Seattle-based Coupang (CPNG) has steadily built one of the most formidable commerce engines in Asia, using South Korea as its proving ground. By pairing its own delivery network with streaming, food delivery, and everyday commerce, the company has spent billions crafting an ecosystem designed to deepen loyalty, compress delivery times, and keep competitors constantly playing catch-up.

That ascent was abruptly interrupted when a massive data breach rattled customers and regulators alike. Personal details linked to 33.7 million users, nearly Coupang’s entire user base, were exposed, sparking anxiety and frustration across the market. Although payment credentials were not compromised, the breach lingered for months, triggered police raids, and ultimately led to CEO Park Dae-jun stepping down in accountability.

Now comes an unusually expensive mea culpa. Coupang is rolling out more than $1 billion in customer compensation through vouchers across its services, while interim CEO Harold Rogers calls the episode a pivotal reset toward rebuilding trust.

With shares rebounding recently and losses gradually being erased, is this billion-dollar apology a true catalyst or merely the opening chapter of a longer credibility test for CPNG stock?

About Coupang Stock

Founded in 2010, Coupang evolved from a simple online marketplace into a full-stack e-commerce powerhouse operating across South Korea and select international markets. Led by founder Bom Kim, the company built a formidable logistics moat, enabling same-day and overnight delivery at scale.

Often called “South Korea’s Amazon,” Coupang now serves millions of active customers and is expanding steadily in Taiwan. With a market capitalization of roughly $43.09 billion, Coupang is pursuing long-term dominance in a retail opportunity exceeding $500 billion, powered by speed, scale, and execution.

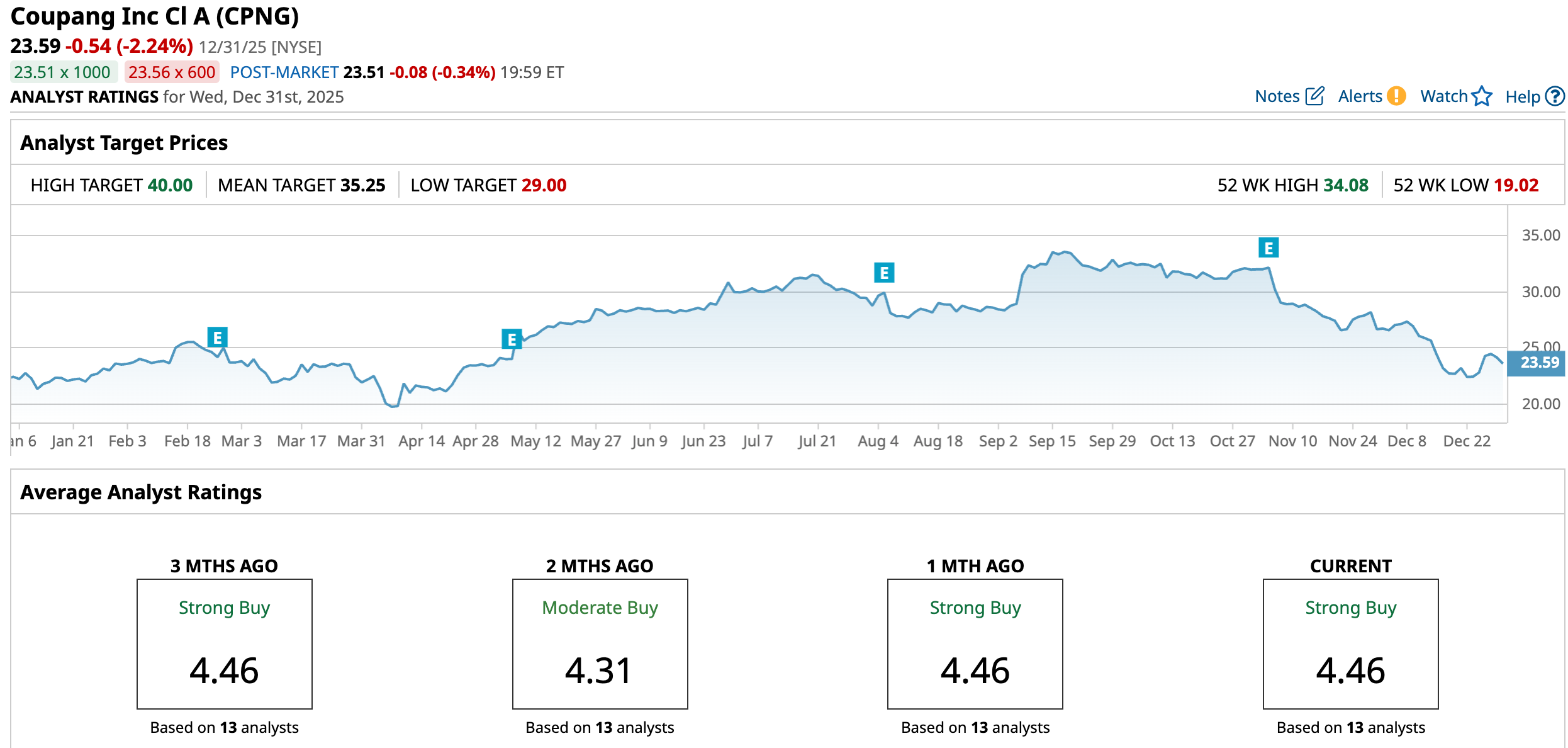

Coupang’s 2025 tape has been anything but smooth. CPNG stock climbed steadily through the first half of the year, eventually peaking at $34.08 in September, before sentiment cracked. A data-breach fallout, leading to the resignation of its Korean subsidiary’s CEO Park Dae-jun, and a round of cautious analyst resets pushed shares sharply lower. Even so, CPNG remains up roughly 9% year-to-date (YTD), suggesting longer-term conviction has not fully broken.

From a technical lens, the stock appears to be stabilizing after months of choppy consolidation. Shares have rebounded off recent lows near the low-$20s, lifting the 14-day RSI to around 37.38, a move out of oversold territory but still well below overbought levels – more reset than breakout.

However, the MACD oscillator urges restraint. The signal line has crossed above the MACD line, both sloping downward, while the histogram remains negative, pointing to lingering bearish momentum. In short, CPNG is trying to stand up again, but the chart indicates the recovery still needs confirmation.

From a valuation lens, CPNG wears a clear premium, trading at 147.74 times forward adjusted earnings and 1.23 times forward sales, reflecting investor confidence in its growth runway, operating leverage, and ambitions beyond South Korea.

Coupang Surpassed Q3 Earnings Results

The e-commerce powerhouse’s third-quarter print, released on Nov. 4, beat projections. EPS came in at $0.05, cruising past Wall Street’s expectations and climbing 25% year-over-year (YOY). Revenue followed suit, advancing 18% annually to $9.3 billion, a reminder that scale, when disciplined, still compounds.

Gross profit rose 20% YOY to $2.7 billion, while margins widened to 29.4%, improving by 51 basis points – a subtle but telling signal of tightening execution. Operating income reached $162 million, and adjusted EBITDA hit $413 million, translating into a 4.5% margin that underscores improving operating leverage.

The cash picture was even louder. Over the trailing twelve months, operating cash flow surged to $2.4 billion, up $549 million YOY, while free cash flow expanded to $1.3 billion, adding $333 million. This is a business funding its own ambition. Plus, cash and cash equivalents as of Sept. 30, 2025, amounted to $7.2 billion.

Coupang’s core commerce engine remained sturdy. Product commerce revenue climbed 16%, or 18% on a constant-currency basis, to $8 billion. Active customers increased 10% to 24.7 million. On paper, the fundamentals held firm.

The market, however, read between the lines. User growth marked a step down from the roughly 11.2% annual pace of the past two years, raising questions about whether newer initiatives are truly accelerating customer acquisition. That nuance mattered. Despite the earnings beat, the stock slid nearly 6% in the following session as investors weighed slowing momentum against an already premium valuation, one that leaves little room for hesitation when growth shows even a modest loss of speed.

Looking ahead, management is guiding for roughly 20% constant-currency net revenue growth for the year, leaning into AI-driven efficiency and logistics expansion, with Taiwan emerging as the next proving ground.

Analysts tracking Coupang expect an EPS of $0.16 in 2025, down 27.3% YOY, before rising by another 56.3% annually to $0.25 in fiscal 2026.

Can Compensation Rebuild Trust?

Coupang’s response to the data breach is as bold as it is costly. The company plans to distribute more than $1 billion in vouchers, offering up to 50,000 won per affected user, redeemable across shopping, food delivery, travel, and luxury beauty. The staggered rollout signals a measured attempt to calm customers while reinforcing daily engagement across its ecosystem.

In theory, the compensation softens immediate anger and keeps users active on the platform. But trust is not rebuilt with credits alone. While the gesture buys time and goodwill, lasting confidence will depend on tighter security, transparency, and whether Coupang can prove this breach was an exception, not a precedent.

What Do Analysts Expect for Coupang Stock?

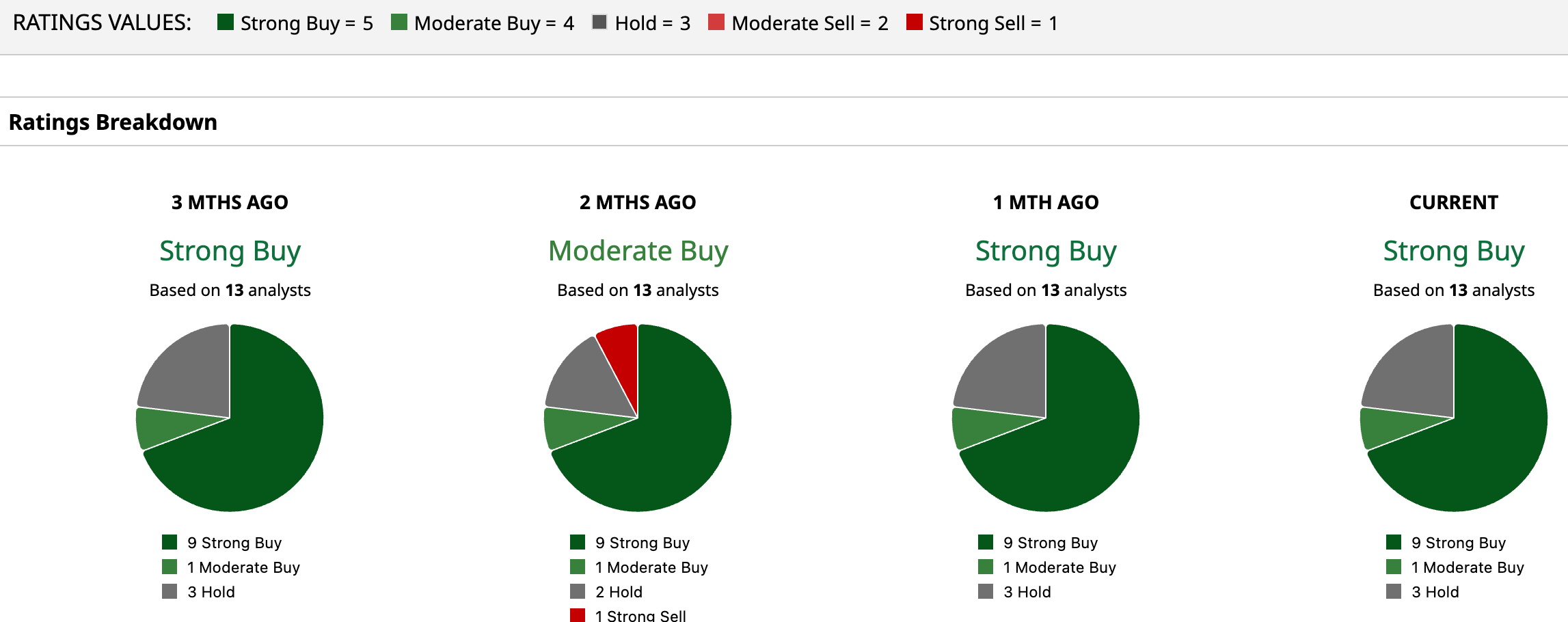

Wall Street’s view on CPNG is bullish. The stock has a consensus “Strong Buy” overall, an upgrade from the “Moderate Buy” rating two months back. Out of 13 analysts offering recommendations on the stock, most lean bullish, with nine backing a “Strong Buy.” Meanwhile, one analyst advises a “Moderate Buy” rating, and the remaining three are playing it safe with a “Hold” rating.

The stock’s average analyst price target of $35.25 suggests CPNG has an upside potential of 49.43%. The Street-high target of $40 implies that CPNG could rally as much as 69.56% from here.

Final Thoughts on CPNG Stock

Coupang is in a bit of a wait-and-watch phase. The business is still solid, cash flows are healthy, and growth has not broken, but the trust overhang and rich valuation make this a stock that needs patience.

While the compensation sounds generous, the vouchers can only be spent within Coupang’s own ecosystem, softening the real cost and drawing sharp criticism from the country's lawmakers and consumer groups, who call it marketing disguised as restitution. With police scrutiny intensifying, reputational risk still lingers. For investors, this is not a chase, nor a panic exit.

Long-term believers may accumulate patiently on pullbacks, while shorter-term traders may wait for clearer technical confirmation. The billion-dollar apology buys time, not immunity. Execution from here decides the stock’s next act.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As MicroStrategy Buys $109 Million of Bitcoin, Should You Buy MSTR Stock?

- Wall Street’s Radial Framework Potentially Exposes a Mispriced Opportunity in Ambarella (AMBA) Stock Options

- A $1 Billion Catalyst Just Hit Coupang. How Should You Play CPNG Stock Here?

- Alphabet Soars — Is GOOGL Stock Still a Buy for 2026?