Streaming stocks have long been a favorite among growth-focused investors, especially as global demand for on-demand entertainment continues to rise. Over the past decade, the sector has reshaped how movies and television reach audiences, while deal-making and consolidation have increasingly become key levers for scaling content libraries, global reach, and long-term revenue growth.

At the center of that shift is Netflix (NFLX), one of the companies that started live streaming and is now once again testing investors’ confidence with its proposed deal for key Warner Bros. (WBD) assets. In a recent letter to employees, Netflix’s co-CEOs framed the agreement as a growth-driven move, arguing it strengthens one of Hollywood’s most recognizable studios while expanding Netflix’s footprint beyond streaming into theatrical releases.

With NFLX stock already pricing in years of success, the question for investors heading into 2026 is whether this bold bet can extend Netflix’s growth story. Let's find out.

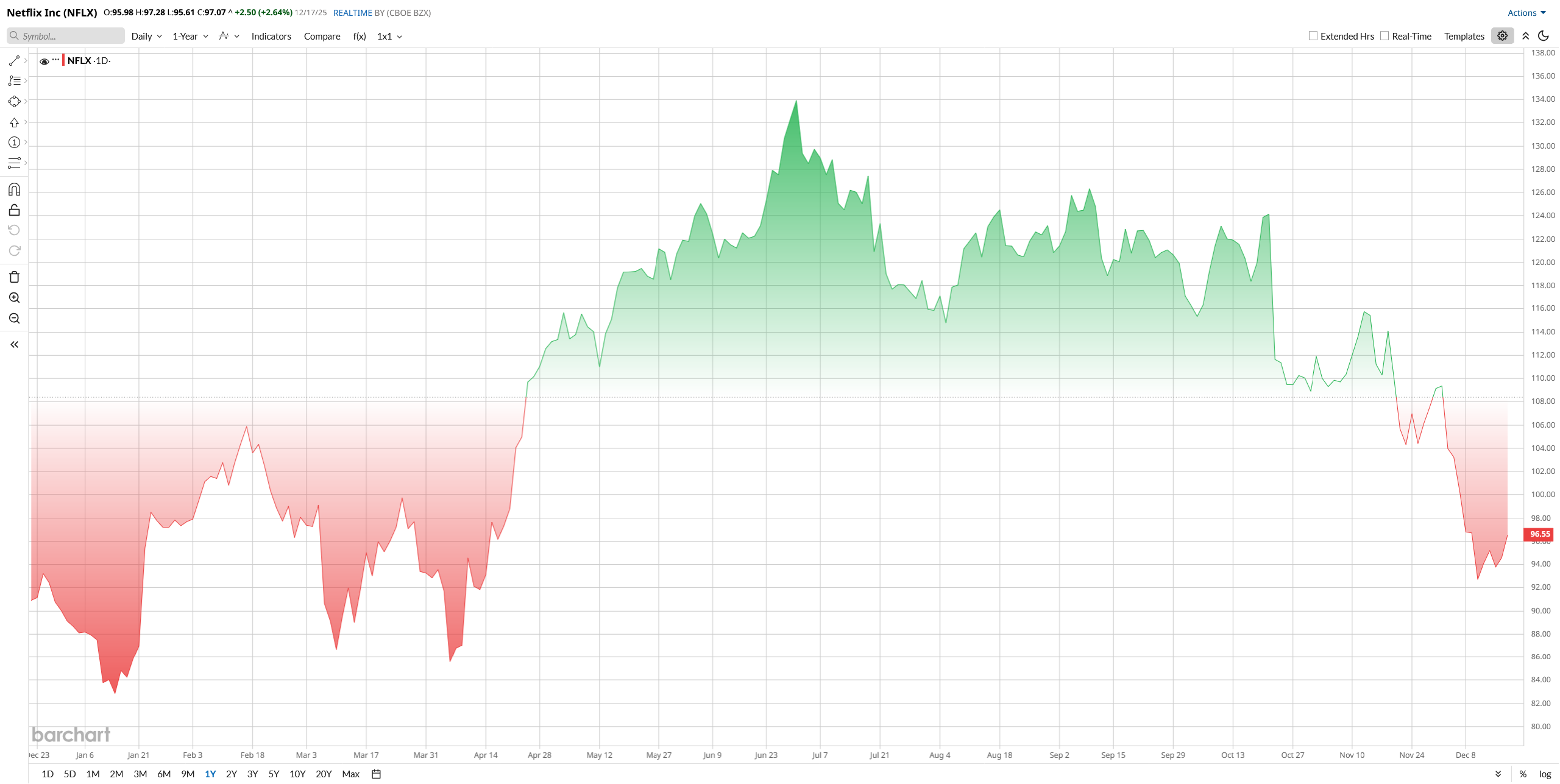

Netflix Stock Performance

Founded in 1997, Netflix is a global entertainment company offering TV series, films, documentaries, and games across more than 190 countries. After dominating streaming, Netflix is now pursuing its next growth phase with the Warner Bros. deal, which shows a strategy to expand premium content, embrace theatrical releases, and strengthen long-term growth prospects.

Valued at about $430 billion by market cap, Netflix’s share price climbed modestly in 2025. After an early-year rally driven by subscriber growth and price hikes, the stock peaked near all-time highs in June before pulling back. As of now, Netflix is roughly 8% up year-to-date (YTD) but has fallen roughly 20% since the June high amid concerns over its rich valuation and the proposed Warner Bros. deal.

No doubt that Netflix trades at premium multiples. Its trailing price-to-earnings ratio is about 39 times, well above the media and tech median of 17 times. Enterprise-value-to-EBITDA is roughly 14 times versus a sector median of around 9 times, and price-to-sales runs about 9.4 times compared with a typical 1.2 times. So currently, Netflix looks expensive relative to peers and the broader market.

Warner Bros. Acquisition News

Netflix has agreed to buy Warner Bros. Discovery’s studios and HBO assets for about $83 billion, offering roughly $27.75 per share in a mix of cash and stock. The deal followed a competitive bidding process that included Paramount-Skydance and Comcast (CMCSA), with Netflix ultimately emerging as the winner.

After the announcement, Netflix shares slipped modestly, which is common when a company makes a large acquisition. Investors also pointed out that Warner Bros. Discovery shares were trading well below the offer price, signaling concerns about whether the deal will close. U.S. officials have raised antitrust questions, adding another layer of uncertainty.

Inside the company, Netflix executives told employees the deal is meant to strengthen long-term growth. They said the acquisition would significantly expand Netflix’s content library and global reach and stressed that it is not expected to lead to job cuts.

If completed, the deal would greatly boost Netflix’s film and TV pipeline, but it also brings regulatory hurdles and integration risks that investors are watching closely.

Netflix Advertising Revenue Hits Record in Q3

Netflix reported third-quarter fiscal 2025 results on Oct. 21, which came below analysts' expectations but showed notable growth. Paid streaming revenue came in at $11.51 billion, up about 17% year-over-year (YoY), driven by strong subscriber growth and higher average revenue per user.

Operating income was $3.25 billion, roughly up 12% YoY, yielding an operating margin of 28.2%. Results missed a 31.5% margin target after a one-time tax charge in Brazil. Net income totalled $2.55 billion, up about 8%, and diluted EPS landed at $5.87, which was about a 9% increase YoY.

The balance sheet remains the showstopper for the company. Free cash flow rose to $2.66 billion, an increase of about 21%. Netflix ended the quarter with roughly $9.29 billion in cash and equivalents against about $14.5 billion of gross debt. During the quarter, the company repurchased about $1.9 billion of its stock.

Q3 was the company’s best-ever advertising quarter; management says ad revenue is on track to more than double in 2025. Hit content is bolstering engagement: the film KPop Demon Hunters became Netflix’s most-watched movie ever, and U.S. TV-viewing share hit record highs. Netflix is also expanding into live events and gaming, e.g., streaming major boxing matches and additional NFL games.

As we look ahead, management reaffirmed full-year 2025 revenue near $45.1 billion, about 16% growth, and forecast roughly 17% revenue growth and a 24% operating margin for Q4. Netflix offered no guidance for fiscal 2026, but Wall Street’s 2025 EPS consensus sits near $24.6.

What Do Analysts Say About NFLX Stock

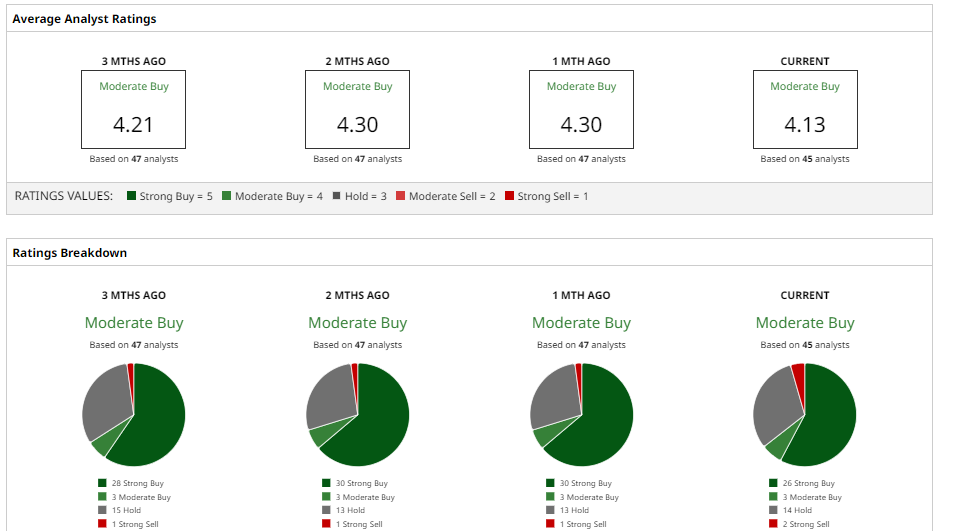

Wall Street sentiment remains cautiously optimistic toward NFLX stock, with several major firms highlighting its growth momentum even as the Warner Bros. Discovery deal adds uncertainty.

Morgan Stanley raised its 12-month target to $150, saying Netflix’s steady subscriber growth, pricing power, and improving ad-tier economics set it apart from legacy media. The bank says Netflix is “playing offense” and that the Warner acquisition could deepen content strength if integrated carefully.

Wedbush moved its target to $140, highlighting expanding free cash flow and durable margins. The firm believes Netflix’s scale and track record could let it absorb large content assets and unlock new theatrical and franchise revenue while flagging execution risk.

Goldman Sachs lifted its target to $114, and J.P. Morgan kept an “Overweight” stance with a $124 target, both pointing to healthy fundamentals and continued monetization levers.

Overall, NFLX holds a consensus “Moderate Buy” rating from the 45 analysts covering the stock. The average 12-month price target set by the group is $129.37, which implies an expected 34% upside potential.

So, in my opinion, Netflix’s recent quarter and strategic announcements point to continued growth in 2026, which is clearly supported by strong subscriber metrics, a booming ad tier, and an aggressive content pipeline. Moreover, the stock is already trading much below its actual price, so there's plenty of room to grow. However, NFLX is already at such a rich premium, and the massive Warner Bros. acquisition carries major execution and regulatory risk.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.