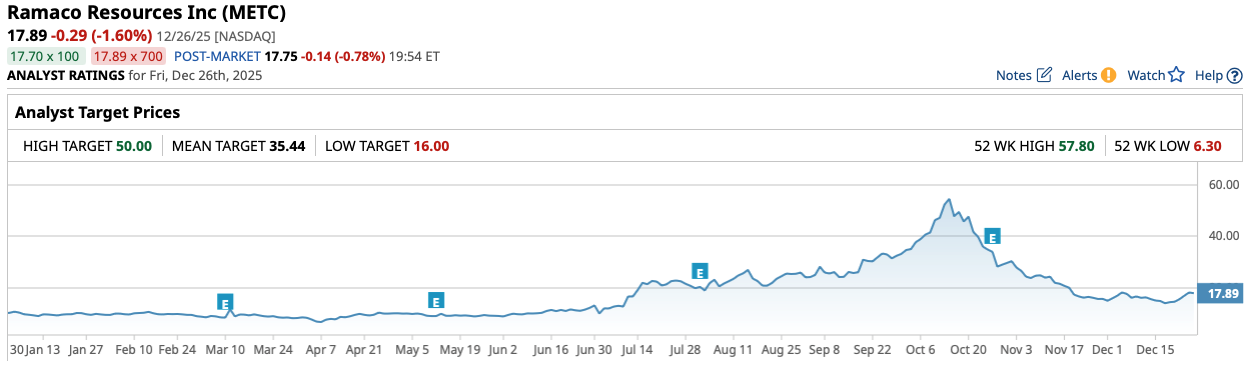

Investors who may be looking for an absolutely incredible stock chart to hone in on before the end of the year have a few decent options to choose from. However, I'd put Ramaco Resources (METC) near the top of the list, given the stock's trough-to-peak move of more than 800% this year.

Now, METC stock has since given up much of its earlier gains seen in October. However, shares of METC stock are still up around 74% on a year-to-date (YTD) basis so far in 2025, and could be poised for a big move higher in the year to come.

Much of this has to do with the overarching bullish narrative around mining companies, with Ramaco being a leading provider of metallurgic coal into the market. As we focus on the energy independence trade, and as costs of electricity generation continue to pick up, companies in all energy related sectors could see an uptick in their discounted future cash flow projections.

Now, that backdrop obviously clashes with the reality that a number of leading commodity prices are on the decline right now. As such, it's hard to gauge which direction this stock will be headed from here.

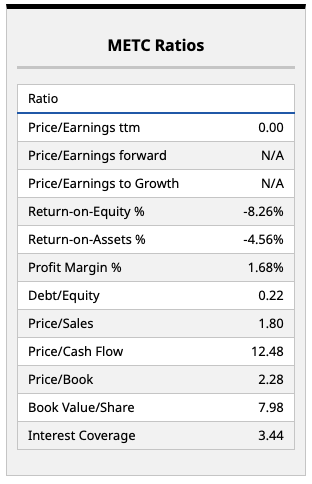

Let's dive into Ramaco's fundamentals, and where METC stock could be headed according to analysts.

What Do Ramaco's Fundamentals Suggest?

Overall, Ramaco's West Virginian coal operations do appear to be in a solid position, with the company's operations feeding improving profitability, at least in recent quarters.

That's to say nothing of the major $100 million share repurchase program Ramaco's board just approved. With such an announcement, investors may rightly view this company's forward cash flow projections as likely underselling the company's future potential.

Of course, we'll have to see whether commodity prices justify this valuation and whether METC stock can begin on another momentum-driven rally higher. For now, I think the jury is out on where this stock could be headed from here. So, with more help in assessing the company's future direction, let's move to what Wall Street analysts think about this name.

The Expert Verdict on METC Stock

Currently, Wall Street analysts have a consensus $35.44 price target on METC stock. That's a remarkable price target, as it suggests this is an investment that could potentially double over the course of the next year.

Of course, it's true that a number of these price targets and ratings materialized ahead of the company's recent earnings report, which was a miss. As such, I suspect that future coverage will factor in lower growth rates (and lower implied coal prices), forcing this stock's consensus target toward its current price range below $20 per share.

That said, many of the same catalysts that took METC stock to its October high are still in play. We'll have to see whether momentum picks up following this share buyback announcement, and whether that's enough to get investors off the sidelines and willing to put capital to work in this stock. I'll be watching this one closely, and aim to provide updates as they come on Ramaco Resources.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nike Insider Robert Swan Just Loaded Up on NKE Shares. Should You Too?

- Should You Buy Berkshire Stock on Warren Buffett’s Last Day as CEO?

- Molina Healthcare Stock Breaks Above Its 100-Day Moving Average as Michael Burry Pounds the Table on MOH

- Applied Digital Just Sent Little-Known Ekso Bionics Stock Soaring. Should You Buy Shares Here?