Ameriprise Financial, Inc. (AMP) is a broad financial services firm that delivers tailored wealth management, asset management, insurance, and banking services. Based in Minneapolis, Minnesota, it provides customized financial advice via advisors across the U.S. and aids clients with investments, retirement planning, and annuities. It has a market capitalization of $45.87 billion.

The company is expected to report its fourth-quarter results for fiscal 2025 soon. Ahead of the release, Wall Street analysts are optimistic about the company’s bottom-line trajectory.

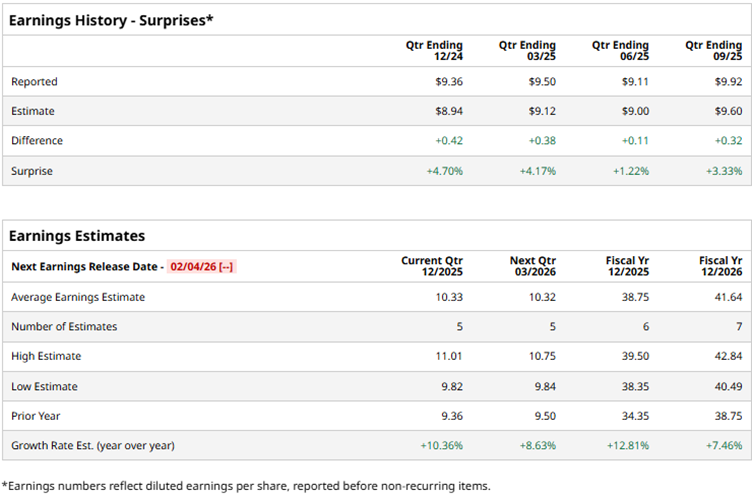

Analysts expect Ameriprise to report a profit of $10.33 per share on a diluted basis for Q4, up 10.4% year-over-year (YOY). The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect Ameriprise’s diluted EPS to grow by 12.8% annually to $38.75, followed by a 7.5% improvement to $41.64 in fiscal 2026.

Ameriprise’s stock has been underperforming the broader market over the past year. Over the past 52 weeks, the stock has declined 5.8%, and over the past six months, it is down 7.2%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 17.1% and 11.1% over the same periods, respectively.

Next, we compare the stock with its own sector’s performance. The State Street Financial Select Sector SPDR ETF (XLF) has gained 15.1% over the past 52 weeks and 5.6% over the past six months. Therefore, the stock has also underperformed its sector over these periods.

On Oct. 30, 2025, Ameriprise reported better-than-expected third-quarter results for fiscal 2025. The company’s adjusted operating net revenues (excluding the impact of unlocking, which reflects the company’s annual review of insurance and annuity valuation assumptions and model changes) grew 6% YOY to $4.61 billion, surpassing the $4.52 billion that Wall Street analysts had expected.

Ameriprise’s assets under management, administration, and advisement were a record high of $1.70 trillion, up 8%. Its adjusted EPS for the third quarter was $9.92, up 12% YOY and above the $9.60 that analysts had expected. Despite the top and bottom-line growth, the stock dropped 5.1% intraday on Oct. 30.

Wall Street analysts have been bullish about Ameriprise’s future. Among the 14 analysts covering the stock, the consensus rating is “Moderate Buy.” The overall rating has changed from a “Hold” to a “Moderate Buy” over the past two months, while the configuration has become slightly more bullish, with six “Hold” ratings now, down from seven. The ratings are rounded by four “Strong Buys,” two “Moderate Buys,” and two “Strong Sell” ratings.

The mean price target of $540 implies an 8.4% upside from current levels, while the Street-high price target of $653 implies 31.1% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Covered-Call Google ETF Yields 41%. These 2 Option Trades Are Even Better.

- Here’s How You Can Intercept IONQ Stock’s Play-Action Pass for a 127% Payout

- Nvidia CEO Jensen Huang Warns ‘Everyone’s Job Will be Affected by AI,’ But Hopes It Will ‘Enhance’ Most Jobs, Not Destroy Them

- Can This New ETF Be a Game-Changer in a Market Stuck Waiting for the AI Bubble to Burst?