In an uncertain market, owning the right businesses that have the ability to grow for a long time matters more than timing the market. Companies with dominant positions, expanding profit engines, and long growth runways tend to reward patient investors. That’s what makes these two smartest stocks stand out.

Smart Stock #1: Amazon (AMZN)

When it comes to long-term compounders, few companies check as many boxes as Amazon (AMZN). The stock has returned a whopping 9,763% over the last 20 years. With its cloud division reaccelerating on the back of artificial intelligence (AI) demand, a high-margin advertising business scaling rapidly, and a retail ecosystem that continues to dominate on selection, price, and speed, Amazon is no longer just a growth story.

The crown jewel remains Amazon Web Services (AWS). AWS revenue increased 20.2% year-on-year (YoY) to $33 billion in the most recent third quarter, the quickest pace in 11 quarters, bringing the annualized run rate to $132 billion. Backlog increased to $200 billion by the end of the quarter, excluding several large deals signed after the quarter, indicating that demand will remain strong well into the future. AWS operational income increased to $11.4 billion, indicating both scale and efficiency.

Amazon is making substantial investments to meet AI-driven cloud demand. Over the last 12 months, AWS has added more than 3.8 gigawatts of electrical capacity, tripling its footprint since 2022 and on track to double again by 2027. Custom silicon, such as Trainium, has become a multibillion-dollar company, expanding 150% quarter after quarter, while Bedrock is being developed into what management expects could someday rival EC2.

Aside from AWS, Amazon's retail division continues to scale smoothly. Revenue in North America increased by 11% YoY, while overseas revenue increased by 10%, and paid unit growth reached 11%. Faster delivery, same-day grocery growth, and AI-powered shopping tools are all driving more engagement and conversion. Meanwhile, advertising income increased by 22% YoY to $17.7 billion, benefiting from Amazon's full-funnel ad ecosystem and new partnerships.

Total revenue for the quarter totaled $180.2 billion, up 12% YoY, while adjusted earnings increased 36.4% to $1.95 per share. Importantly, trailing twelve-month free cash flow increased to $14.8 billion, indicating improved cash generation across the business. Amazon intends to spend approximately $125 billion on capital expenditures in 2025, with spending projected to increase in 2026, mostly to support AI, cloud infrastructure, and logistics. While margins may fluctuate, management is committed to long-term returns on invested capital and continuous customer value creation.

Analysts expect that Amazon's earnings will climb by 29.6% in 2025, followed by an increase of 9.5% in 2026. Amazon's reaccelerating AWS growth, AI leadership, growing cash flow, and robust core businesses make it one of the best companies to own through 2026 and beyond.

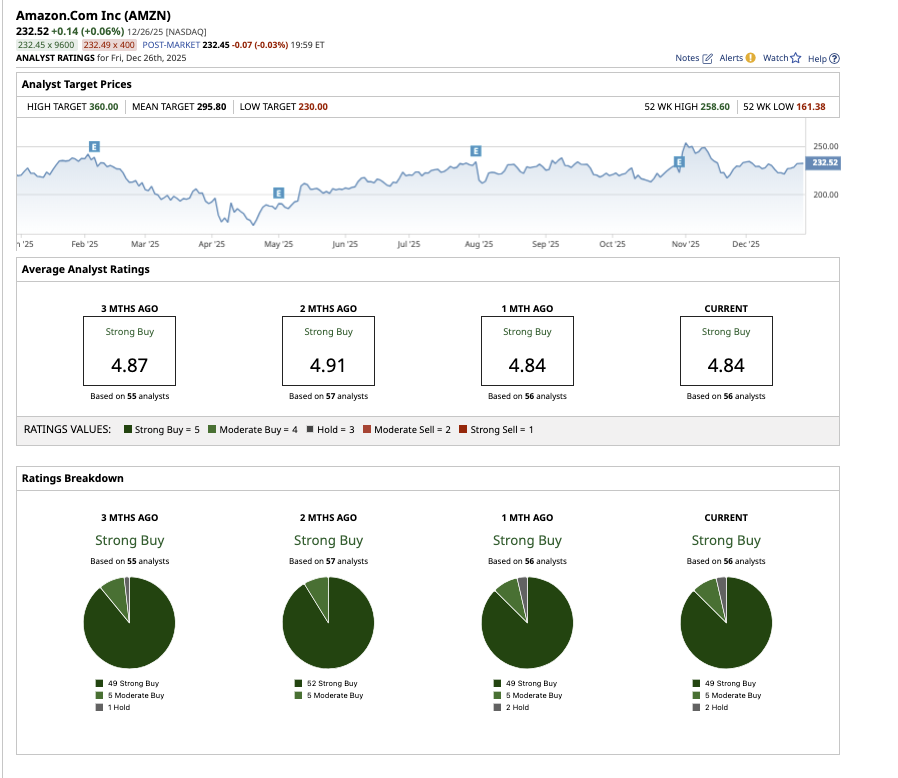

Is AMZN Stock a Buy, Hold, or Sell on Wall Street?

Overall, AMZN stock is rated a “Strong Buy” on Wall Street. Of the 56 analysts covering the stock, 49 have given it a “Strong Buy” rating, five recommend a “Moderate Buy,” and two say it is a “Hold.” The average target price is $295.80, indicating a potential upside of 27% from its current price. Additionally, the highest target price of $360 suggests the stock could rise by as much as 55% over the next 12 months.

Smart Stock #2: Alphabet (GOOGL)

Alphabet (GOOG) (GOOGL) is the second company on my list that clearly stands out as a solid long-term investment for 2026 and beyond, thanks to its solid fundamentals, expanding profitability, and deep leadership in AI, cloud computing, and digital platforms. GOOGL stock has returned 730% over the last decade.

In the third quarter, Alphabet recorded its first-ever $100 billion-plus quarter, with revenue of $102.3 billion, up 16% YoY. Just five years ago, quarterly revenue stood at $50 billion, underscoring how rapidly the business has scaled. The company saw double-digit increases in Search, YouTube, subscriptions, smartphones, and Google Cloud, indicating solid execution across the entire business.

AI is increasingly driving real business results across Alphabet. The company's Gemini models currently process billions of tokens every minute via APIs, and the Gemini app has well over 650 million monthly active users. Token processing has increased more than 20-fold across all Google surfaces year after year, showing AI's expanding significance in how consumers search, create, and engage online.

Google Cloud remains a solid growth driver. Cloud revenue increased 34% YoY to $15.2 billion, while operating income increased 85% to $3.6 billion, resulting in operating margins of 23.7%. The cloud backlog increased to $155 billion, up 46% sequentially, thanks to high demand for enterprise AI infrastructure, proprietary TPUs, and generative AI solutions built on Gemini. Notably, Alphabet closed more billion-dollar cloud deals in the first nine months of 2025 than in the past two years combined.

Financially, Alphabet remains exceptionally strong. The company generated $24.5 billion in free cash flow in the quarter and $73.6 billion over the trailing twelve months, ending the period with nearly $100 billion in cash and marketable securities. While capital expenditures are rising sharply to support AI infrastructure, management views these investments as critical to long-term value creation, with 2026 expected to see even higher spending.

Analysts predict Alphabet’s earnings to increase by 31.6% in 2025, followed by another 4.3% in 2026. All in all, Alphabet’s leadership in AI, rapidly expanding cloud profitability, durable advertising engine, and massive financial flexibility position it as one of the smartest stocks investors can hold into 2026 and beyond.

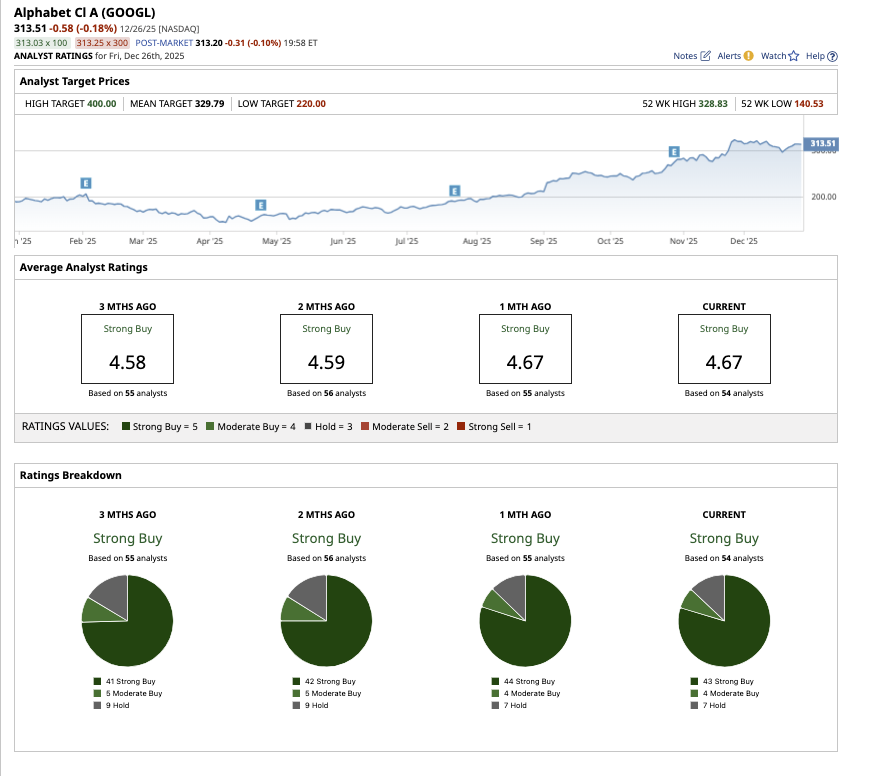

Is GOOGL Stock a Buy, Hold, or Sell on Wall Street?

Overall, on Wall Street, GOOGL stock is a “Strong Buy.” Of the 54 analysts covering the stock, 43 rate it a “Strong Buy,” four say it is a “Moderate Buy,” and seven rate it a “Hold.” The stock’s average target price of $329.79 indicates the stock can rally another 5.2% from current levels. Plus, its high price estimate of $400 suggests the stock has an upside potential of 27.6% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart