Urges Shareholders to Vote “FOR” ALL of US Foods’ Highly Qualified Directors on the WHITE Proxy Card

Highlights Track Record of Earnings Growth, Long-Range Plan to Create Shareholder Value and Refreshed Board of Directors

US Foods Holding Corp. (NYSE: USFD) (“US Foods” or the “Company”), one of the largest foodservice distributors in the United States, today sent a letter to shareholders in connection with its May 18, 2022 Annual Meeting of Shareholders (the “2022 Annual Meeting”). Shareholders of record as of March 21, 2022, will be entitled to vote at the meeting.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220417005036/en/

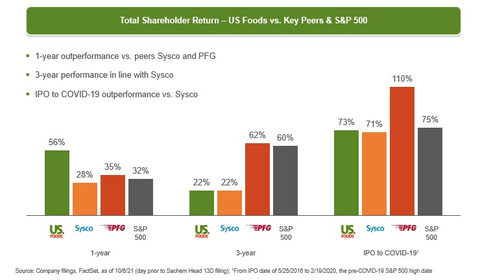

Total Shareholder Return - US Foods vs. Key Peers and S&P 500 (Graphic: Business Wire)

Highlights from the letter include:

- US Foods has a track record of driving profitable growth.

- US Foods is confident that its plan is creating shareholder value.

- US Foods’ Board has been refreshed with highly qualified directors with relevant skills and experiences and is best suited to lead the Company through the execution of its strategy.

- US Foods has constructively engaged with Sachem Head to avoid a proxy contest, but the erratic nature of Sachem Head’s demands has impeded a settlement.

- US Foods’ Board will continue to act as its own agent of change for the benefit of all of the Company’s shareholders.

The definitive proxy materials and other materials related to the 2022 Annual Meeting, including director biographies and additional details on the Company’s long-range plan, are available at https://www.VoteforUSFoods.com.

The full text of the letter being sent to shareholders follows:

Dear Fellow US Foods Shareholder,

Your vote at US Foods’ upcoming 2022 Annual Meeting of Shareholders is critical, as Sachem Head Capital Management LP (“Sachem Head”) is conducting an unnecessary proxy contest in an attempt to remove members of your Board of Directors (the “Board”). We urge you to support your Board by voting the WHITE proxy card today “FOR” all US Foods director nominees. When voting the WHITE proxy card, consider the following:

- In the four years leading up to the pandemic, US Foods has a track record of driving profitable growth.

- We recognize that we did not deliver on expectations we set in the past. While we made progress towards our goals in 2018 and 2019, we fell short of fully achieving them. However, during the pandemic, which had an outsized negative impact on our industry, we took important steps not only to weather the unprecedented challenges, but also to emerge as a stronger and more focused company, as demonstrated by our more recent financial performance.

- Our long-range plan, which we shaped over the last twelve months, balances profitable market share and revenue growth, gross margin expansion and cost reduction through a number of tested initiatives and addresses the opportunities we have for further improvement. Recognizing opportunities for improvement, US Foods has made changes to its management team, operating model and customer prioritization to further enable the success of this plan.

- We believe that Sachem Head’s single-minded operational focus on cost reduction will reduce, rather than increase, shareholder value in the long-term. Sachem Head’s proposals are single-mindedly focused on cost reduction. In our industry, one of the biggest drivers of EBITDA and ROIC growth is winning new customers in our target segments, which is why we have built a plan that balances delivering top-line growth by offering customers reliable service and differentiated solutions while also remaining intensely focused on cost management and margin expansion.

- Your Board is composed of directors who bring a diverse, relevant and complementary set of experiences, ranging from distribution and supply chain management to financial expertise, digital technology and restaurant management experience. The Board has shaped our long-range plan and continues to actively oversee its execution. We are committed to ongoing refreshment and recently added two high-quality, independent directors who have further enhanced the diverse skillset and experiences of your Board.

- We have tried hard to avoid a proxy contest, but the erratic nature of Sachem Head’s proposals has impeded a settlement. Our Board and management team have engaged with Sachem Head on numerous occasions, seeking to understand what Sachem Head would do differently with respect to our business, and exploring common ground for a settlement. We have offered Sachem Head multiple reasonable settlement solutions, all of which Sachem Head rejected. In addition, Sachem Head’s erratic series of proposals has created an unfruitful negotiating environment: first proposing three directors, then seven, then six, then four, and now most recently five. Further, Bernardo Hees was removed from Sachem Head’s slate last week after Sachem Head had for six months mandated that Mr. Hees was a non-negotiable precondition to any settlement and insisted that Mr. Hees was not a “stealth CEO candidate.” Now, Mr. Hees’s nomination has been abandoned and Sachem Head is demanding the replacement of our CEO or the sale of the Company instead. The US Foods Board believes that reasonable negotiations require forward progress, rather than the contradictory proposals that have been made by Sachem Head.

STRATEGIC INVESTMENTS HAVE DRIVEN RESULTS AND ESTABLISHED A STRONG FOUNDATION

Our recent progress is part of a longer track record of growth and margin expansion enabled by a strategy designed to stay ahead of evolving customer needs and industry conditions. While we acknowledge that opportunities remain to improve supply chain efficiency, our approach has already delivered significant results.

Our progress has resulted in a strong one-year total shareholder return (TSR) of 56% as of October 6, 2021 (the last day prior to Sachem Head’s Schedule 13D filing), exceeding both US Foods’ peers and the S&P 500, leading the post-pandemic recovery. Our three-year TSR to this same date, as well as our performance from US Foods’ 2016 IPO through the onset of the pandemic, is comparable with that of our largest competitor. (See associated graph)

The execution of our strategy leading up to the pandemic advanced three primary objectives: profitable market share growth through product differentiation, gross margin expansion and operational efficiency improvements:

Objective |

Pre-Pandemic Progress1 |

Profitably Grow Market Share |

|

Optimize Gross Margins

|

|

Improve Operational Efficiency

|

|

The pandemic accelerated the need for continued adaptation in our business, and we responded by focusing on further differentiating the solutions we provide, streamlining our operating model and building out our omni-channel platform. These actions enabled us to enhance gross profit and reduce costs while simultaneously building our foundation for post-pandemic growth. At the same time, we successfully managed the business through increased volatility of demand, product supply and labor. Combined, these initiatives helped us navigate and emerge successfully from the pandemic, and we are confident they will underpin our continued success:

Objective |

Pandemic Progress |

Profitably Grow Market Share

~$1B in Net New National Customer Wins4 |

|

Optimize Gross Margins

Record Adjusted Gross Profit per Case in 2021 |

|

Improve Operational Efficiency

$130M in Selling and Administrative Cost Savings5 |

|

WE ARE CONFIDENT THAT OUR PLAN IS CREATING SHAREHOLDER VALUE

Following the pandemic, the industry has continued its decades-long growth of food away from home relative to food at home. In addition, our industry continues to evolve in a way that favors scale distributors who bring innovative solutions to customers. For example, more restaurants than ever are offering off-premise dining. This evolution in operator preferences is necessitating investments in technology and solutions that provide foodservice customers more tools and greater flexibility. On the product front, increasing demand for sustainable products creates even more opportunity for a distributor with our capabilities and our strategy.

Over the last year, the Board has been actively involved in overseeing the development of our long-range plan. This plan is based on three pillars. First, driving market share by evolving our differentiated solutions in light of market trends, while also offering consistent service and fresh quality. Independent research shows no single broadline distributor has a clear advantage on a dimension of great importance to customers. Second, building upon our successful track record of optimizing gross margins. And third, bringing new processes and talent to drive operational efficiency.

Objective |

Strategic Initiatives |

Profitably Grow Market Share ~ $290M Adj. EBITDA Growth6

|

|

Optimize Gross Margins

~ $325M Adj. EBITDA Growth6 |

|

Improve Operational Efficiency

~ $235M Adj. EBITDA Growth6 |

|

By executing our strategy to drive profitable volume growth and margin expansion, we expect to deliver ~$1.7 billion in Adjusted EBITDA in 2024.

These increased earnings will produce strong and growing cash flows, which we can then — in order of priority — prudently allocate to reinvest in the business, reduce leverage, return capital to shareholders and opportunistically pursue tuck-in M&A.

To further demonstrate a commitment to shareholder value, your Board reshaped our 2021 executive compensation to motivate and drive performance to align with shareholders and TSR. The Board introduced special one-time “Value Creation Awards” in 2021, with vesting tied to the achievement of best-in-class TSR growth targets over a four-year performance period. These awards vest in 2025 only if management achieves significant increases in TSR, kicking in only if US Foods trades above $48 per share, with additional higher payout opportunities above $59 and $70 per share. Achievement of these stock price targets is equivalent to market capitalization growth between $2.7 billion and $8.2 billion and would require successful execution of our long-term strategic initiatives aligned with shareholder value creation.

As you consider our plan in the context of Sachem Head’s proxy contest against the Company, it is important to understand that the vast majority of ideas Sachem Head has put forth were already part of our plan that we have been executing over the last 18 months. There is one very important distinction to draw: We believe that Sachem Head’s single-minded focus on cost reduction will reduce, rather than increase, shareholder value in the long-term. One of the biggest drivers of EBITDA and ROIC growth is winning new customers in our target segments, which is why we have built a holistic plan that continues to offer customers reliable service and differentiated solutions, while remaining intensely focused on cost management and margin expansion.

Your Board and management team are not sitting still. We are confident that we have the right plan and the right team to capitalize on the opportunities ahead to generate significant value for our shareholders.

WE HAVE AND WILL CONTINUE TO ACT AS OUR OWN AGENTS OF CHANGE FOR THE BENEFIT OF ALL US FOODS SHAREHOLDERS

We are open to change, supported by strong governance. The Board’s composition reflects a commitment to refreshment and bringing in new perspectives. We have appointed six new independent directors during the last four years, five of whom are diverse by gender or ethnicity. The Board’s average tenure is approximately four years. The directors standing for election this year are highly respected in the foodservice and restaurant industry and/or bring significant distribution, supply chain, finance, technology, governance and C-suite operating experience to guide and oversee the Company at this critical time.

The Board has also made substantive governance changes in recent years in line with investor feedback and governance best practices, including:

- Separation of Chairman and CEO roles;

- Declassification of the board, which will be complete at our 2022 Annual Meeting;

- Refreshed committee chairs and committee membership;

- Elimination of supermajority voting requirement to amend the bylaws;

- Adoption of a majority voting standard for uncontested director elections with a director resignation policy (and a plurality vote standard for contested director elections); and

- Enhancement of board diversity.

WE OFFERED SACHEM HEAD REASONABLE SETTLEMENT SOLUTIONS… SACHEM HEAD REJECTED THEM

Since Sachem Head filed its Schedule 13D in October of last year, your Board and management team have engaged seriously and with a sense of urgency with Sachem Head, seeking to understand what Sachem Head would do differently with respect to our business, and exploring common ground for a settlement. The Nominating and Corporate Governance Committee interviewed Sachem Head’s original three director candidates with an open mind and in the spirit of trying to resolve this matter. Following these interviews, the Board offered to add two new directors: Scott Ferguson, its principal, and a mutually agreed director with supply chain expertise. However, for six months, Sachem Head made the appointment of Bernardo Hees as executive chairman a non-negotiable precondition to any settlement.

Despite our genuine efforts to reach a resolution, Sachem Head went silent on us for many weeks and then publicly released a letter to the media. Without giving any advance notice to US Foods, Sachem Head proceeded to nominate seven director candidates to take control of the Company (four of whom Sachem Head had never mentioned previously to US Foods).

Following the nomination, we requested to interview his four new director candidates, but Mr. Ferguson declined our request. Subsequently Mr. Ferguson made the following proposal: agree to give Sachem Head four seats on the Board and publicly announce either a search for a new CEO or a review of strategic alternatives. He further elaborated that if the Company decided not to pursue a CEO search or sale of the Company, Sachem Head should be given control through a majority of the seats on the Board. US Foods made a fair counterproposal including the appointment of two Sachem Head nominees to the Board (other than Mr. Hees and Ms. Adler, who were removed from Sachem Head’s slate last week) and the formation of a five-member committee charged with the evaluation of avenues to create shareholder value, which would include both Sachem Head directors.

Sachem Head rejected our counterproposal and laid out a new proposal which again increased the number of directors Sachem Head would require to settle the proxy contest to five. To recap the history of Sachem Head’s proposals: Sachem Head first demanded three directors, then seven, then six, then four, and now most recently five. Sachem Head also previously insisted that they simply wanted limited director representation to help improve operations and that Mr. Hees was not a “stealth CEO candidate”; now they are demanding a change in CEO or a sale of the Company. The Board believes that reasonable negotiations require forward progress, rather than the erratic and inconsistent demands that have been made by Sachem Head.

After all this back and forth, Sachem Head’s goal appears to be clear: sell the Company or replace the CEO.

US Foods has the right board and management team to lead the Company through the execution of its strategy. The Board has been significantly refreshed and features diverse viewpoints. We continually evaluate the composition of our Board and are confident that our current Board has a stronger mix of skills than Sachem Head’s nominees and the experience needed to deliver shareholder value. As we have throughout our engagement, we remain open to evaluating reasonable proposals to avoid an unnecessary proxy contest.

VOTE THE WHITE PROXY CARD TODAY “FOR” ALL US FOODS’ DIRECTOR NOMINEES

We urge you to use the enclosed WHITE proxy card to vote today “FOR” ALL of US Foods’ nominees. Simply follow the easy instructions on the enclosed proxy card to vote by telephone, by Internet or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided. Please disregard any gold proxy card you get from Sachem Head.

We encourage you to visit VoteforUSFoods.com for more information about our long-range plan to enhance shareholder value, our highly qualified directors and how to vote your shares.

On behalf of your Board and the management team, thank you for your continued support.

Sincerely,

The US Foods Board of Directors

/s/ Cheryl A. Bachelder

/s/ Court D. Carruthers

/s/ Robert M. Dutkowsky

/s/ Marla C. Gottschalk

/s/ Sunil Gupta

/s/ John A. Lederer

/s/ Carl A. Pforzheimer

/s/ Quentin Roach

/s/ Pietro Satriano

/s/ Nathaniel H. Taylor

/s/ David M. Tehle

/s/ Ann E. Ziegler

Centerview Partners LLC and J.P. Morgan Securities LLC are acting as financial advisors to US Foods. Sidley Austin LLP is serving as legal counsel to US Foods.

About US Foods

With a promise to help its customers Make It, US Foods is one of America’s great food companies and a leading foodservice distributor, partnering with approximately 250,000 restaurants and foodservice operators to help their businesses succeed. With 69 broadline locations and more than 80 cash and carry stores, US Foods and its 28,000 associates provides its customers with a broad and innovative food offering and a comprehensive suite of e-commerce, technology and business solutions. US Foods is headquartered in Rosemont, Ill. Visit www.usfoods.com to learn more.

ADDITIONAL INFORMATION

On April 11, 2022, the Company filed a definitive proxy statement, an accompanying WHITE proxy card, and other relevant documents with the SEC in connection with the solicitation of proxies from the Company's shareholders for the 2022 annual meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a copy of the definitive proxy statement, an accompanying WHITE proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC at no charge at the SEC's website at www.sec.gov. Copies will also be available at no charge in the “SEC Filings” subsection of the “Financial Information” section of the Company's Investor Relations website at https://ir.usfoods.com/investors or by contacting info@okapipartners.com.

FORWARD-LOOKING STATEMENTS

Statements in this press release which are not historical in nature are “forward-looking statements” within the meaning of the federal securities laws. These statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “outlook,” “estimate,” “target,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecast,” “mission,” “strive,” “more,” “goal,” or similar expressions and are based upon various assumptions and our experience in the industry, as well as historical trends, current conditions, and expected future developments. However, you should understand that these statements are not guarantees of performance or results and there are a number of risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed in the forward-looking statements, including, among others: cost inflation/deflation and commodity volatility; competition; reliance on third party suppliers; interruption of product supply or increases in product costs; changes in our relationships with customers and group purchasing organizations; our ability to increase or maintain the highest margin portions of our business; effective integration of acquisitions; achievement of expected benefits from cost savings initiatives; fluctuations in fuel costs; economic factors affecting consumer confidence and discretionary spending; changes in consumer eating habits; our reputation in the industry; labor relations and costs; access to qualified and diverse labor; cost and pricing structures; changes in tax laws and regulations and resolution of tax disputes; governmental regulation; product recalls and product liability claims; adverse judgments or settlements resulting from litigation; disruptions of existing technologies and implementation of new technologies; cybersecurity incidents and other technology disruptions; management of retirement benefits and pension obligations; extreme weather conditions, natural disasters and other catastrophic events; risks associated with intellectual property, including potential infringement; indebtedness and restrictions under agreements governing indebtedness; potential interest rate increases; risks related to the impact of the ongoing COVID-19 outbreak on our business, suppliers, consumers, customers and employees; and potential costs associated with shareholder activism.

________________________

1 From FY 2015 to FY 2019 |

2 As defined by Technomic |

3 Scoop™ statistics through FY 2021 |

4 From FY 2020 to FY 2021 |

5 From FY 2020 to FY 2021 |

6 Growth as compared to full-year 2021 results. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220417005036/en/

Contacts

INVESTOR CONTACT:

Snehal Shah

847-720-8109

Snehal.Shah@usfoods.com

Bruce Goldfarb / Pat McHugh

Okapi Partners

212-297-0720

info@okapipartners.com

MEDIA CONTACT:

Jamie Moser / Matthew Sherman

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449