Visa Inc. (V), based in San Francisco, is a global payment technology company with a market cap of $599.2 billion. Operating in over 200 countries, it facilitates secure, fast transactions through its advanced technology and global infrastructure, enabling digital money movement and supporting commerce worldwide.

Despite its reputation as a global payments powerhouse, Visa has struggled to keep pace with the broader market over the past year. Visa has declined 4.9% over this time frame, while the broader S&P 500 Index ($SPX) has soared 15.4%. Moreover, on a YTD basis, the stock is down 6.2%, compared to SPX’s 1.1% uptick.

Nonetheless, zooming in further, V has outpaced the Amplify Digital Payments ETF(IPAY), which has dipped 23.7% over the past year and 10.9% on a YTD basis.

On Jan. 29, Visa shares popped 1.5% after the company reported its fiscal 2026 Q1 results. Its net revenue of $10.9 billion increased 15% year over year, driven by resilient consumer spending, robust holiday shopping, and higher payments and cross-border volumes. Adjusted EPS of $3.17 also grew 15% and beat analyst expectations. Payment volume expanded about 8%, processed transactions rose 9%, and cross-border volumes climbed 12%, highlighting broad demand across its network.

For fiscal 2026, ending in September, analysts expect V’s EPS to grow 11.9% year over year to $12.83. The company’s earnings surprise history is promising. It surpassed the consensus estimates in each of the last four quarters.

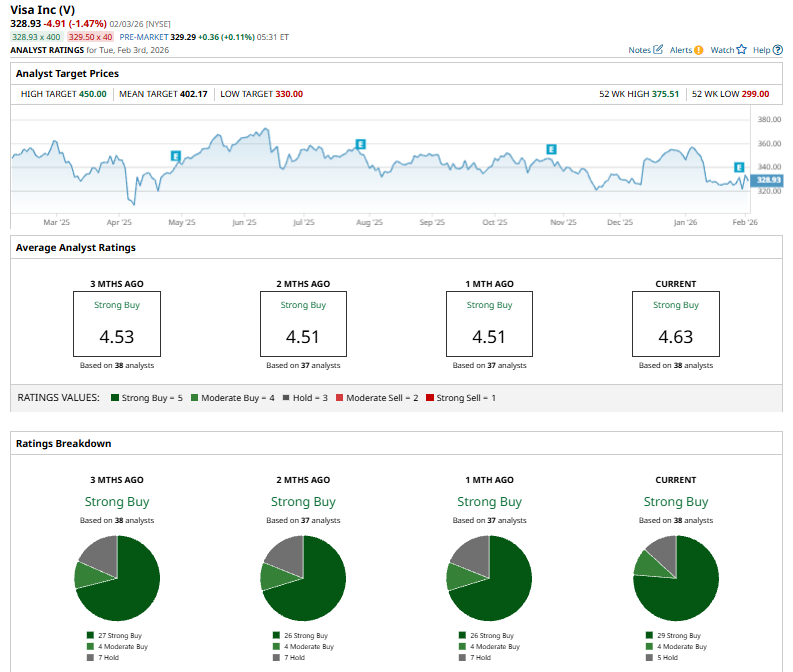

Among the 38 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 29 “Strong Buy,” four “Moderate Buy,” and five "Hold” ratings.

This configuration is slightly bullish than a month ago, with 26 analysts suggesting a “Strong Buy” rating.

On Feb. 3, RBC Capital Markets analyst Daniel Perlin reiterated a “Buy” rating on Visa, setting a $395 price target.

The mean price target of $402.17 represents an 22.3% premium from V’s current price levels, while the Street-high price target of $450 suggests an upside potential of 36.8%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why This Analyst Just Raised Their Price Target on Broadcom Stock

- Strategy Inc Bear Call Spread Could Net 15% in Two Weeks

- Stock Index Futures Steady After Tech-Led Selloff, U.S. ADP Jobs Report and Alphabet Earnings in Focus

- General Motors Just Raised Its Dividend 20%. Does That Make GM Stock a Buy?