Betting on early-stage biotech companies is rarely for the faint of heart. Regulatory uncertainty, clinical trial risks, and funding concerns often make these stocks among the market’s most volatile. Yet this year, one of the riskiest biotech companies, AtaiBeckley (ATAI), which makes psychedelic-based mental health therapies, delivered a standout payoff for investors who were willing to take that risk.

Atai stock has soared 213% year-to-date (YTD), wildly outperforming the S&P 500 Index’s ($SPX) gain of 17.9%. Is ATAI still a buy for 2026?

A High-Risk Sector With High Stakes

Valued at $1.5 billion, AtaiBeckley operates in one of the most controversial and uncertain areas of biopharma and psychedelic-inspired treatments for severe mental health conditions. The research is encouraging, but the regulatory approach is complicated, public opinion is divided, and failure rates remain high. For much of the year, this made ATAI a stock that investors avoided. However, the company has regained traction following recent encouraging clinical developments.

The U.S. Food and Drug Administration recently designated BPL-003, AtaiBeckley's mebufotenin benzoate nasal spray for treatment-resistant depression (TRD), as a Breakthrough Therapy. The company published promising Phase 2a and Phase 2b data, showing immediate, meaningful, and long-lasting antidepressant benefits, including better outcomes following a second dose. Importantly, the treatment was typically well tolerated, which addresses one of the most common concerns about psychedelic-based therapies. This regulatory milestone greatly reduces development risk and accelerates the path to approval.

Furthermore, the strategic merger between atai Life Sciences and Beckley Psytech Limited in November, forming AtaiBeckley, further strengthened its position as a global leader in next-generation mental health treatments.

A Strengthening Pipeline Beyond One Drug

While BPL-003 made headlines, AtaiBeckley quietly pursued additional high-risk, high-reward projects. The company has completed enrollment in a Phase 2a trial of EMP-01 (oral R-MDMA) for social anxiety disorder, with topline data anticipated in early 2026. It also expanded its VLS-01 DMT buccal film study to various countries, widening its global clinical presence. Adding to its long-term optionality, AtaiBeckley secured a multi-year NIDA grant worth up to $11.4 million to develop non-hallucinogenic 5-HT2A/2C receptor agonists for opioid use disorder, an area with significant unmet need.

Another major reason this risky bet paid off this year was the company’s balance sheet discipline. AtaiBeckley closed a $150 million public offering, extending its cash runway until 2029, well beyond important Phase 3 milestones. For a clinical-stage biotech, this greatly minimizes dilution and survival risk.

AtaiBeckley combined three things investors look for in risky bets: regulatory validation, solid clinical data, and sufficient capital to reach the next inflection point. In a year when many volatile penny stocks failed to deliver, this was one risky bet that rewarded patience and conviction. ATAI stock could be a great long-term bet for investors willing to take the risk of investing in a clinical-stage biotech stock.

What Are Analysts Saying About ATAI Stock?

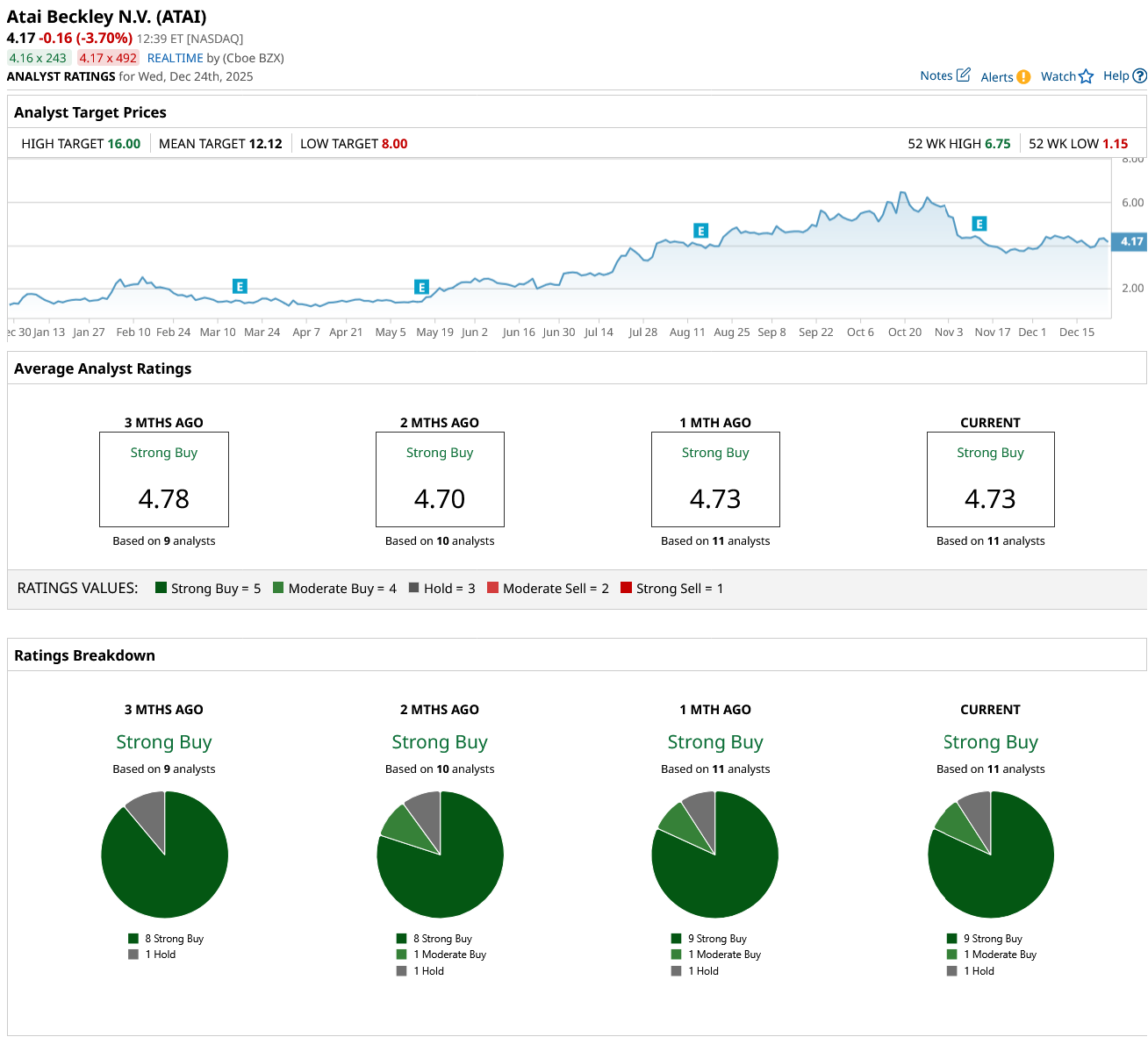

Overall, Wall Street rates ATAI stock a “Strong Buy,” signaling that the reward potential significantly outweighs the risk, but outcomes will hinge on upcoming clinical and regulatory milestones. Out of the 11 analysts covering the stock, nine rate it a “Strong Buy,” one recommends a “Moderate Buy,” and one rates it a “Hold.”

Despite the stock’s dramatic rise this year, analysts expect it to soar 190% from current levels based on its average analyst target price of $12.12. Plus, the high price estimate of $16 implies that the stock can rise by 284% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?

- Wall Street Thinks This 1 Psychedelic Stock Can Gain 335% in 2026

- As the FDA Approves a Wegovy Pill, Should You Buy, Sell, or Hold Novo Nordisk Stock?

- This Cannabis Stock Got Destroyed in 2025. Can Trump Make 2026 a Different Story?