Applied Digital (APLD) announced a strategic spinoff that could reshape its position in the booming AI infrastructure market. The data center operator revealed plans to merge its cloud computing division, Applied Digital Cloud, with EKSO Bionics Holdings (EKSO) in a deal that will create a new entity called ChronoScale Corporation, focused exclusively on AI workloads.

The transaction structure is unusual but potentially lucrative for Applied Digital shareholders. Once the deal is closed, Applied Digital will retain approximately 97% ownership of the combined company. It will effectively spin out its cloud business while maintaining near-complete control.

ChronoScale will operate as a standalone accelerated compute platform for GPU-intensive AI training and inference workloads that require dense, reliable infrastructure. The separation of the cloud computing business from its core data center development business should allow both entities to pursue growth strategies with greater capital flexibility.

For Applied Digital investors, this spinoff creates exposure to two separate AI infrastructure plays rather than one combined operation.

Is Applied Digital Stock a Good Buy Right Now?

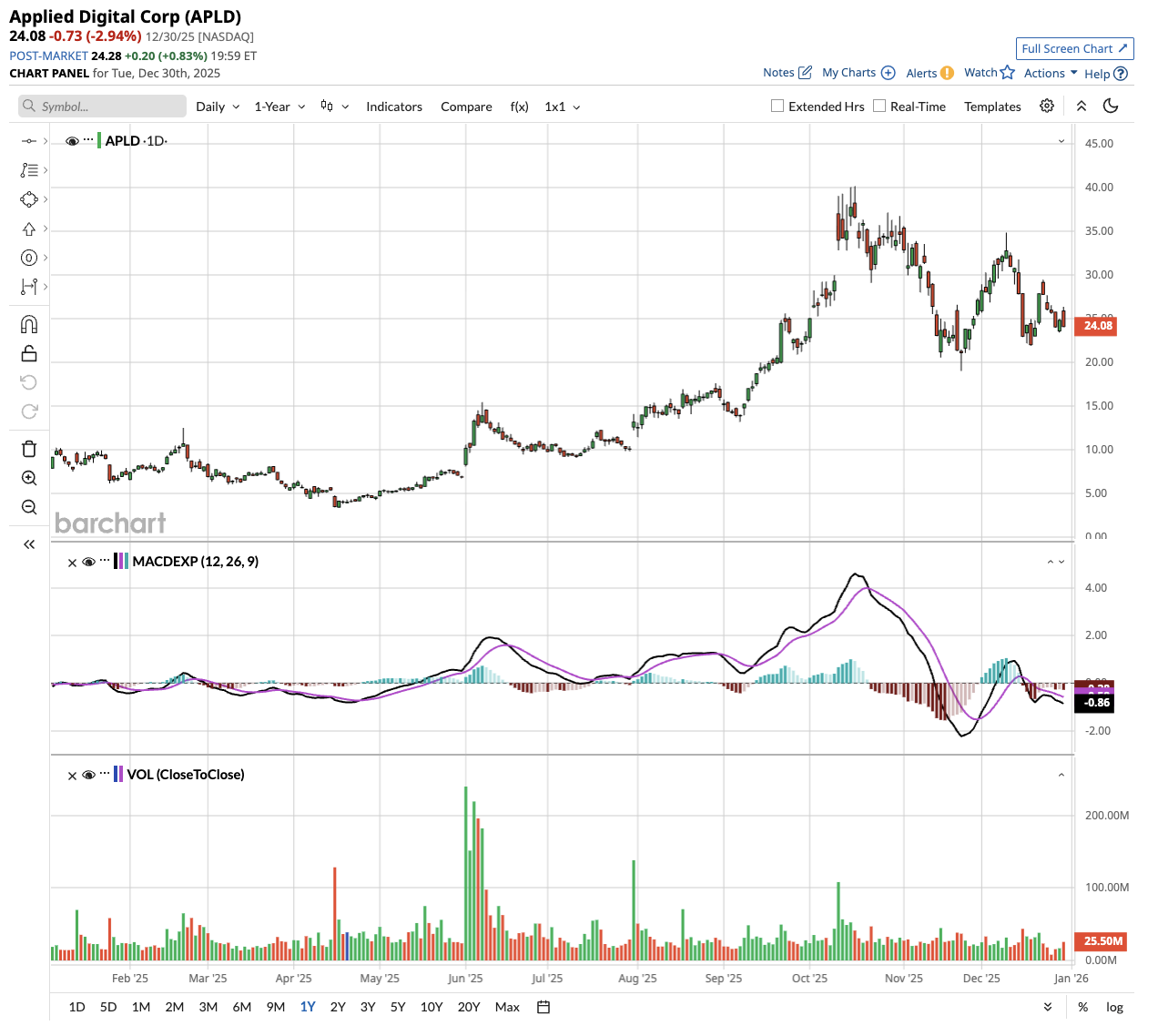

Valued at a market cap of $6.88 billion, Applied Digital's stock has more than tripled in the past 12 months. Despite these outsized gains, APLD stock is down almost 40% from its 52-week high.

Applied Digital is transforming itself from a cryptocurrency mining operation into a serious contender in the AI infrastructure race. APLD is building massive data centers to handle the growing power demands of AI computing. The company has already secured billions in long-term contracts, providing shareholders with long-term revenue visibility.

The flagship campus, Polaris Forge 1, is a 400-megawatt facility fully leased to CoreWeave (CRWV) under a 15-year agreement with a total contract value of approximately $11 billion. Applied Digital followed that up with a $5 billion deal for its Polaris Forge 2 campus with an investment-grade hyperscaler customer, though the company hasn't publicly named that client yet.

Applied Digital is building data centers in North Dakota, where electricity costs are 24% below the national average. This is a crucial moat, given AI queries consume up to 15 times more power than traditional internet searches. The cold climate also delivers over 200 days of free cooling annually, further reducing operational expenses.

These advantages may prove significant, as hyperscalers such as Amazon (AMZN) and Microsoft (MSFT) are projected to spend more than $350 billion on data center infrastructure in 2025.

Applied Digital also operates 286 megawatts of blockchain mining capacity, which is its legacy business. Applied Digital's development pipeline now exceeds 4 gigawatts, focused entirely on AI workloads.

Nvidia (NVDA) took a stake in the company, which serves as both validation and a strategic partnership. The recent announcement to spin out its cloud computing division into ChronoScale Corporation suggests management is getting more aggressive about unlocking value from different parts of the business.

A Strong Performance in Fiscal Q1

In fiscal Q1, Applied Digital revenue rose 84% year-over-year (YoY) to $64.2 million, up from $34.8 million in the year-ago period. The increase in sales was driven by $26.3 million from tenant fit-out services for CoreWeave at the Polaris Forge 1 campus. This is low-margin work, around mid-single digits, but it demonstrates Applied Digital's ability to serve hyperscalers beyond just leasing space.

The company currently has 700 megawatts under construction simultaneously across multiple North Dakota sites. CEO Wes Cummins said construction timelines have been cut from 24 months down to 12 to 14 months, which represents a significant competitive advantage when hyperscalers need capacity immediately. The first 100-megawatt building is nearing completion and should start generating lease income by the end of this calendar year.

Applied Digital's balance sheet reflects the capital intensity of this buildout. The company has now invested more than $1.6 billion in property and equipment, but those assets have not yet generated meaningful income statement returns. Management expects the CoreWeave lease alone to support roughly $500 million in annual net operating income once fully operational, with Polaris Forge 2 adding significantly more.

The Macquarie (MQG.AX) partnership continues to be the financial engine. Applied Digital drew an initial $112.5 million from a $5 billion preferred equity facility and expects to close project financing this fiscal quarter at around 70% loan-to-cost with pricing between 400 and 450 basis points over SOFR.

CFO Saidal Mohmand said the project financing will cover both buildings at Polaris Forge 1 simultaneously, rather than building by building, which is unusual but reflects the scale and timing demands from CoreWeave.

Demand signals remain exceptionally strong. Cummins said the company reviewed more than 50 sites in the past four weeks as parties with power, but no construction capability, seek development partners.

What Is the APLD Stock Price Target?

Analysts tracking APLD stock forecast revenue to increase from $215 million in fiscal 2025 to $970 million in fiscal 2028. While still unprofitable, it is projected to report a net income of $276 million, or $0.92 per share, in fiscal 2030, compared to a loss of $77.5 million, or $0.68 per share, in fiscal 2024.

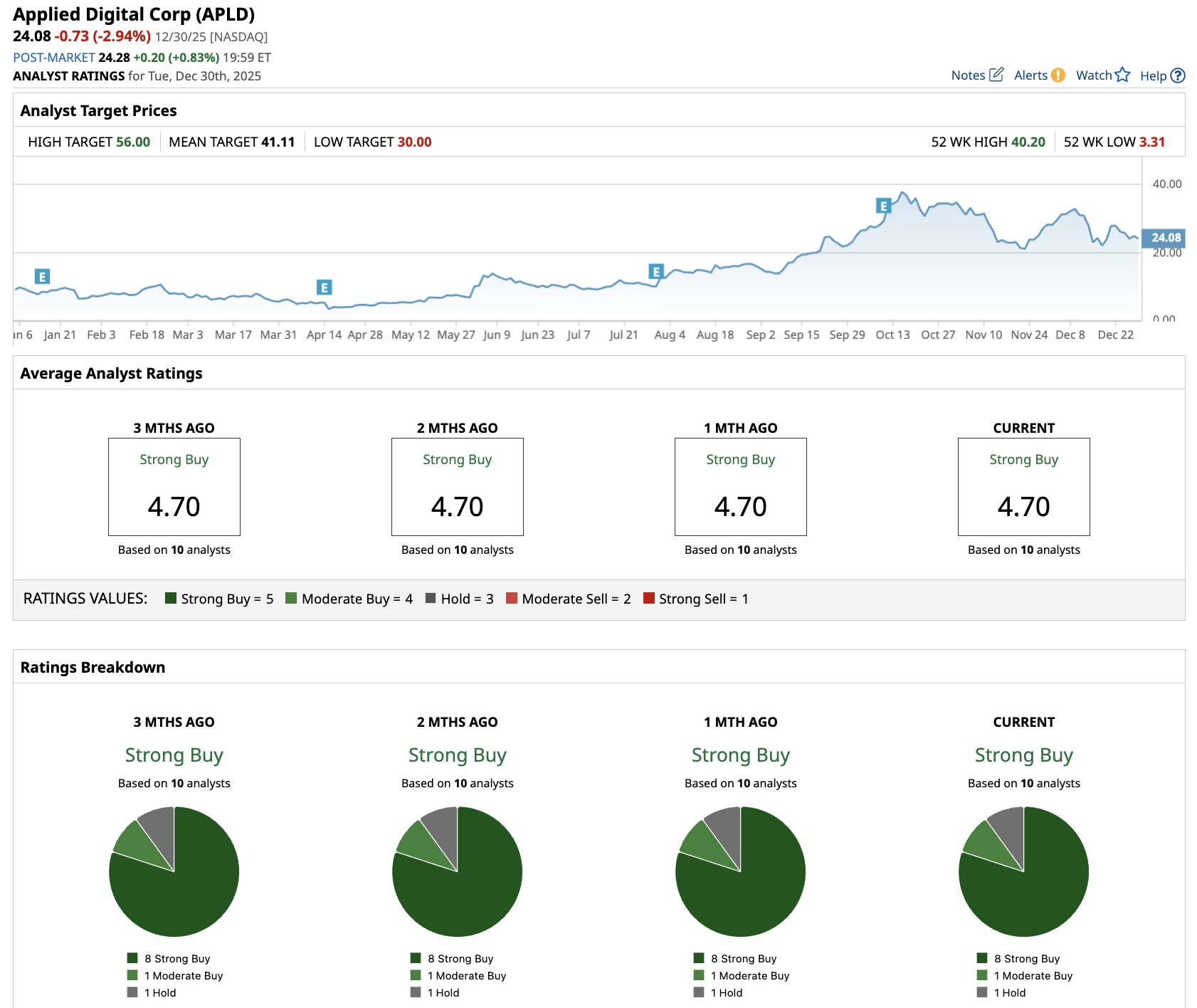

Out of the 10 analysts covering APLD stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” and one recommends “Hold.” The average APLD stock price target is $41.11, indicating an upside potential of 60% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ulta Stock ‘Unleashed’ Gains in 2025. Should You Keep Buying Shares in 2026?

- Nvidia Could Buy AI21 Next. What Does That Mean for NVDA Stock?

- Memory Stocks Could Dominate (Again) in 2026. Should You Buy Micron Stock Now?

- The Next GEICO? Michael Burry Is Pounding the Table on This 1 Warren Buffett-Esque Stock.