DTE Energy Company (DTE) is a diversified energy company engaged in the development and management of energy-related businesses and services across the United States, including regulated electric and natural gas utilities as well as non-utility energy operations. Headquartered in Detroit, Michigan, DTE serves approximately 2.3 million electricity customers and 1.3 million natural gas customers in Michigan through its primary utility subsidiaries, while also participating in industrial energy projects, energy marketing, and trading. Its market cap is around $26.7 billion.

Companies with a market cap of $10 billion or more are generally described as “large-cap stocks,” and DTE Energy fits that category, with its market cap exceeding that threshold, reflecting its substantial size and influence in the regulated electric industry.

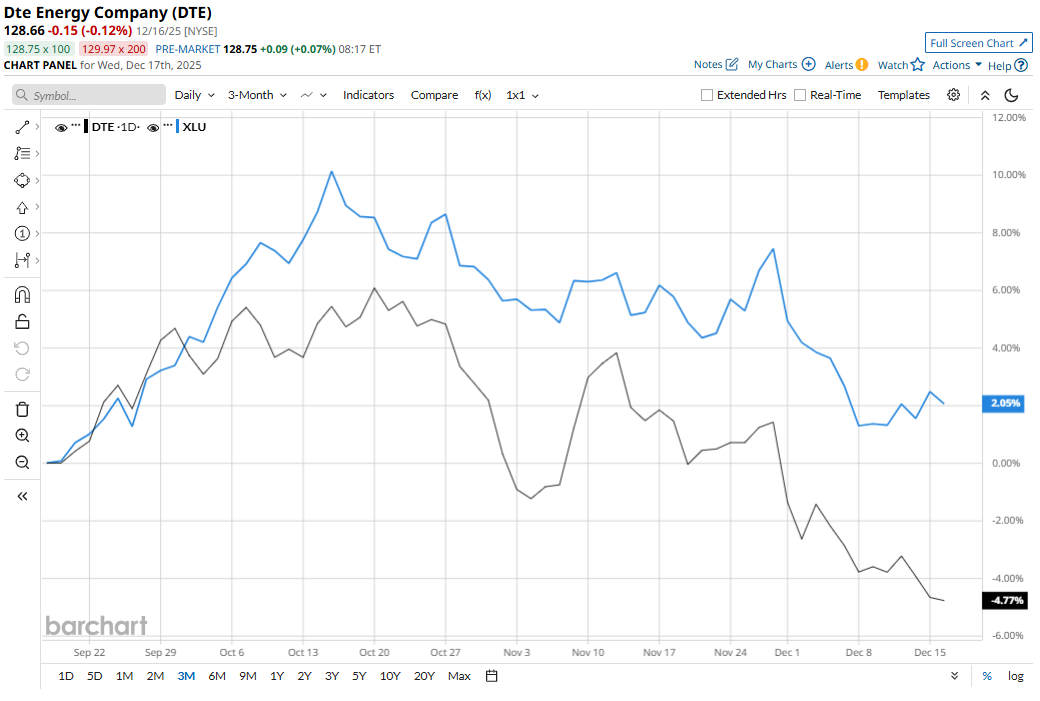

DTE touched its 52-week high of $143.79 on Oct. 7 and is now trading 10.5% below that peak. The stock declined 4.7% over the past three months, lagging behind the Utilities Select Sector SPDR Fund’s (XLU) 2.3% gains during the same time frame.

Over the longer term, DTE has trailed behind XLU. DTE gained 6.7% over the past 52 weeks and 6.6% in 2025, underperforming XLU’s 12.5% gains over the past year and 14% returns on a YTD basis.

While the stock has mostly traded above the 200-day moving average over the past year, it has dropped below the line in December. The stock has been trading below the 50-day moving average since mid-November.

DTE Energy stock is declining lately, amidst market concerns over data center development issues and recent analyst adjustments. Specifically, JPMorgan lowered its price target for DTE from $151 to $145 on Dec. 11, reflecting a conservative near-term outlook. Furthermore, recent protests and regulatory scrutiny regarding the utility’s proposed data center contracts, are creating market uncertainty and putting pressure on the stock price.

DTE Energy’s competitor Dominion Energy, Inc. (D), has outperformed DTE. D gained 11.1% over the past year and 10.5% in 2025.

Among the 17 analysts covering the DTE stock, the consensus rating is a “Moderate Buy.” The mean price target of $150.54 represents a potential upside of 17% from current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.