Clean energy company FuelCell Energy (FCEL) reported its fiscal fourth-quarter earnings on Dec. 18. As the results topped expectations, the stock gained 22% intraday on the same day.

Notably, the company reported solid prospects from data centers, which drive higher energy demand. FCEL says its sales and marketing focus is centered around data center operations and engaging with data center operators and infrastructure finance providers to make it clear that FuelCell is equipped to power their energy-intensive applications.

As AI demand accelerates, the company expects to increase production, creating a clear path to profitability. Believing that once it reaches an annualized production rate of 100 megawatts, it will translate into positive adjusted EBITDA.

So, should you consider buying FuelCell’s stock now?

About FuelCell Stock

Danbury, Connecticut-based FuelCell is a leader in developing stationary fuel cell platforms for sustainable, efficient power production. The company designs, manufactures, installs, operates, and services megawatt-scale systems powered by molten carbonate technology, generating ultra-clean electricity with minimal emissions.

These versatile platforms enable carbon capture and sequestration, hydrogen and water production, plus long-duration energy storage solutions customized for utilities, industries, and municipalities. Founded in 1969, FuelCell Energy advances reliable fuel cell innovations to support global clean energy needs and environmental goals. The company has a market capitalization of $269.34 million.

The stock has been volatile on Wall Street amid broader market volatility. Adding to the pressure is the new tax legislation, also called the One Big Beautiful Bill Act (OBBBA). The new tax regime significantly curbs the clean hydrogen production credit under the Inflation Reduction Act (IRA), requiring facilities to begin construction by January 1, 2028, to remain eligible.

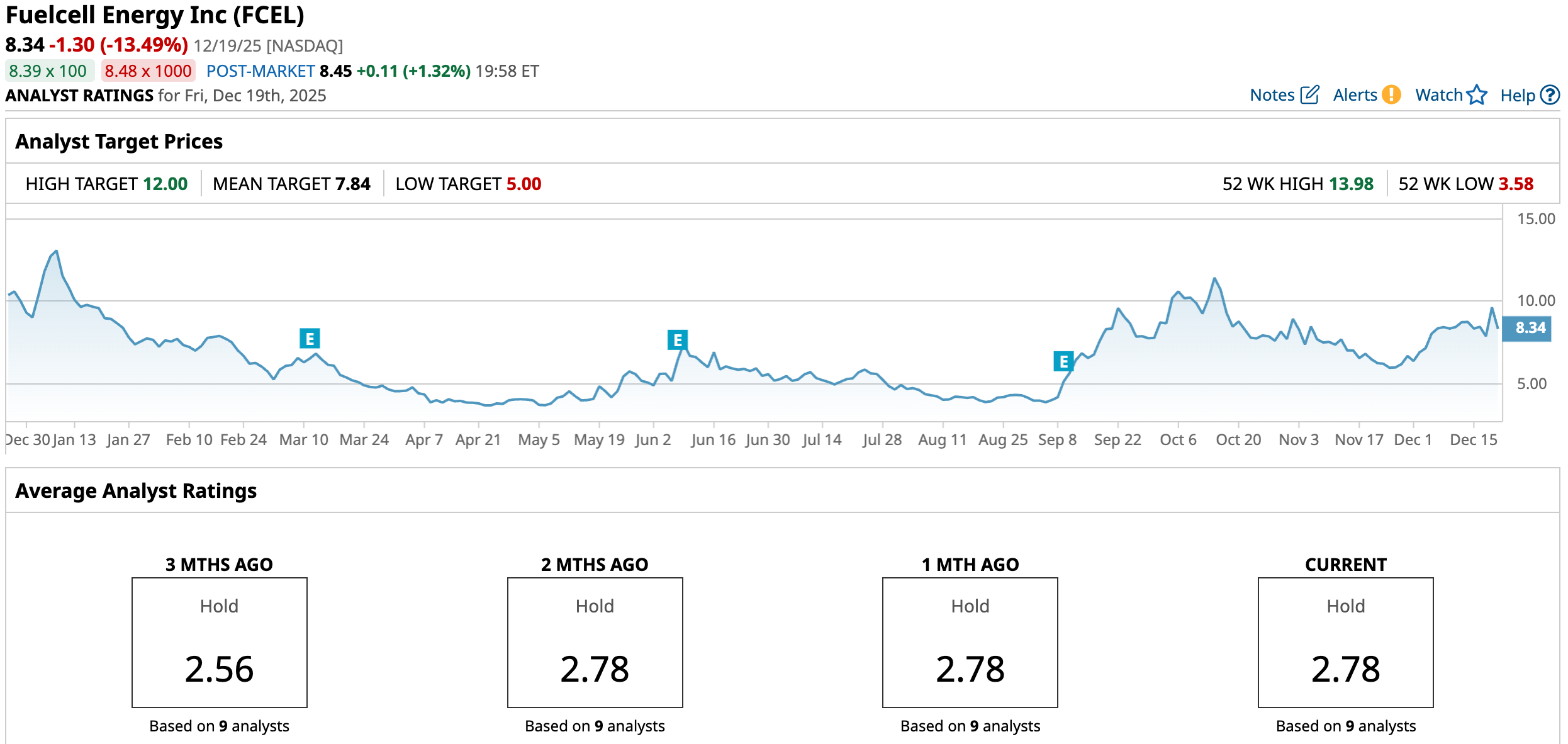

Over the past 52 weeks, FuelCell’s stock has dropped by 10.6%. However, over the past six months, it has gained 37.17%. The stock had reached a 52-week high of $13.98 in January, but is down 40% from that level. It reached a 52-week low of $3.58 in May and is up 133% from that level.

FuelCell’s stock is trading at a lower valuation than its peers. Its price-to-sales ratio of 1.36x is lower than the industry average of 1.81x.

FuelCell’s Q4 Results Were Better Than Expected

On Dec. 18, FuelCell reported its fourth-quarter and fiscal year 2025 (the period that ended on Oct. 31). The company’s quarterly revenue increased 12% year-over-year (YOY) to $55.02 million, which is higher than the $43.96 million that Wall Street analysts had expected.

The top line growth was driven by product revenue increasing 18% from the prior year’s period to $30.03 million. This was based on the company recording $30 million in revenue from its extended service contract with Gyeonggi Green Energy Co., Ltd. (GGE), covering the supply and activation of 10 fuel cell units for GGE’s 58.8 MW power facility in Hwaseong-si, South Korea.

FuelCell reported that it has streamlined its product lineup, increased efficiency, and incorporated absorption chilling to manage thermal loads, which is essential for high-compute environments. The company has also become seemingly more cost-efficient, as its bottom line losses are declining.

Its adjusted EBITDA loss was $17.68 million, down by 30% YOY. FuelCell’s adjusted net loss per share for Q4 was $0.83, down 55% from the prior-year period’s per-share loss of $1.85, and lower than the $1.03 per-share loss that Street analysts had expected.

The company announced that it took “proactive measures” to strengthen its balance sheet and bolster its liquidity. As of Oct. 31, FuelCell had $278.10 million in unrestricted cash and cash equivalents. It also had a total backlog of $1.19 billion, $30.41 million higher than it was a year ago.

What Do Analysts Think About FuelCell Stock?

Wall Street analysts have a mixed view about FuelCell Energy’s bottom-line trajectory. For the current fiscal year (fiscal 2026), analysts expect the company’s loss per share to reduce by 29.3% YOY to $3.12, followed by losses deepening by 42.6% to $4.45 per share in the following fiscal year.

After the Q4 earnings report, Street analysts have not noticeably changed their stance on FuelCell’s stock. Experts at Canaccord Genuity recently reiterated their “Hold” rating and $12 price target. Despite acknowledging FuelCell's upside potential, Canaccord Genuity analysts noted that the company must demonstrate that its data center initiatives will deliver “tangible outcomes.”

Meanwhile, TD Cowen analysts reaffirmed their “Hold” rating but raised the price target from $7 to $9. This indicates that while sentiment remains tepid, it may be improving in the near future.

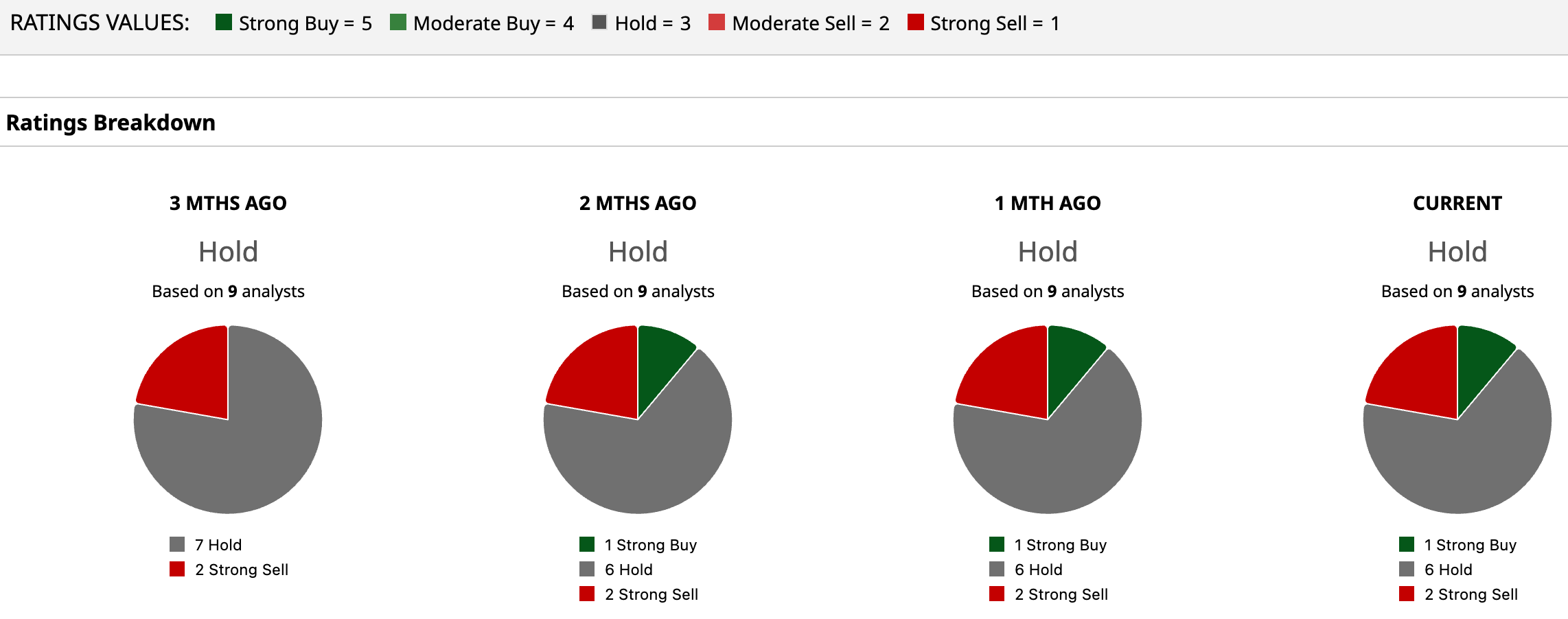

Wall Street analysts are taking a cautious stance on FuelCell’s stock now, with a consensus “Hold” rating overall. Of the nine analysts rating the stock, one analyst gave a “Strong Buy” rating, while six analysts are playing it safe with a “Hold” rating, and two analysts gave a “Strong Sell” rating. The consensus price target of $7.84 represents an 6% downside from current levels. However, the Street-high Canaccord Genuity-given price target of $12 indicates a 43.9% upside from current levels.

Key Takeaways

Data center demand is expected to keep FuelCell’s operations robustly buoyed. However, the company continues to report losses and needs to scale its operations to achieve profitability. Therefore, it might be wise to observe the stock for now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Instacart Is Under Investigation. Should You Buy the Dip in CART Stock?

- The Saturday Spread: How a Little-Known Options Strategy Targets Asymmetric Upside (ORCL, NEE, IRM)

- Data Center Demand Is Transforming FuelCell Energy. Should You Buy FCEL Stock After Earnings?

- Did Nvidia Just Lose Its Spot as Wall Street’s AI Chip Darling? JPMorgan Says This ‘Overall Top Pick’ Is Better.