Alphabet Inc. (GOOG), headquartered in Mountain View, California, is a leading global technology company formed as the parent organization of Google. It manages Google’s core internet products alongside other innovative ventures. Alphabet’s diverse operations include digital advertising, cloud computing, artificial intelligence (AI) research, hardware, and more.

The company continues advancing its technological innovations and expanding its market presence, maintaining strong dominance in search, advertising, and cloud services worldwide. It has a massive market capitalization of $3.86 trillion, which classifies it as a “mega-cap” stock and a member of the coveted “trillion-dollar club.”

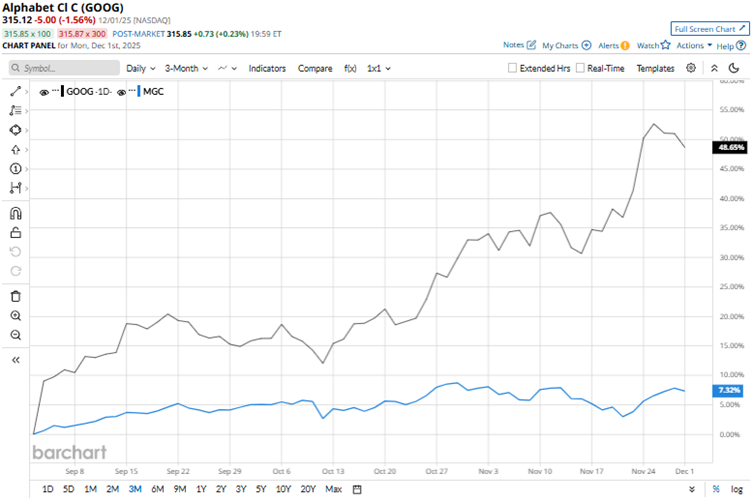

GOOG’s stock reached a 52-week high of $328.67 on Nov. 25, but is down 4.1% from that level. With strong financials and rapid advances in AI, the stock has gained 47.6% over the past three months. In stark contrast, the Vanguard Mega Cap Index Fund (MGC) has gained 6.6% over the same period. So, GOOG is the clear outperformer during this period.

Over the longer term, this outperformance persists. Over the past 52 weeks, GOOG’s stock has gained 84.8%, while it is up 82.3% over the past six months. On the other hand, the Vanguard Mega Cap Index Fund is up 15.7% and 17.2% over the same periods, respectively.

The stock has been trading above its 50-day moving average since late June and its 200-day moving average since early July.

Investors have been supporting the stock because they believe the mega-cap company will continue to grow robustly, despite its already massive size. The company faces the tailwinds of AI and cloud operations, which are expected to bolster its prospects.

For instance, Morgan Stanley analysts believe that Alphabet’s on-demand business will grow by 15% or more, with an additional $50 billion in net backlog expected over the next year. If these two conditions are met, Google Cloud’s revenue growth rate could approximately double from 25% in 2025 to more than 50% in 2026.

As Google Gemini’s user base grows, so does the company’s demand for tensor processing units (TPUs), which are said to be better at handling AI workloads than traditional GPUs. There are also reports that Meta Platforms, Inc. (META) is considering shifting to Google TPUs to power its data centers.

The company’s financial growth also remains solid. On Oct. 29, Alphabet reported its third-quarter results for 2025. Its revenues climbed by 15.9% year-over-year (YOY) to $102.35 billion, while its EPS grew 35.4% YOY to $2.87. The stock gained 2.5% intraday on Oct. 30.

We compare Alphabet’s performance with that of another tech behemoth, Microsoft Corporation (MSFT), which has gained 14.9% over the past 52 weeks and 5.7% over the past six months. Therefore, GOOG has been the clear outperformer over these periods.

Wall Street analysts are strongly bullish on Alphabet’s stock. The stock has a consensus rating of “Strong Buy” from the 55 analysts covering it. The mean price target of $321.96 indicates a 2.2% upside compared to current levels. The Street-high price target of $355 indicates a 12.7% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.