With a market cap of $18.5 billion, J.B. Hunt Transport Services, Inc. (JBHT) is a U.S.-based surface transportation, delivery, and logistics company, operating through five segments: Intermodal, Dedicated Contract Services, Integrated Capacity Solutions, Final Mile Services, and Truckload. The company transports and manages a wide range of freight across the United States using extensive company-owned and contracted equipment and drivers.

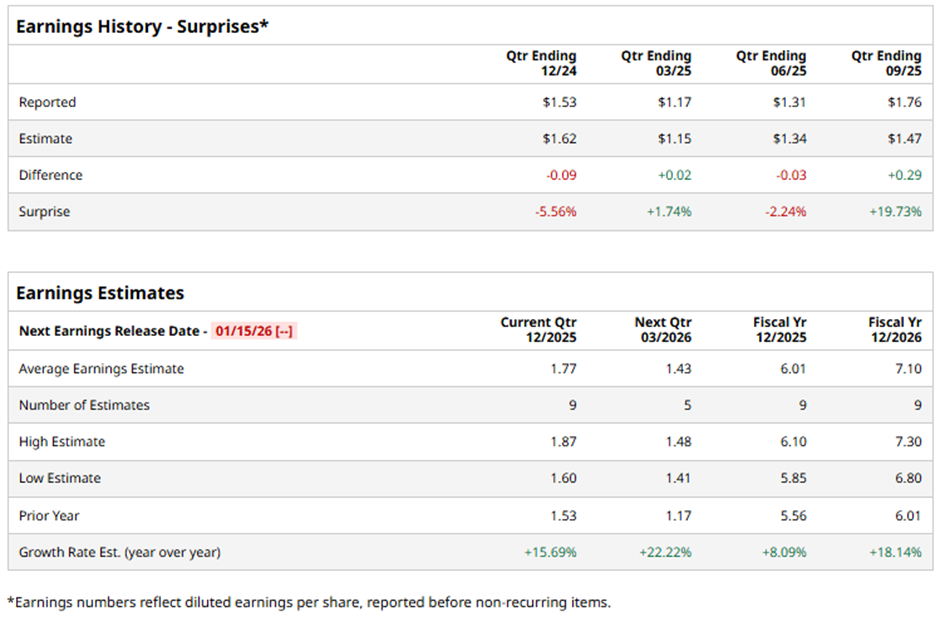

The Lowell, Arkansas-based company is set to unveil its fiscal Q4 2025 results soon. Prior to the event, analysts anticipate JBHT to report a profit of $1.77 per share, up 15.7% from $1.53 per share in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the trucking and logistics giant to report EPS of $6.01, a rise of 8.1% from $5.56 in fiscal 2024. Looking forward to fiscal 2026, EPS is forecasted to grow 18.1% year-over-year to $7.10.

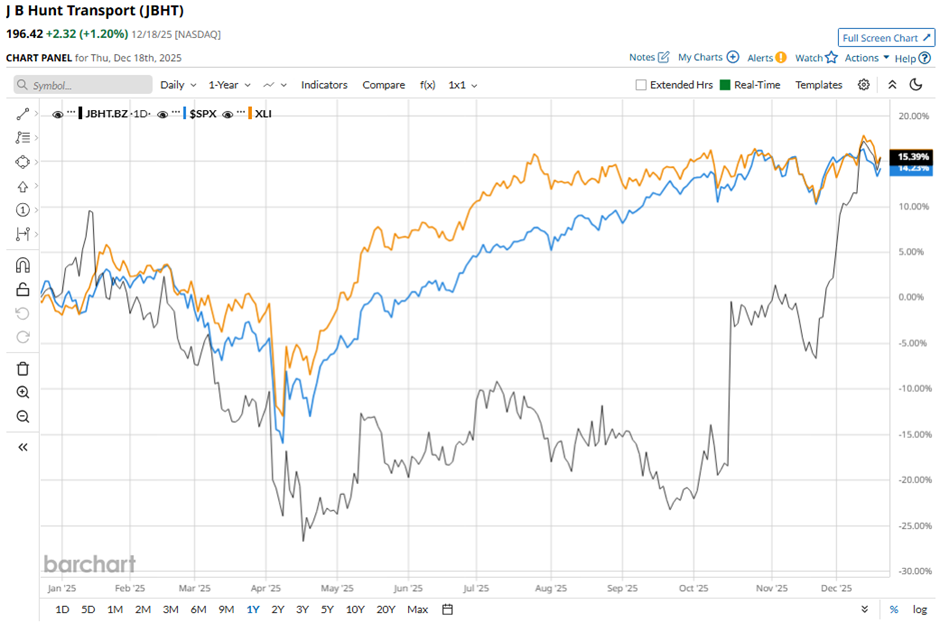

JBHT's shares increased 15.3% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.4% gain and the Industrial Select Sector SPDR Fund's (XLI) 16.7% return on a YTD basis.

Shares of JBHT climbed 22.1% following its Q3 2025 results on Oct. 15. The company delivered stronger-than-expected revenue of $3.05 billion and EPS of $1.76. Investors responded positively to clear evidence of structural cost reductions and productivity improvements across key segments, including 12% operating income growth in Intermodal, 9% operating income growth in DCS, and a sharply narrowed loss in ICS.

Analysts' consensus rating on J.B. Hunt Transport stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 25 analysts covering the stock, opinions include 13 "Strong Buys," one "Moderate Buy," 10 "Holds," and one "Moderate Sell."

As of writing, it is trading above the average analyst price target of $174.39.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart