International Business Machines (IBM) has been a participant in the AI-driven rally in tech stocks. For the year, IBM stock has trended higher by almost 40%.

With the recent earnings beat and a positive outlook for Q4 2025, IBM stock is likely to maintain the bullish momentum. Amidst this background, IBM has also announced that it will be cutting thousands of jobs in Q4.

However, this is unlikely to impact the company’s growth, as the job cuts are in sync with the industry trend of improving productivity and increasing reliance on AI tools. As markets continue to focus on improving financials, IBM looks attractive.

About IBM Stock

IBM is a provider of services and solutions globally in the software, consulting, and infrastructure segments. In the dynamic world of technology, the company has made inroads in the AI, cloud, and quantum computing businesses. IBM remains high on R&D with 19 research facilities across six continents.

For Q3 2025, IBM reported revenue growth of 9% on a year-on-year (YoY) basis to $16.3 billion. Further, with the AI business gaining traction, IBM has guided for full-year revenue growth exceeding 5%.

Amidst these positive developments, IBM stock has trended higher by 20% in the last six months.

Strong Q3 Results and a Positive Outlook

IBM delivered a double beat for Q3 2025 on the revenue and earnings per share front. Revenue increased by 7% on a YoY basis to $16.3 billion. Further, EPS growth (operating) was robust at 15%. Healthy growth was attributed to innovation coupled with a diversified portfolio.

Besides the headline numbers, there are three important points to note:

- IBM has guided for full-year free cash flows of $14 billion. This provides the company with high flexibility for innovation, dividends, and potential acquisitions. In October, IBM acquired Txture to boost its cloud services. It’s worth adding here that IBM closed Q3 2025 with cash and equivalents of $14.9 billion.

- The company ended Q3 with an AI book of business at more than $9.5 billion. This is a good indicator of the AI momentum accelerating and is likely to translate into healthy top-line growth.

- Besides the highest revenue growth in several years, IBM reported sequential acceleration across segments. Further, revenue growth for the Americas and EMEA was 9% on a YoY basis. While Asia Pacific reported flat YoY numbers, the region holds potential to be a growth catalyst.

What Analysts Say About IBM Stock

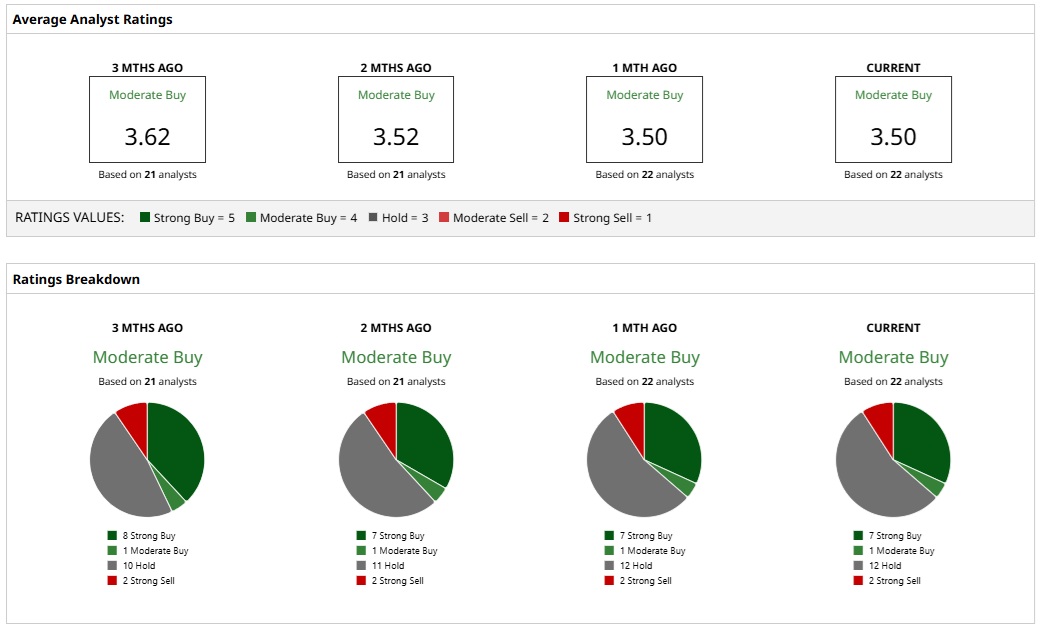

Based on the rating of 22 analysts, IBM stock is a consensus “Moderate Buy.”

Seven analysts have assigned a “Strong Buy” rating, one gives it a “Moderate Buy,” 12 analysts opine that IBM stock is a “Hold,” and two say “Strong Sell.” Further, based on these ratings, the average price target for IBM stock is $286.10. From current levels, this would imply a downside potential of 6.7%.

However, if we look at some of the bullish views, Wedbush has an “Outperform” rating with a price target of $325. Similarly, Stifel has reiterated its “Buy” rating after the announcement of Q3 2025 results.

Back in October, Goldman Sachs listed the top technology stocks in terms of capex and R&D. IBM was among the featured names with 6% of capex and R&D as a percentage of the company’s market capitalization. Robust investments are likely to translate into earnings growth acceleration in the coming years.

It’s worth noting that IBM stock trades at a forward price-earnings ratio of 27. As the AI momentum accelerates for the company, valuations seem attractive. Further, IBM offers an annualized dividend of $6.72, which translates into a healthy yield of 2.2%. Given the growth momentum, it’s likely that dividends will continue to increase in the long term.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart