Stamford, Connecticut-based Synchrony Financial (SYF) is a leading consumer financial services company delivering one of the industry's most comprehensive digitally enabled product suites. Valued at $30.9 billion by market cap, the company provides a range of credit products such as credit cards, commercial credit products, and consumer installment loans through programs established with a diverse group of national and regional retailers, local merchants, manufacturers, and more. The consumer credit company is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

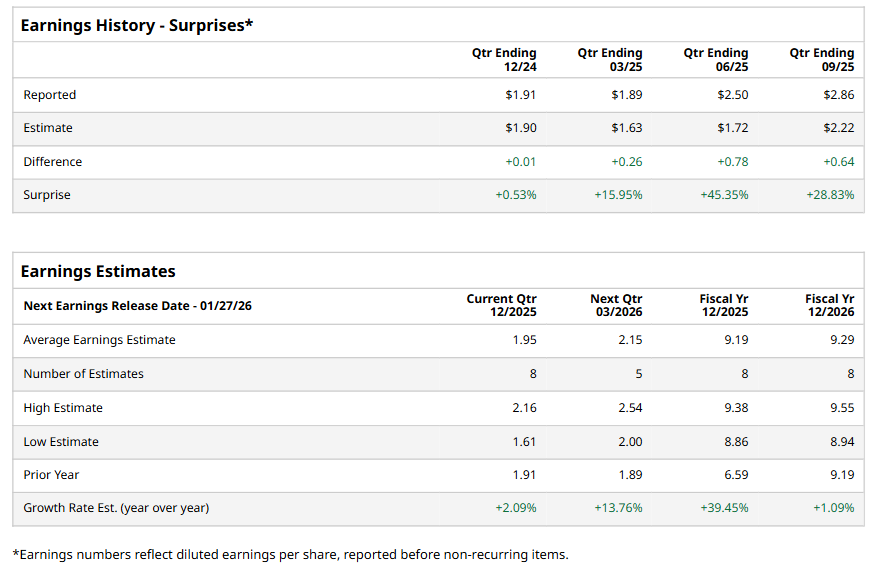

Ahead of the event, analysts expect SYF to report a profit of $1.95 per share on a diluted basis, up 2.1% from $1.91 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect SYF to report EPS of $9.19, up 39.5% from $6.59 in fiscal 2024. Its EPS is expected to rise 1.1% year over year to $9.29 in fiscal 2026.

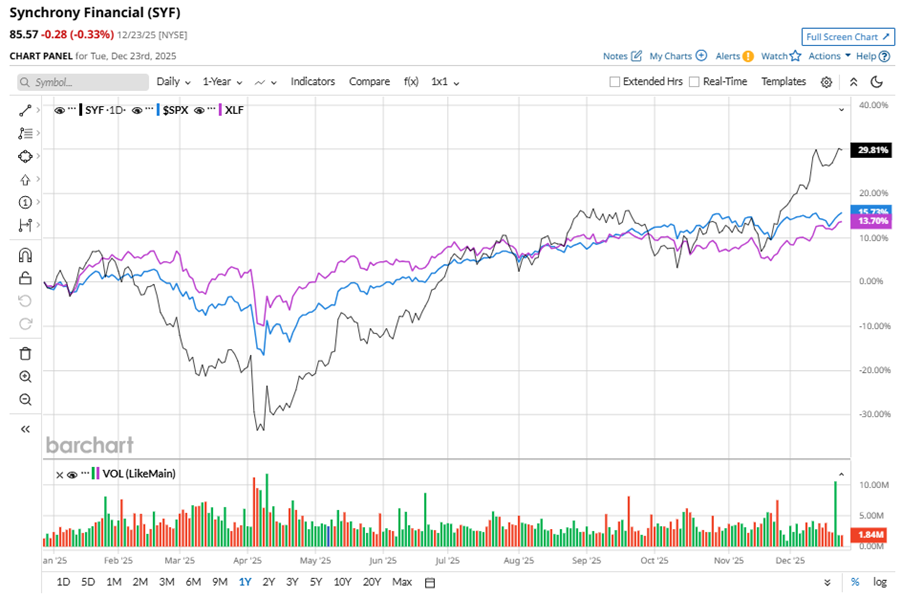

SYF stock has outperformed the S&P 500 Index’s ($SPX) 15.7% gains over the past 52 weeks, with shares up 30.7% during this period. Similarly, it outpaced the Financial Select Sector SPDR Fund’s (XLF) 14.5% gains over the same time frame.

SYF is outperforming due to a renewed partnership with Mitsubishi Electric Trane HVAC U.S. LLC, strong credit performance, and 2% growth in purchase volume, driven by selective credit actions. Growth is driven by digital, health & wellness, and diversified value segments, with improved delinquency and charge-off trends attributable to disciplined credit management. New product launches, such as the Walmart credit card by Walmart Inc. (WMT) and Pay Later at Amazon.com, Inc. (AMZN), as well as strategic partnerships, are also contributing factors.

On Oct. 15, SYF shares closed down marginally after reporting its Q3 results. Its EPS of $2.86 beat Wall Street expectations of $2.22. The company’s adjusted revenue was $4.72 billion, exceeding Wall Street forecasts of $4.69 billion.

Analysts’ consensus opinion on SYF stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 24 analysts covering the stock, 12 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 11 give a “Hold.” While SYF currently trades above its mean price target of $85.38, the Street-high price target of $101 suggests an upside potential of 18%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart