In a market becoming obsessed with fast rewards and short-term excitement, it’s easy to overlook the companies quietly doing everything right.

Income investors are often pushed toward the flashiest yields or the latest trends, yet the strongest long-term returns tend to come from businesses that consistently grow earnings, steadily raise dividends, and compound value over time.

That is exactly the reason I like to stay on top of the Dividend Kings, particularly those that are overlooked and accelerating their dividend growth, showing improving profitability, and maintaining long-term bullish momentum, all while remaining relatively undercovered by Wall Street. These aren’t turnaround stories or speculative bets. Rather, they’re established businesses with the financial strength and discipline to reward shareholders year after year.

Using appropriate filters, the result is a focused list of Dividend Kings built to be held long term and relied on for consistent income.

How I came up with the following stocks

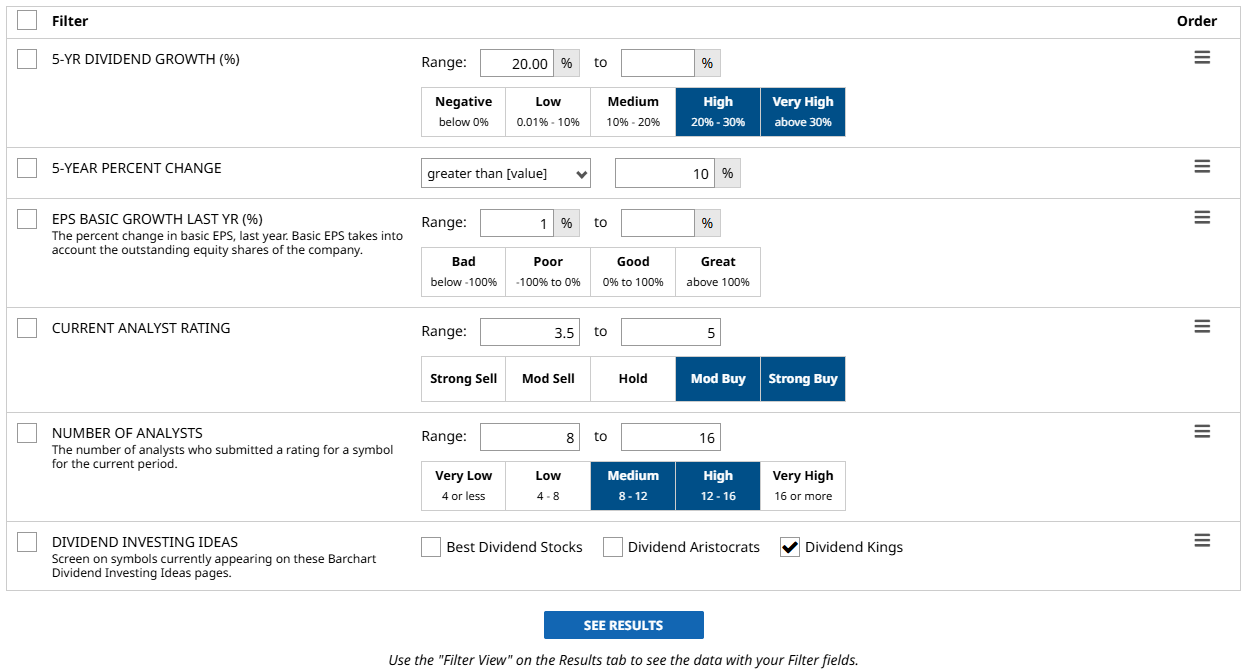

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- 5-YR Dividend Growth (%): 20% or higher. I filtered the results to companies with a “High” or “Very High” 5-year dividend trend, then sorted them from highest to lowest.

- EPS Basic Growth Last Year (%): at least 1% to find companies whose profitability has increased over the past year.

- 5-YR Percent Change: Greater than 10%. I am looking for those in a long-term bullish momentum.

- Current Analyst Rating: 3.5-5. Stocks that are rated an average “Moderate” and “Strong Buy”.

- Number of Analysts: 8-16 - More analysts signal a higher confidence in the rating.

I ran the screen and got 4 results. I will cover them all, from highest to lowest, 5-YR Dividend Growth.

Let’s kick off this list with the first Dividend King:

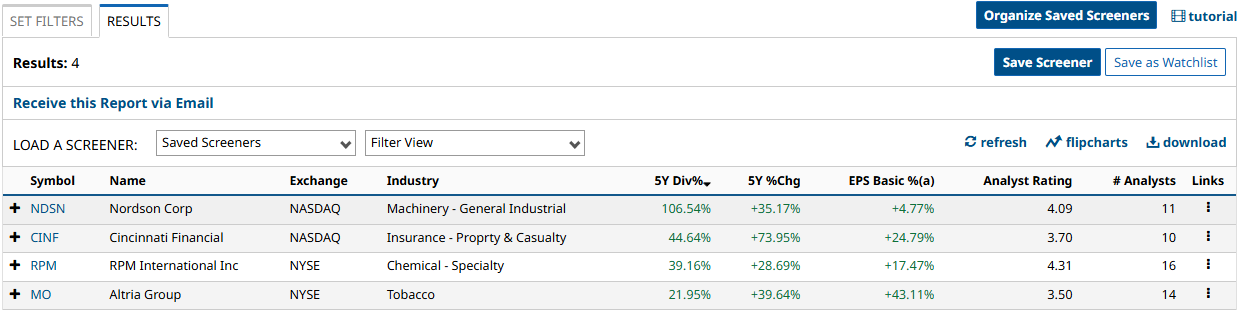

Nordson Corp (NDSN)

Nordson Corp is a global leader in precision manufacturing, creating complex components and advanced technologies for industries such as aerospace, medical, and electronics.

In its recent financials, the company’s sales rose 1% YOY to $752 million. Net income was up 24% to $152 million, while its basic EPS grew 4.77%. The company also pays a forward annual dividend of $3.28, translating to a yield of around 1.2%. Coupled with a 5-Year dividend growth rate north of 106%, Nordson is an overall attractive investment with strong upside potential.

A consensus among 11 analysts rates the stock a “Moderate Buy”. There could also be as much as 8% upside should the stock achieve its projected high of $295 over the next 12 months.

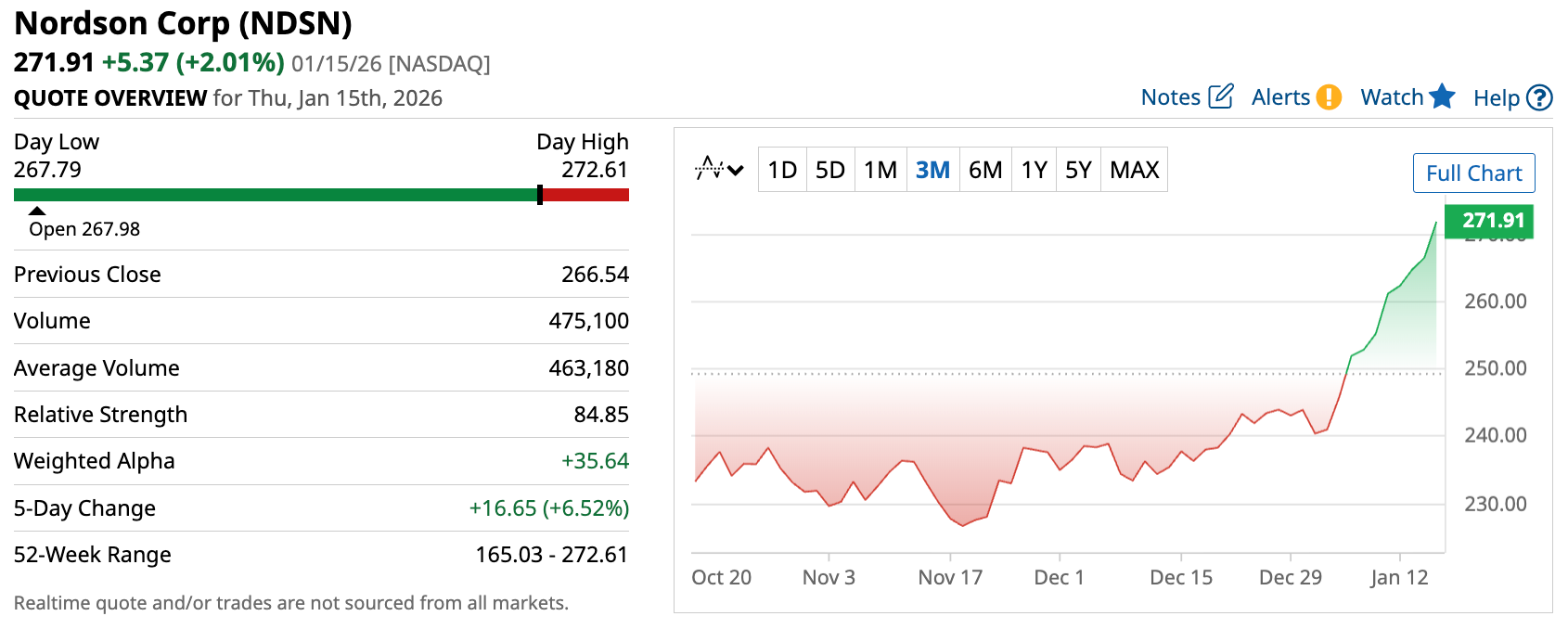

Cincinnati Financial (CINF)

The second Dividend King is Cincinnati Financial, one of the largest U.S. insurers, offering property, life, and other insurance products, and whose shares have steadily outperformed the broader financial sector.

In its recent quarterly financials, Cincinnati’s sales rose 12% YOY to $3.7 billion. Net income was up 37% to $1.1 billion, while its basic EPS increased 24.79%. The company has a 5-year dividend growth rate above 44% and pays a forward annual dividend of $3.48, translating to a yield of approximately 2.15%. This combination makes it a potentially solid investment for those looking for stable, increasing payouts.

Further, a consensus among 10 analysts rates the stock a “Moderate Buy”, with an upside potential of 17% if it hits its high price of $191.

RPM International Inc (RPM)

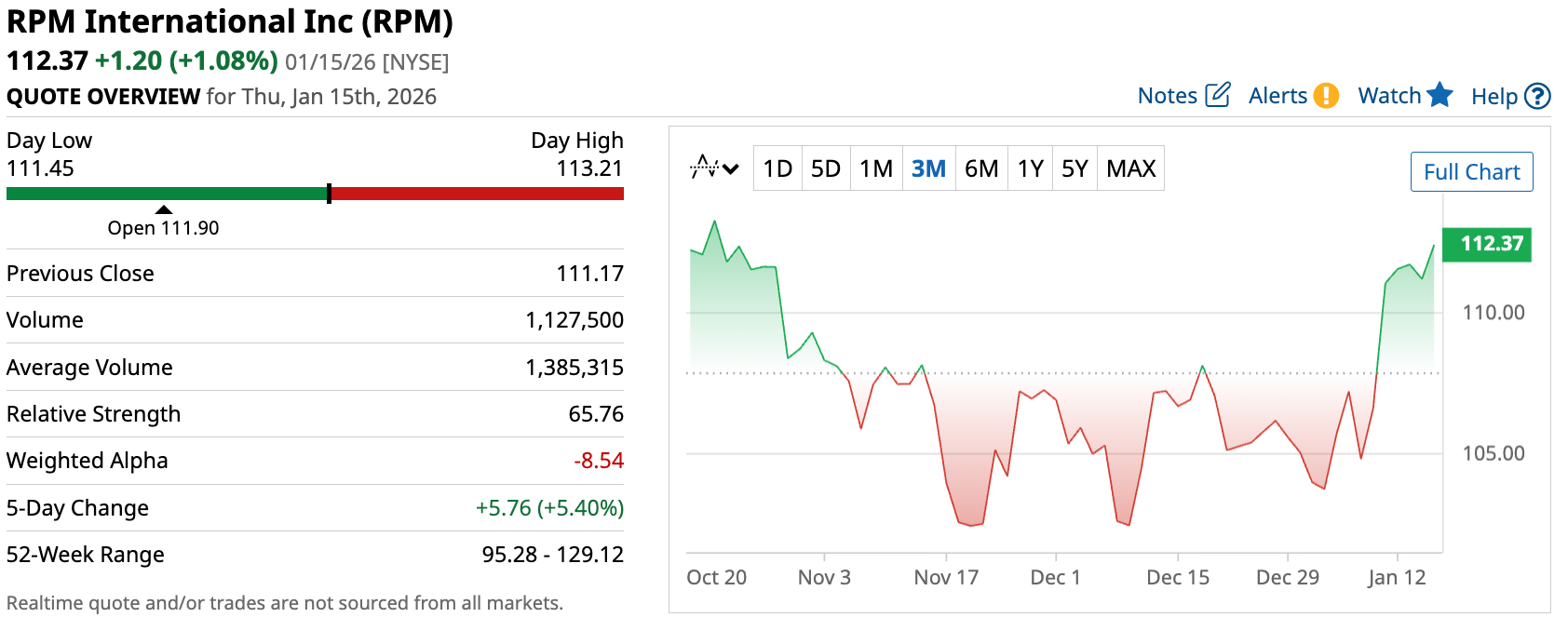

Next on my list of Dividend Kings is RPM International, a global leader in building materials, including specialty coatings, sealants, and related products. It owns some of the industry's famous brands, such as Rust-Oleum, DAP, and Zinsser, and is expanding its global reach through the acquisition of Kalzip, a leader in high-performance roofing and façade systems.

The company’s recent quarterly financials reported that sales were up 3.5% YOY to $1.9 billion, while net income fell 12% to $161 million due to higher costs and integration expenses, even as overall demand supported higher sales. Still, basic EPS grew 17.47%, and the company pays a forward annual dividend of $2.16, translating to a yield of around 1.9%. With a 5-year dividend growth rate approaching 40% RPM stock still looks like a pretty decent investment.

Plus, consensus among 16 analysts rates the stock a “Moderate Buy”. With a high target of $151, analysts see as much as 34% upside in the stock this year.

Altria Group (MO)

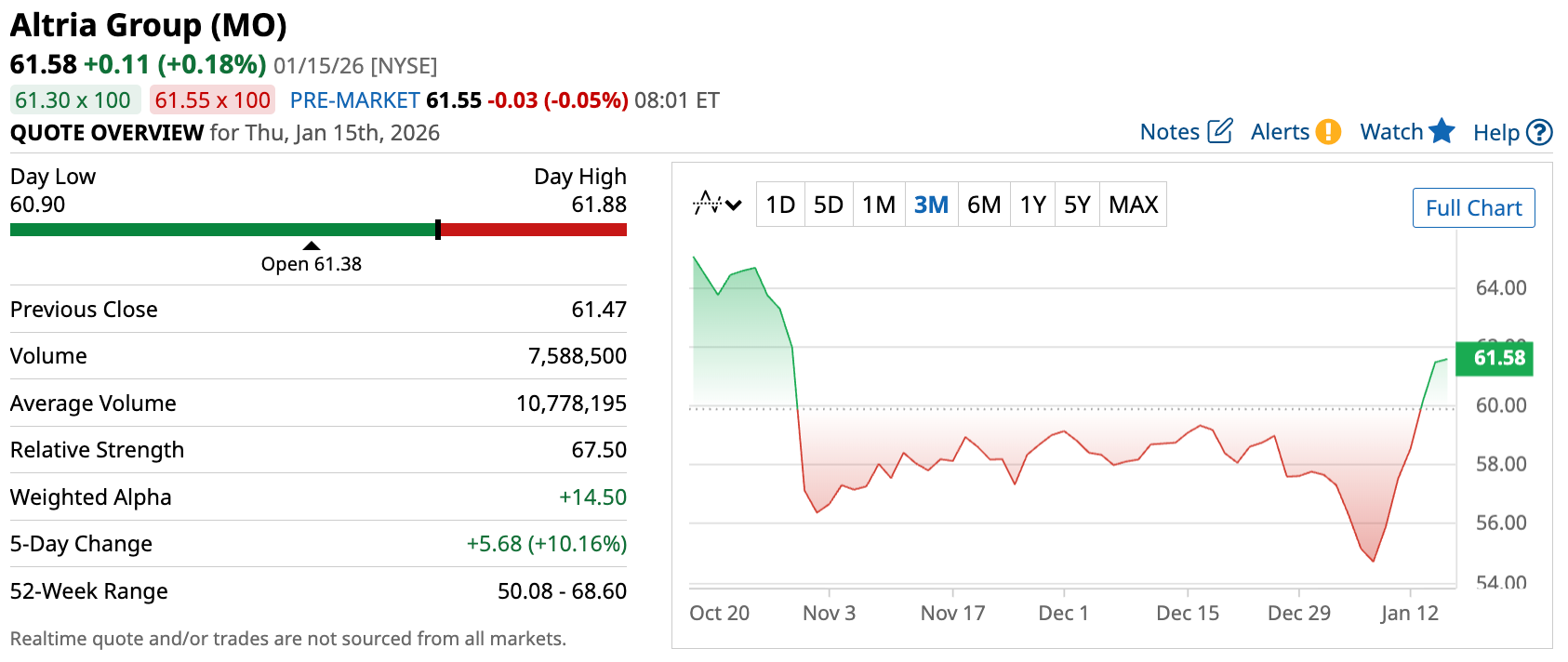

The last Dividend King on my list is Altria Group, one of the most important companies in tobacco.

In its most recent financials, sales were down 3% YOY to $6.1 billion, but net income grew 3.6% to $2.4 billion. Aside from that, basic EPS grew 43.11%, the highest in this list. Further, the company pays a quarterly dividend of $1.06, translating to a yield of approximately 6.8%, also the highest on my list. With a 5-year dividend growth of around 22%, MO stock makes a pretty strong case for being a must-have investment.

A consensus of 14 analysts rates the stock a “Moderate Buy,” up from “Hold” over the past three months. It also has upside potential of almost 17% if it reaches its high target price of $72.

Final Thoughts

With a growing preference for stocks with the highest returns, Dividend Kings are often overlooked, but not for me. These companies have proven their resilience, stability, and capacity to deliver increasing yields for over a decade, a feat few can match. While stocks with the flashiest yields make noise, these Dividend Kings quietly prove their worth through a long-term upside trend, making them a good investment for income-focused investors.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Most Overlooked Dividend Kings to Buy in 2026

- 2 Smart Stocks for Patient Long-Term Investors to Buy Now

- Super Micro Computer Is One of the Most Shorted Stocks. Could a Squeeze Take It Higher in 2026?

- Intel Reports Earnings on January 22. Here Is Where Options Data Says INTC Stock Could Be Trading Next.