Mental health has moved from the margins to the center of the global healthcare conversation. Rising anxiety, depression, and treatment-resistant conditions are stretching traditional therapies to their limits, forcing the industry to search for approaches that go beyond incremental relief. That search has brought psychedelic-assisted therapies back into focus, and this time backed by data, regulation, and serious capital. The space is now gaining legitimacy as clinical results and market demand begin to align.

Within this evolving landscape, Mind Medicine (MNMD) has carved out a clear role. The company, also known as MindMed in short, is developing psychedelic-inspired treatments for brain health disorders, led by MM120, now advancing through late-stage trials for anxiety and depression. In 2025, MNMD stock reflected that progress, delivering strong gains as investors responded to clinical momentum and a maturing pipeline that extends into autism research.

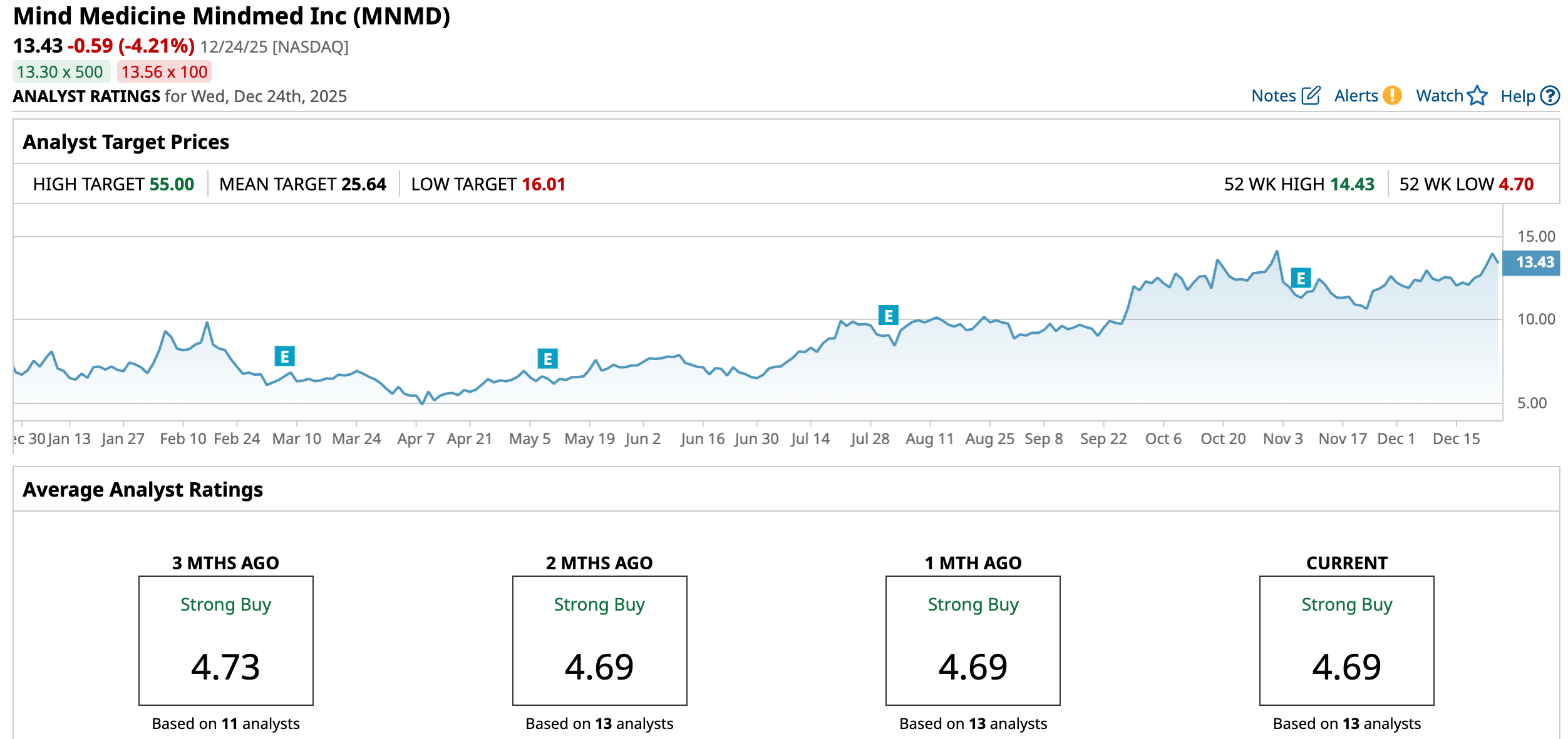

Wall Street has taken note. Jones Trading recently initiated coverage with a bullish stance, pointing to MindMed’s positioning in a fast-growing therapeutic category and the potential of upcoming Phase 3 data. With the brokerage firm’s price target of $61 – also the Street’s highest – implying over 354% upside potential from current levels, let’s see why expectations have shifted so decisively in MindMed’s favor.

About Mind Medicine Stock

New York-based MindMed is a late-stage clinical biopharmaceutical company focused on reshaping how brain health disorders are treated. At the heart of its story is MM120, now in Phase 3 trials for generalized anxiety disorder, targeting a condition long underserved by existing therapies.

Alongside it, MM402, an MDMA-inspired compound, is being explored for autism spectrum disorder, aiming to address core symptoms rather than surface relief. With a pipeline centered on complex mental health challenges, MindMed is steadily carving out space in a field hungry for innovation.

Valued at roughly $1.4 billion, the company’s shares have been drawing growing investor attention as its clinical ambitions move closer to reality. MindMed’s shares have been steadily building a strong comeback story over the past few years. Just over the past 52 weeks, shares climbed 83.5%, and momentum has clearly picked up in 2025.

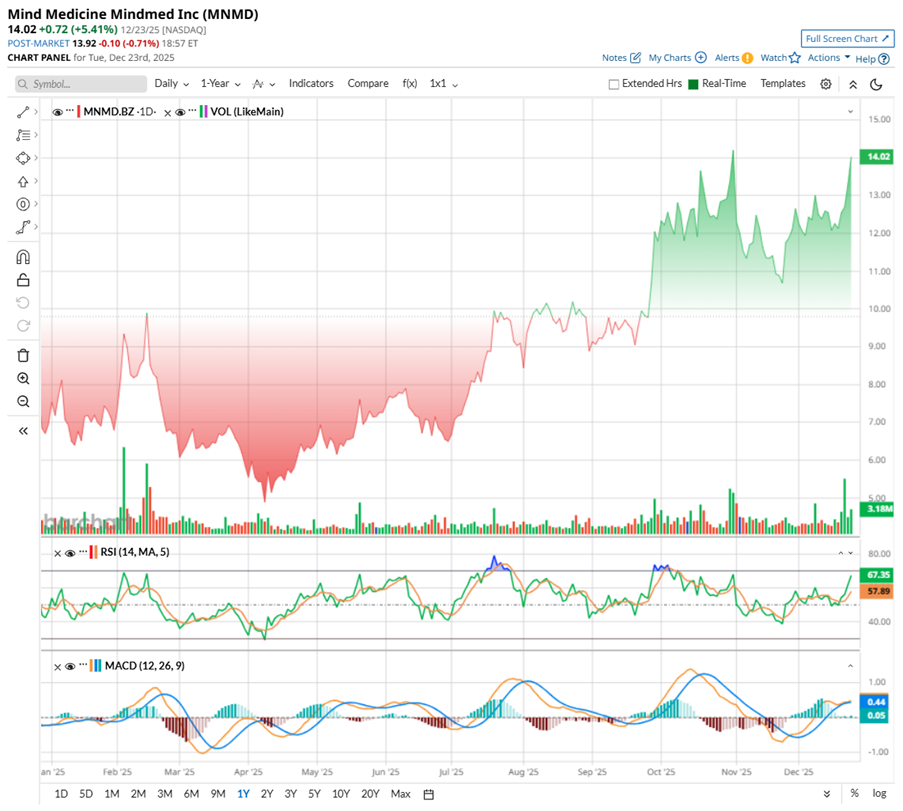

In the past six months alone, MNMD has jumped 87.96%, while the most recent three months delivered a solid 36.76% gain, reflecting growing and consistent investor interest. The stock is now trading just 7.5% below its year-to-date (YTD) high of $14.43, reached in late October, and continues to edge closer to that level.

From a technical standpoint, the trend remains supportive. Trading volume has been rising, confirming participation behind the move. The 14-day RSI has eased from overbought conditions seen earlier but now sits around 60 and is turning higher again, pointing to renewed momentum.

Meanwhile, on the MACD oscillator, the yellow MACD line remains above the blue signal line, keeping the trend bullish, though the narrowing gap between the two hints at short-term consolidation rather than reversal.

A Closer Look at MindMed’s Mixed Q3 Results

MindMed’s fiscal 2025 third-quarter update, released on Nov. 6, reflected a company firmly in an investment and development phase rather than one focused on near-term results. The pre-revenue biotech posted a loss of $0.78 per share, wider than last year’s $0.27 loss and below Wall Street’s $0.52 estimate. The miss was not about stalling science, but it was about spending with intent.

Research and development costs surged from $17.2 million in Q3 2024 to $31 million, driven largely by an $11.7 million jump in MM120 program expenses, alongside higher internal staffing costs as the company scaled its R&D engine. General and administrative expenses followed suit, nearly doubling annually to $14.7 million, reflecting heavier investment in people, commercial readiness, and corporate infrastructure. In short, MindMed spent more because it chose to move faster.

On the balance sheet, the picture steadied. Cash, cash equivalents and investments stood at $209.1 million as of Sept. 30, down from $273.7 million as of Dec. 31, 2024, but still sufficient to fund operations through 2028. That runway was further extended after quarter-end, when MindMed completed a public offering that raised $258.9 million gross, or $242.8 million net, adding serious financial firepower.

Operationally, momentum continued. The MM402 Phase 1 study in healthy adults was completed, with a Phase 2a autism study planned by the end of 2025. More importantly, MindMed published full Phase 2b MM120 data in JAMA, showing strong, durable efficacy in GAD. A single dose delivered statistically and clinically meaningful improvements, including a 65% response rate and 48% remission rate at 12 weeks, with tolerability aligned to expectations. Those results earned MM120 FDA Breakthrough Therapy Designation (BTD).

Looking ahead, MindMed is lining up what could be a defining 2026, with three Phase 3 readouts across anxiety and depression. The losses are visible, but so is the architecture of something larger being built.

Analysts tracking the company don’t expect MindMed to generate any revenue this fiscal year or the next. Losses are projected to deepen first, widening about 37% year-over-year (YOY) to a -$1.92 per-share loss, before improving in fiscal 2026, when the loss is forecast to narrow roughly 13% annually to -$1.67 per share.

What Do Analysts Think About Mind Medicine Stock?

Jones Trading approaches MindMed with clear confidence, having assessed the landscape carefully and still finding the opportunity compelling. The brokerage firm initiated coverage with a confident “Buy” rating and a Street-high $61 target, implying a potential upside of 354% from here. The optimism rests on MM120, MindMed’s lead asset, which Jones believes is well-timed for a neuropsychiatry world increasingly open to psychedelic-based therapies. Positive Phase 3 outcomes in generalized anxiety disorder and major depressive disorder are central to that vision.

The firm does not ignore the shadows. MM120’s link to LSD, a Schedule I substance, brings clinical and regulatory complexity that few drugs carry. Still, Jones argues that strong data could cut through those barriers. LSD’s long, well-documented history may actually work in MindMed’s favor, driving awareness and speeding adoption. In Jones Trading’s view, the risks are meaningful, but the potential rewards are equally compelling.

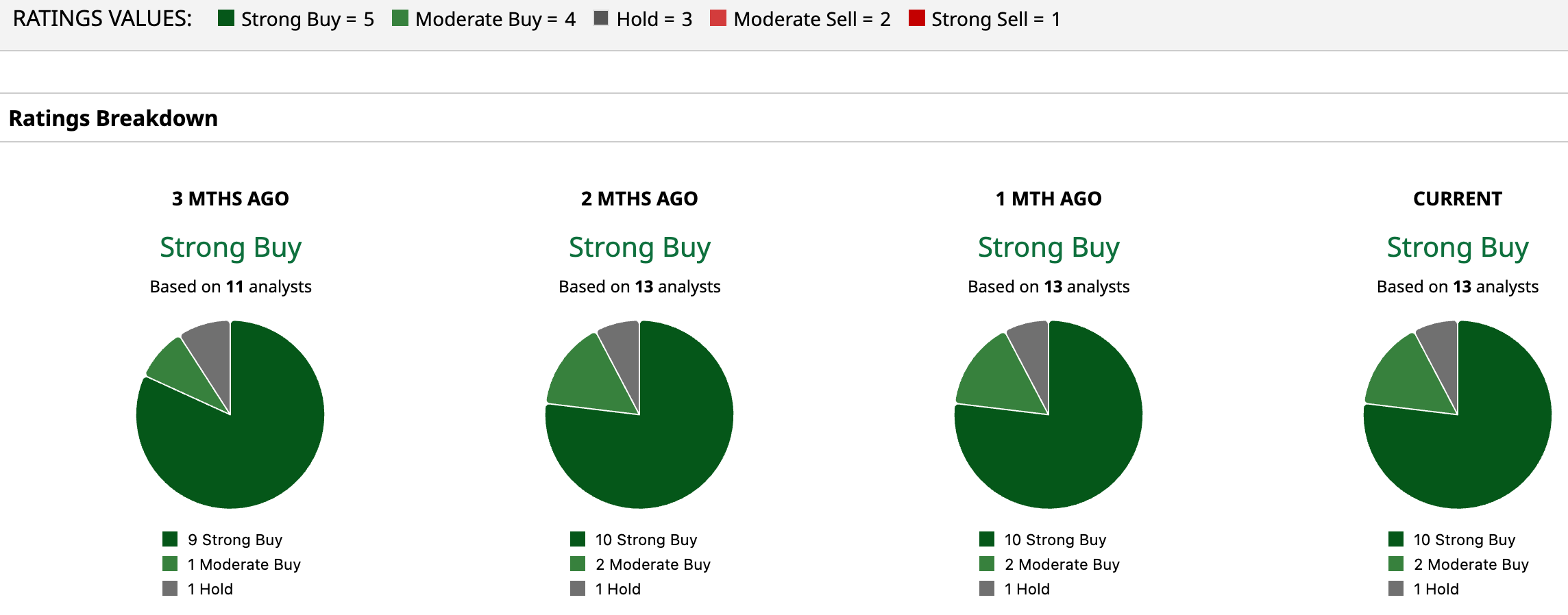

Overall, MNMD is getting a strong thumbs-up from analysts, carrying a consensus rating of “Strong Buy.” Of the 13 analysts covering the stock, a majority of 10 analysts recommend a “Strong Buy,” two advise a “Moderate Buy,” while the remaining one has a “Hold” rating. The average analyst price target of $25.64 indicates significant upside potential of 90.9% from the current price levels.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Sydney Sweeney Made American Eagle Stock a Star in 2025. Should You Keep Buying AEO in 2026?

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?

- Wall Street Thinks This 1 Psychedelic Stock Can Gain 335% in 2026

- As the FDA Approves a Wegovy Pill, Should You Buy, Sell, or Hold Novo Nordisk Stock?