Supermicro (SMCI) shares rallied today after the Nasdaq-listed firm unveiled a new high-density, liquid-cooled blade server designed for artificial intelligence (AI) and high-performance compute workloads.

Dubbed the SBI-622BA-1NE12-LCC, this latest addition to the company’s SuperBlade family “is powered by dual Intel Xeon 6900 series processors,” according to its press release on Friday.

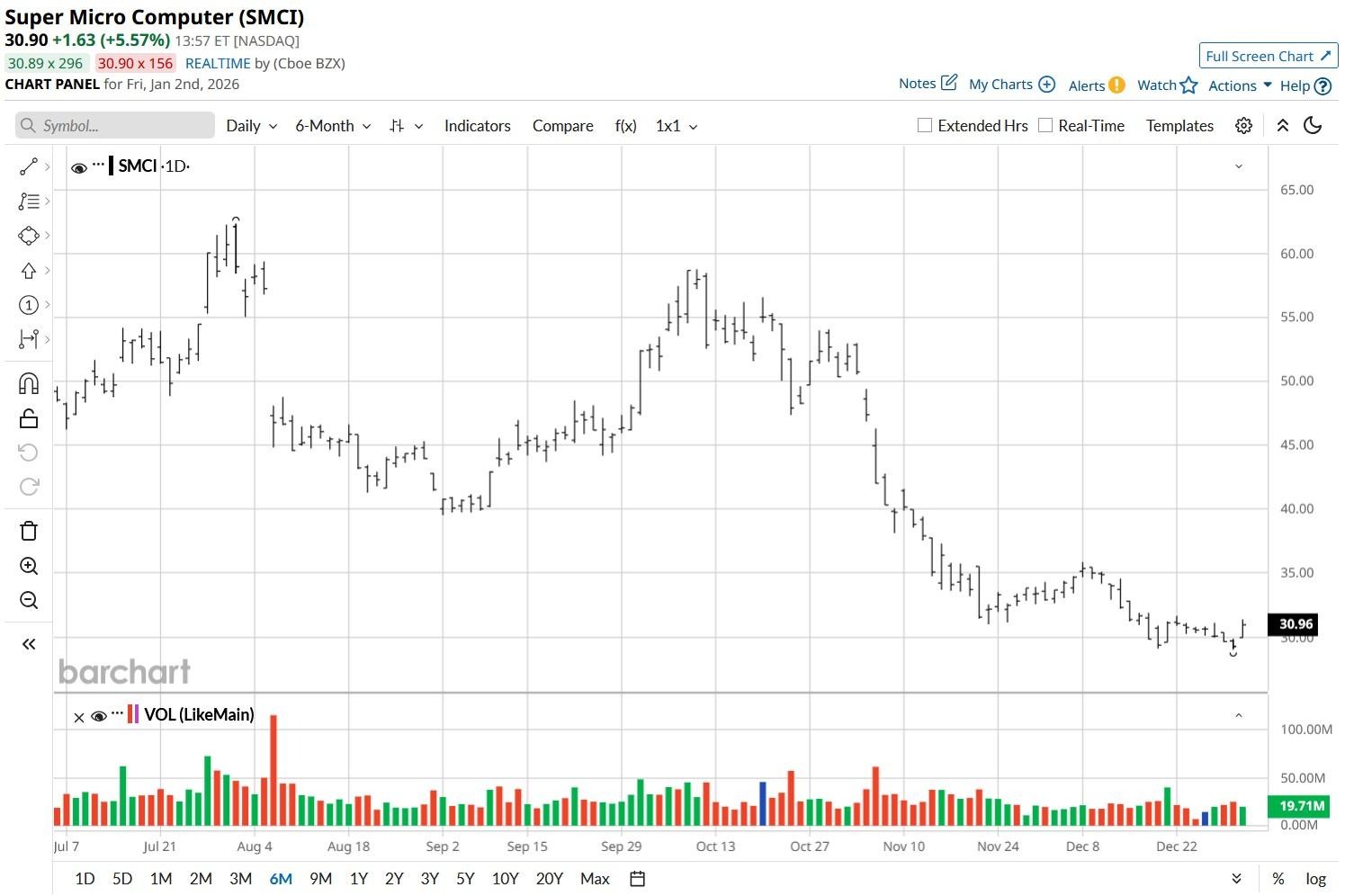

Despite today’s gains, SMCI stock remains down more than 50% versus its October high.

Significance of the AI Server Launch for SMCI Stock

Supermicro’s new server delivers rack-level performance in a compact footprint, reducing cabling by a remarkable 93% and supporting up to 3TB of memory.

Investors cheered the announcement mostly because it positions SMCI as a key player in next-gen AI infrastructure, especially as demand for scalable, energy-efficient solutions continues to ramp in 2026.

According to Charles Liang, the chief executive of Super Micro Computer, “this new iteration is the most core-dense SuperBlade we’ve ever created, providing customers with a scalable, efficient platform.”

With applications spanning finance, climate modeling, and scientific research, this new AI server strengthens the company’s competitive edge, which is why SMCI shares are pushing higher on Jan 2.

Are Supermicro Shares Worth Owning in 2026?

At a price-to-sales (P/S) multiple of about 0.8x currently, SMCI stock appears priced for permanent impairment, despite clear signs of operational momentum.

Moreover, the AI server specialist has entered 2026 with a $13 billion backlog, offering sufficient visibility into future demand, particularly across artificial intelligence and HPC verticals.

If the firm delivers on its roadmap and capitalizes on hyperscale infrastructure growth, its current valuation could prove deeply discounted.

Note that Supermicro shares now look headed to challenge their 20-day moving average (MA) at $31.86 level, a break above which could further accelerate upward momentum in the near term.

What’s the Consensus Rating on SMCI Shares?

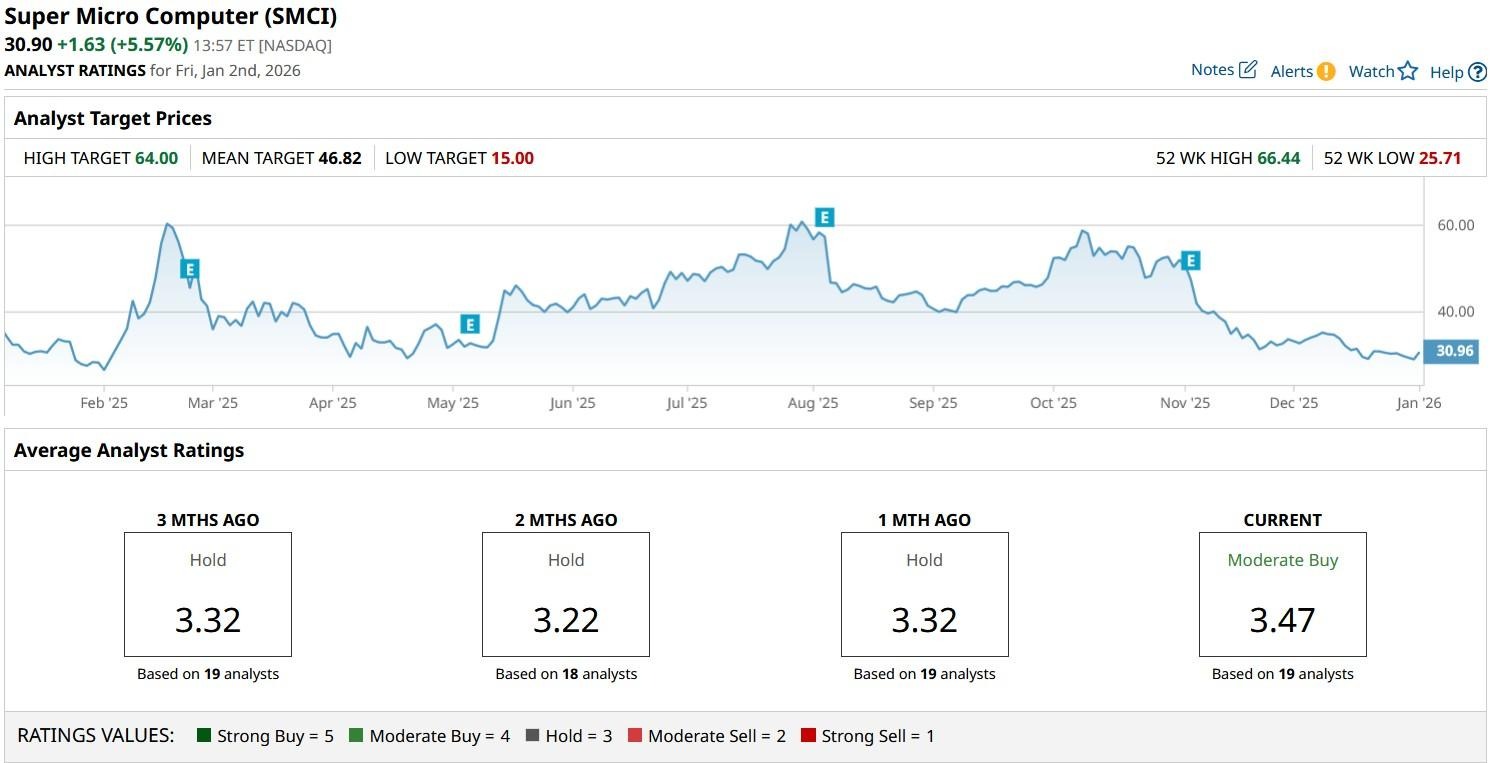

Long-term investors could also take heart in the fact that Wall Street remains bullish on Supermicro stock for 2026.

The consensus rating on SMCI shares currently sits at “Moderate Buy” with the mean target of about $47 indicating potential upside of another 50% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Under-the-Radar AI Company Could Be the Best Stock You Buy in 2026.

- LRCX Outperformed in 2025, but Valuation and Options Activity Flag 2026 Risks

- Micron Stock Just Moved Into Overbought Territory After Massive 2025 Run. Is It Too Late to Buy MU Shares?

- Super Micro Computer Just Launched a New AI Server. Should You Buy SMCI Stock Today?