Capital One (COF) shares plunged nearly 7% on Monday after President Donald Trump proposed capping credit card interest rates at 10% for one year. The announcement sent shockwaves through the financial services sector and raised questions about the stock's bullish Wall Street consensus.

Trump caught bank executives off guard and triggered a broad selloff across the industry. Shares of major banks, including Citigroup (C), J.P. Morgan Chase (JPM), Wells Fargo (WFC), and Bank of America (BAC), dropped between 1% and 3%, while card-focused companies like Visa (V), Mastercard (MA), and American Express (AXP) also declined. Capital One took the hardest hit, reflecting its heavy reliance on credit card operations, which dominate its loan portfolio.

The proposed interest rate cap is set to take effect next week. How it would be enforced (and its legality) is still unclear, but despite that, even just the concept still poses a significant threat to Capital One’s business model. According to data from Bankrate, the average credit card rate is around 19.7%, while rates for subprime borrowers and store-specific cards are even higher. A 10% ceiling would negatively impact the profit margins of several credit card companies, including Capital One.

Moreover, the policy would force banks to serve subprime borrowers or scale back reward programs and credit availability. This could trigger broader economic consequences and reduce consumer spending, resulting in a broader economic slowdown.

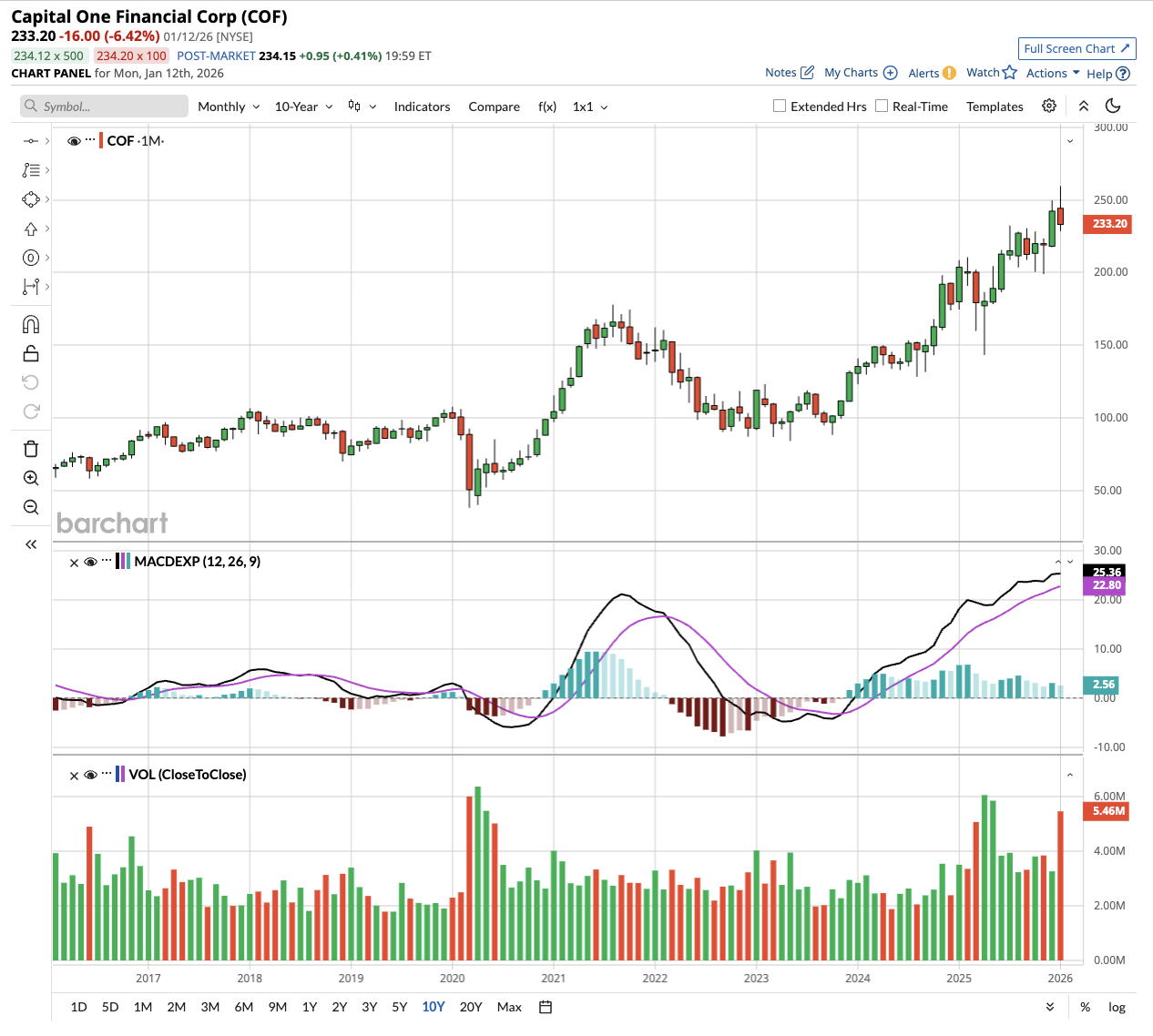

Is COF Stock a Good Buy Right Now?

A closer look at the company's recent performance and strategic positioning reveals a more complex story for investors weighing the stock's prospects. The bank has been delivering strong financial results, with third-quarter earnings of $4.83 per share and revenue jumping 23% following the full integration of its Discover acquisition.

- Credit performance has been particularly impressive, with charge-off rates dropping to 4.63%, down nearly a full percentage point from a year ago.

- Delinquencies have stabilized and are tracking in line with normal seasonal patterns, suggesting the worst of post-pandemic credit normalization may be over.

Capital One closed its massive Discover deal in May, adding scale to both its credit card business and gaining control of a rare asset in the payments industry. It remains on track to deliver $2.5 billion in combined synergies, with revenue benefits already flowing from moving debit volume onto the Discover network. Management expects this transition to be completed by early next year, accelerating the financial payoff from the acquisition.

The Trump proposal introduces significant uncertainty into this otherwise positive picture. However, Capital One's leadership has emphasized the company's strong capital position, with a common equity tier one ratio of 14.4% and a new $16 billion share buyback authorization.

The bank recently increased its quarterly dividend from $0.60 to $0.80 per share and ramped up repurchases to $1 billion last quarter, with management indicating further increases ahead.

Capital One is also investing heavily in technology, artificial intelligence capabilities, and premium card offerings to compete at the top of the market. CEO Rich Fairbank described these investments as essential for capturing growth opportunities, though they may pressure near-term efficiency metrics.

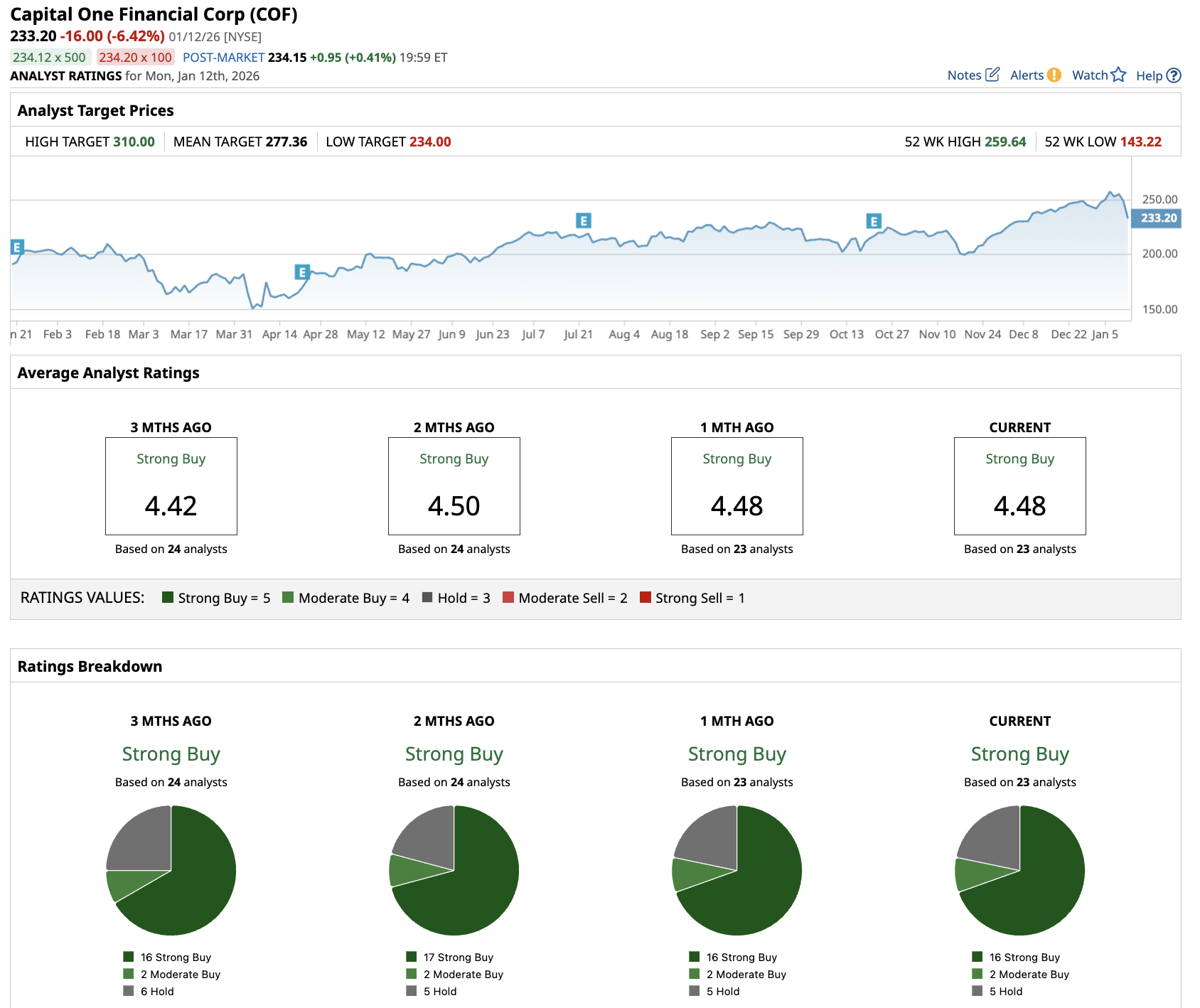

What Is the COF Stock Price Target?

Analysts tracking COF stock forecast adjusted earnings to expand from $13.96 per share in 2024 to $29 per share in 2029. The bank stock trades at 11.70x forward earnings, which is above its five-year average of 9.1x. If it trades at the historical average, COF stock should be priced around $263 in late 2028, indicating an upside potential of over 10% from current levels.

Out of 23 analysts covering COF stock, 16 recommend “Strong Buy,” two recommend “Moderate Buy,” and five recommend “Hold.” The average Capital One stock price target is $277.36, indicating an upside potential of 19% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mizuho Says This 1 Lesser-Known Chip Stock Is a Top Buy for 2026

- Citi Is Betting on Another ‘Supercycle’ in Palantir Stock. Should You Buy PLTR Here?

- Palmer Luckey Warns China’s ‘Most Powerful Weapon’ Isn’t a ‘Missile or Drone, It’s Their Ability to Control People’s Minds Through the Media’

- Analysts Say Capital One Stock Is a ‘Strong Buy.’ Did Trump Just Change That?