Chinese electric vehicle (EV) companies have emerged as a formidable competitor to Western automakers. Foreign automakers who lost ground to domestic companies in the Chinese markets are now witnessing Chinese EV companies grabbing market share in their home markets as well.

Musk Has Praised Chinese EV Companies

During Tesla’s Q4 2023 earnings call, CEO Elon Musk said, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.” The world’s richest person famously added, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

That prophecy might come close to fulfillment as President Donald Trump's trade policies push U.S. allies closer to China. Let's discuss it in detail.

Several Countries Have Clamped Down on EV Imports From China

Several countries have imposed punitive tariffs on EV imports from China to fend off cheap cars flooding their markets. While some of the tariffs were relatively benign, others virtually closed the door for EV imports from China.

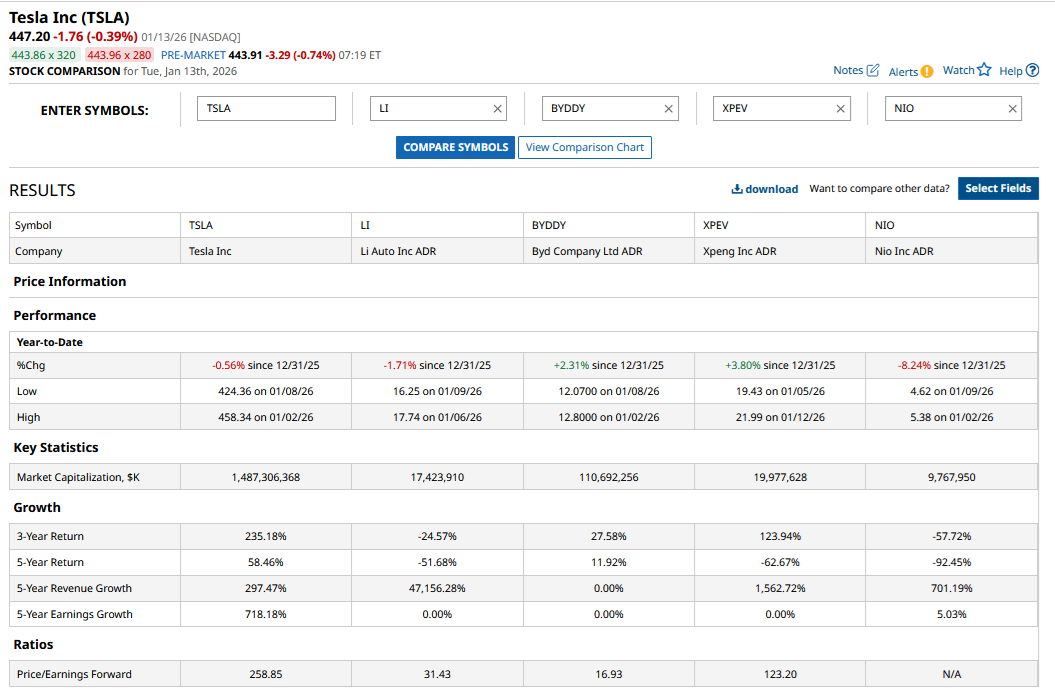

For instance, in 2024, the U.S. quadrupled the tariffs on EV imports from China to 100%—a move Canada shortly replicated. The same year, the EU also announced countervailing duties on China-made electric cars. They ranged from a low of 7.8% (on Tesla) and went as high as 35.3% on companies that did not cooperate in its probe. BYD (BYDDY)—which last year surpassed Tesla (TSLA) to become the biggest EV seller—was slapped with a 17% tariff.

EU Is Looking to End Its EV Feud with China

Meanwhile, a trade realignment seems to be happening globally, at least in response to U.S. President Donald Trump’s tariffs. For instance, the EU is now adopting a softer approach to EV imports from China and is considering replacing tariffs with a “price floor.” Put simply, Chinese EV companies can potentially avoid the tariffs if they agree to sell their cars above a certain price threshold.

China, which had vehemently opposed EU 2024 tariffs and retaliated against imports from the region, has unsurprisingly welcomed the move. “This is conducive not only to ensuring the healthy development of China-EU economic and trade relations, but also to safeguarding the rules-based international trade order,” said China’s Commerce Ministry in its statement.

Canada Is Reportedly Looking to Lower Tariffs on Chinese EVs

Reports suggest that Canada could also follow suit, and the country is in “active discussions” about easing, if not outright dropping, the EV tariffs in exchange for concessions on the counter-tariffs that China had imposed on seafood and canola imports. Incidentally, India has also taken a softer stance against China over the last few months, even though the country still has stringent tariffs on auto imports from its northern neighbor, with whom it shares a long and contentious border. While the overall global tariff regime is still quite restrictive for Chinese EV companies, there are signs that countries are now looking at a more amenable approach to the world’s second-biggest economy at a time when there is trade friction with the U.S.

Notably, as is the case for most industries in China, there is a massive EV production overcapacity in the country, leading to a price war. Amid a slowdown in growth in the domestic market, Chinese EV companies have been aggressively expanding to global markets. For instance, BYD sold 1 million cars outside China last year, which was 150% higher than in 2024. For 2026, the company has set an ambitious target of 1.6 million international deliveries, which, for context, is similar to what Tesla sold in all of 2025.

Other Chinese EV companies also reported a massive rise in global sales. XPeng Motors’ (XPEV) global deliveries nearly doubled to 45,008 vehicles last year. While the rise admittedly came from a smaller base, Chinese EV companies are now looking to conquer global markets after having pushed foreign automakers to the fringes in China.

China Exported More Cars Than Japan in 2025

Last year, China exported more cars than Japan, ending the country’s two-decade-long dominance in global car exports. The country was already the world’s biggest automotive market, and has now emerged as a major exporter. While the tariffs have put speed bumps in the Chinese EV industry’s global ambitions, things could change if more countries open up their economies.

Cheap imports from China overwhelmed domestic producers in several industries. The country now dominates the global manufacturing landscape and looks on track to do the same in the automotive industry. Foreign automakers—who have been awed by their Chinese counterparts, albeit privately, if not publicly—are also exploring partnerships. For instance, Volkswagen (VWAGY) invested in XPeng Motors, while Stellantis (STLA) became a strategic investor in Leapmotor (ZJLMF).

All said, Musk's prophecy about Chinese EV companies “demolishing” other automakers could come close to reality as other countries take a congenial approach to the country amid President Trump's tariffs.

On the date of publication, Mohit Oberoi had a position in: TSLA , XPEV . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Behind Berkshire’s Curtain: Is Greg Abel Preparing to Cut Davita Loose?

- Thursday Earnings Preview: Look to These Banking Giants for Key Consumer Insights

- As Wayfair Launches New AI Shopping Features, Should You Buy, Sell, or Hold W Stock?

- MicroStrategy Just Exponentially Increased Its Bitcoin Purchases. What Does That Mean for MSTR Stock?