Princeton, New Jersey-based Bristol-Myers Squibb Company (BMY) is a leading biopharmaceutical company focused on developing treatments for serious diseases such as cancer, inflammatory, immunologic, cardiovascular, and fibrotic diseases. With a market cap of $111.2 billion, its strong oncology portfolio includes blockbuster drug Opdivo and other drugs like Revlimid, Pomalyst, Sprycel, Yervoy, and Empliciti. It also has important immunology and cardiovascular drugs like Orencia and Eliquis.

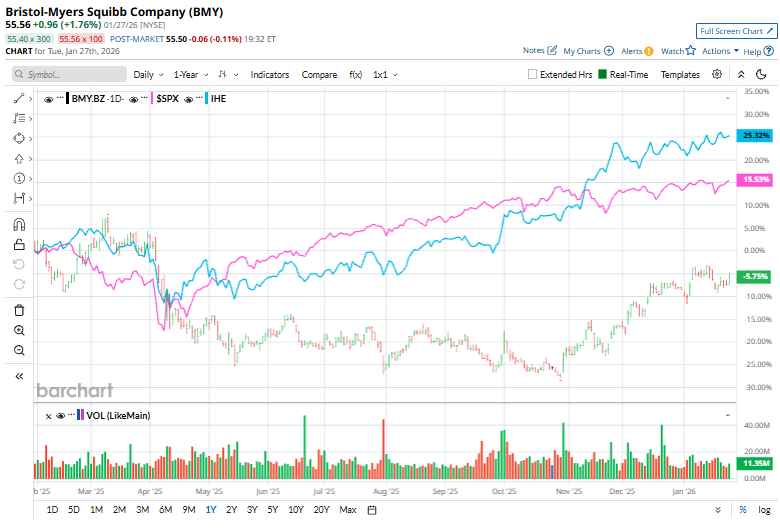

Shares of this biopharma giant have considerably underperformed the broader market over the past year. BMY has declined 8.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. Over the past six months, however, the stock has climbed 14.7%, surpassing the SPX’s 9.2%.

Narrowing the focus, BMY has trailed the iShares U.S. Pharmaceuticals ETF (IHE). The exchange-traded fund has gained 24.8% over the past year and 25.6% over the past six months.

Over the past year, shares of Bristol Myers Squibb have lagged the broader market mainly due to concerns over upcoming patent expirations for key drugs like Eliquis and Opdivo, which threaten future revenue. The company has also faced slower growth, mixed results from past acquisitions, and rising competition in oncology. In addition, regulatory pressure on drug pricing, relatively high debt, and its perception as a defensive, dividend-focused stock have made it less attractive compared with high-growth sectors.

For FY2025 that ended in December, analysts expect BMY’s EPS to grow 455.7% to $6.39 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

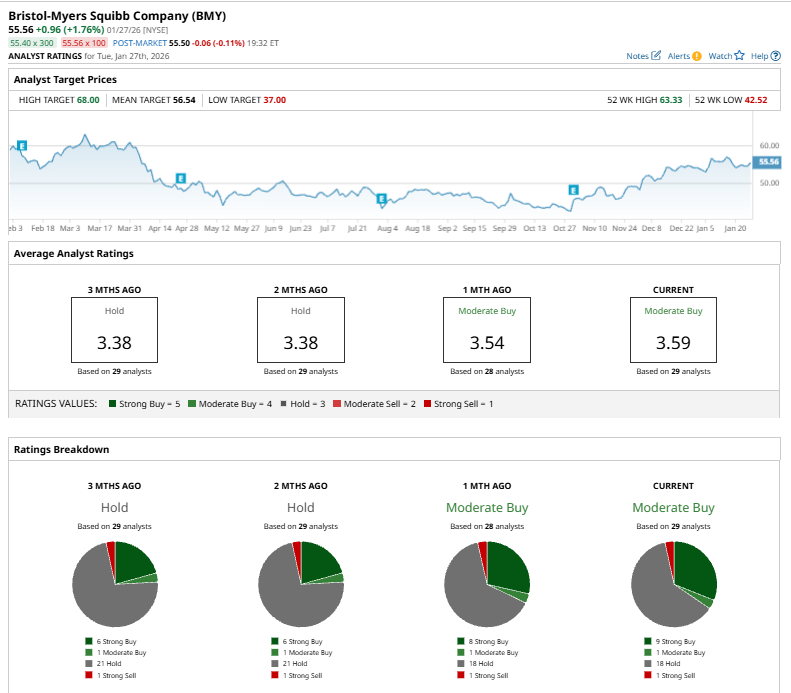

Among the 29 analysts covering BMY stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” 18 “Holds,” and one “Strong Sell.”

This overall rating is bullish than two months ago when the stock had a “Hold” rating.

On Dec. 15, BofA Securities upgraded BMY stock to “Buy” and raised its price target to $61, citing the strength of its R&D pipeline and expected progress on multiple programs. The upgrade followed a similar positive rating from Guggenheim. Investor sentiment was further supported by a recent dividend increase and FDA approval of its cancer therapy, Breyanzi.

The mean price target of $56.54 represents a 1.8% premium to BMY’s current price levels. The Street-high price target of $68 suggests an upside potential of 22.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nasdaq Futures Rally as ASML Provides a Boost, Fed Decision and Big Tech Earnings Awaited

- 1 Dividend Stock to Buy Now as Trump Turns Up the Tariff Heat Again

- Nvidia Just Gave You a $2 Billion Reason to Buy CoreWeave Stock

- GameStop Stock Is Now in Overbought Territory as Michael Burry Buys Shares. Is It Too Late to Chase GME Stock Here?