platform to provide value-added services that can help grow and develop higher value relationships over time. But firms need to do a better job explaining how that digital advice works and articulating a clear value proposition for investors. Right now, investors are interested, but if they are going to stick around for the long haul, they need to understand the value of the service they are receiving.”

Following are key findings of the 2023 study:

- Millennials1 and Gen Z highly receptive to digital advice: Younger self-directed investors within the do-it-yourself segment are hungry for advice and the majority are receptive to the idea of receiving digital, or robo-advice. Currently, 86% of Gen Z investors and 79% of Millennial investors are interested in receiving robo-advice. Those numbers have increased 5 percentage points and 3 percentage points, respectively, during the past three years as market conditions have become more challenging.

- Widespread lack of understanding: Despite strong interest in digital advice, very few users of the technology understand how it works. Just 22% of investors who currently use robo-advice offerings from their brokerage firm say they “completely understand” how the technology manages their portfolio. Net Promoter Scores®2 decrease significantly when investors say they are unsure how the digital technology works.

- Human support is a key variable: Don’t be fooled by the terms do-it-yourself and robo-advice. Self-directed investors are still looking for human support when it comes to onboarding, answering technical questions and resolving problems. Human support also plays a key role in providing greater transparency and trust in digital advice.

Study Rankings

Fidelity (704) ranks highest in self-directed investor satisfaction among investors seeking guidance. E*Trade (698) ranks second and Charles Schwab (695) ranks third.

Vanguard (734) ranks highest in self-directed investor satisfaction among do-it-yourself investors. T. Rowe Price (724) ranks second and Charles Schwab (717) ranks third.

The U.S. Self-Directed Investor Satisfaction Study, now in its 21st year, evaluates key satisfaction drivers and firm performance among both investors seeking guidance (those who don’t have a dedicated financial advisor but do have access to interact with a registered investment professional) and true do-it-yourself investors (those who do not interact with professional advisors). The study measures self-directed investors’ satisfaction with their investment firm based on performance in seven factors (in order of importance): trust; digital channels; the ability to manage wealth how and when I want; products and services; value for fees; people; and problem resolution.

The study is based on responses from 5,165 investors who make all their investment decisions without the counsel of a full-service dedicated financial advisor. It was fielded from October 2022 through January 2023.

For more information about the U.S. Self-Directed Investor Satisfaction Study, visit

https://www.jdpower.com/business/wealth-management-platform.

See the online press release at http://www.jdpower.com/pr-id/2023035.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

2 Net Promoter Score, NPS and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230413005109/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com