International Business Machines (IBM) shares have lost more than 6% this week after Anthropic launched new plugins for Claude Cowork, signaling it’s now moving into the application layer.

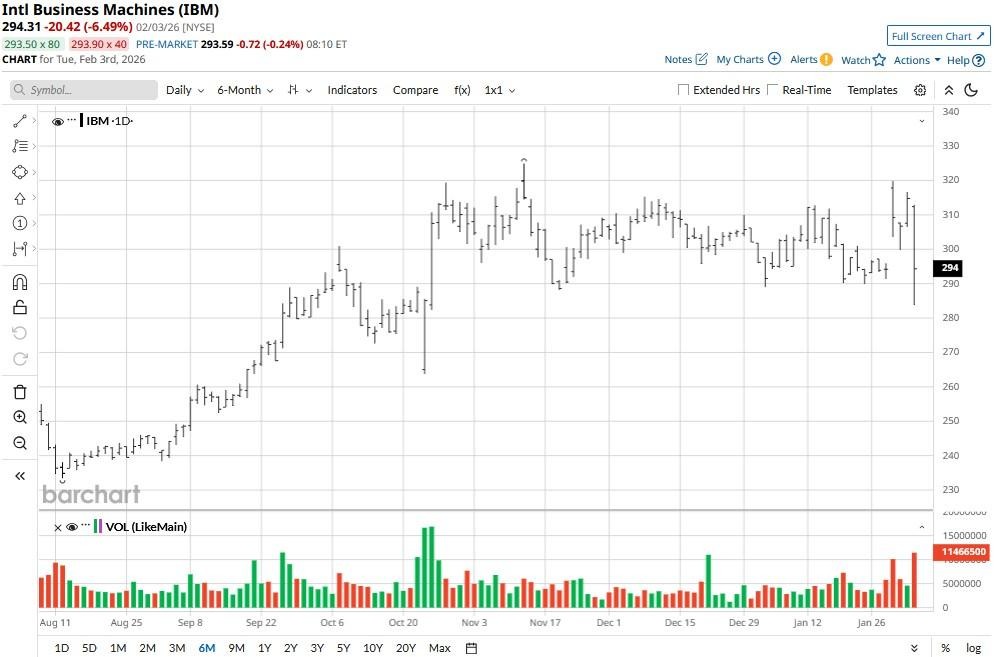

The downward pressure on IBM has pushed its price below a key support level — coinciding with its 100-day moving average (MA), signaling the bearish momentum could sustain in the near-term.

Despite the recent selloff, IBM stock remains up more than 25% versus its August low.

Why Anthropic’s Latest Offering Is Negative for IBM Stock

The Anthropic news is concerning for IBM shares given its new tools — specifically the legal, sales, and data plugins — directly automate complex workflows that IBM charges high premiums for.

If a Claude Cowork agent at about $30 per month can handle document review, NDA triage, and data analysis via a plugin, investors sure have reason to question the long-term value of traditional enterprise software licenses.

Still, famed investor Jim Cramer recommends loading up on IBM following its recent decline, as it’s a “rare AI winner with a fairly low price-to-earnings multiple.”

The tech stock is going for about 25x forward earnings at the time of writing, which makes it much “cheaper than some of the other big software-as-a-service (SaaS) companies,” Cramer said in a recent segment on CNBC.

Cramer Says IBM Shares Have a Lot More Room to Run

According to Cramer, long-term investors should buy IBM shares at current levels also because the multinational offered “a terrific full-year forecast for 2026” last week.

The Nasdaq-listed firm expects its revenue to grow by more than 5% and free cash flow to increase by a whopping $1 billion this year.

“Long story short, I’m betting IBM has a lot more room to run,” he told viewers, noting the tech firm has topped earnings expectations for 17 consecutive quarters.

Investors should also note that IBM has a history of closing both February and March in the green, a seasonal pattern that makes its stock even more exciting to own in the near-term.

Wall Street Shares Cramer’s Positive View on IBM

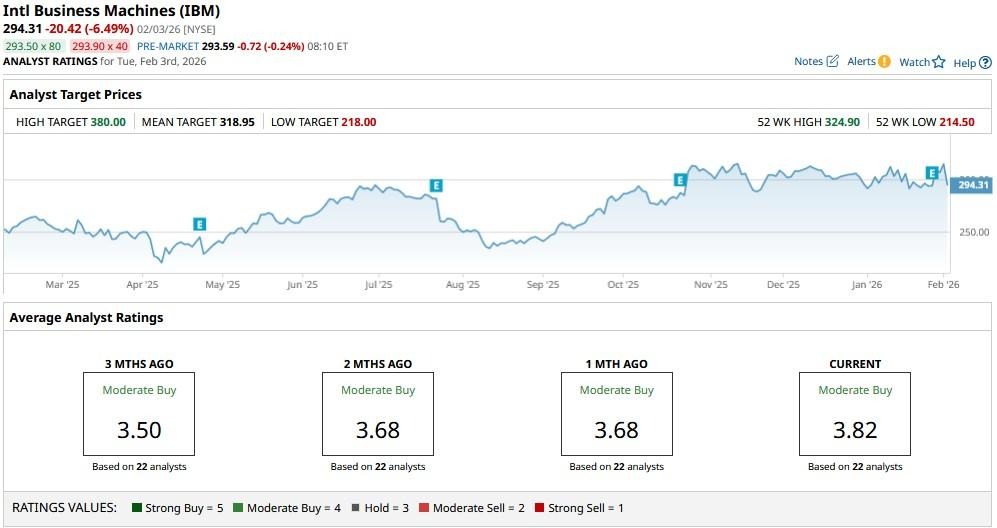

Wall Street analysts agree with Cramer’s optimism on IBM stock as well.

The consensus rating on International Business Machines remains at a “Moderate Buy,” with price targets as high as $380 indicating potential upside of some 30% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?