Portage, Michigan-based Stryker Corporation (SYK) is a leading global medical technology company specializing in orthopaedics, MedSurg, and neurotechnology solutions, serving hospitals and healthcare providers worldwide. Valued at $135.7 billion by market cap, the company is best known for its joint-replacement implants, surgical equipment, and advanced technologies, including the Mako robotic-assisted surgery platform, which enhances procedural precision and efficiency.

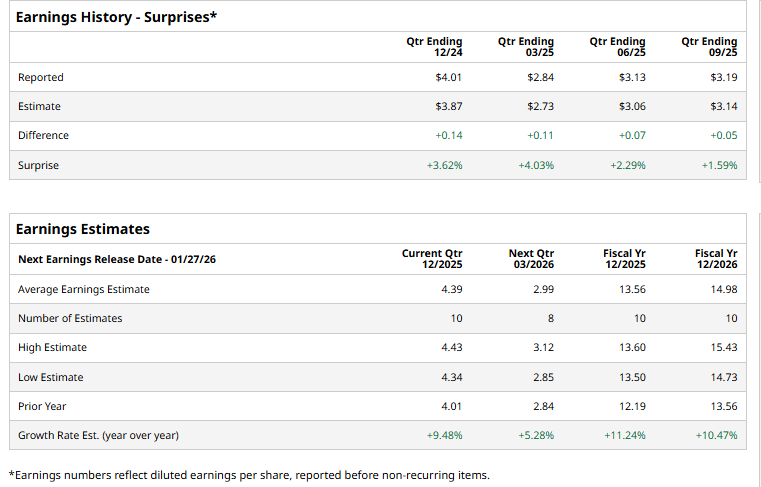

The Medtech giant is expected to announce its fiscal fourth-quarter earnings soon. Ahead of the event, analysts expect SYK to report a profit of $4.39 per share on a diluted basis, up 9.5% from $4.01 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect SYK to report EPS of $13.56, up 11.2% from $12.19 in fiscal 2024. Its EPS is expected to rise 10.5% year over year to $14.98 in fiscal 2026.

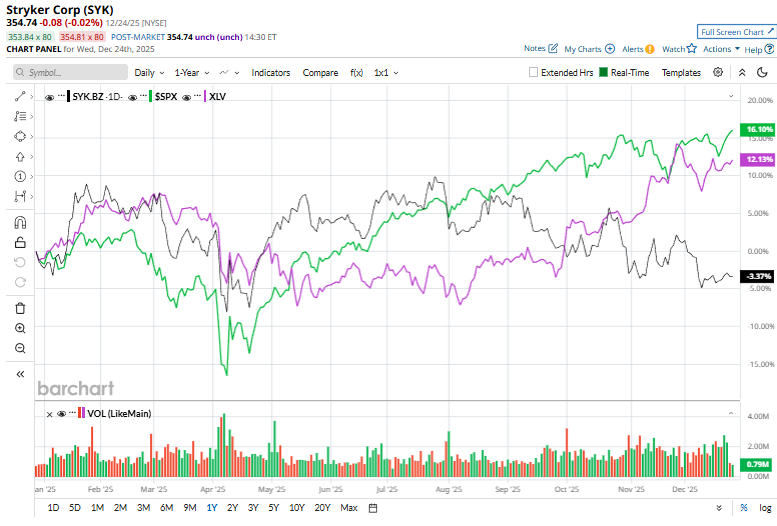

SYK stock has declined 4.3% over the past year, underperforming the S&P 500 Index’s ($SPX) 14.8% gains and the Health Care Select Sector SPDR Fund’s (XLV) 11.8% rise over the same time frame.

On Dec. 19, shares of Stryker rose more than 1% after Citizens JMP Securities upgraded the stock to “Outperform” from “Market Perform” and set a $440 price target. The upgrade reflects growing confidence in Stryker’s long-term growth outlook, supported by strong demand for its orthopaedics and MedSurg products, continued momentum in robotic-assisted surgery, and improving operating leverage.

Analysts’ consensus opinion on SYK stock is reasonably bullish, with a “Strong Buy” rating overall. Out of 27 analysts covering the stock, 18 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and seven give a “Hold.” SYK’s average analyst price target is $432.88, indicating a potential upside of 22% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Giant Yielding 4.5% Is Wall Street’s Top Telecom Pick for 2026

- Have a MERRY Christmas With These 9 Unusually Active Options

- Sydney Sweeney Made American Eagle Stock a Star in 2025. Should You Keep Buying AEO in 2026?

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?