Getty Images (GETY) is known for bringing exclusive coverage to major cultural events like Coachella Valley Music & Arts Festival and The Met Gala. It was recently named the official photography partner to the British Film Institute. These relationships show how Getty stays close to global culture and entertainment.

Now, the company is making headlines for its latest move. Getty just secured a multi-year, global agreement with Perplexity AI, which processes 150 million queries each week. The deal instantly caught Wall Street’s attention as Getty shares surged to $3.21 after the announcement. Analysts say the stock could jump over 120%, reflecting optimism and belief in Getty’s AI strategy.

Getty’s push into AI licensing is being recognized not just for growth potential, but as a move to set new standards for attribution and creator recognition in the AI era. With the Perplexity partnership, Getty shows it’s ready to innovate and capture fresh growth. Investors are watching closely. Will Getty’s creative assets and new tech deals truly unlock lasting value? Let’s find out.

GETY’s Financial Value

Getty Images helps companies and creatives worldwide find visuals for ads, marketing, news, and branding needs.

Getty’s shares are still down 12.96% year-to-date (YTD) and have lost 53.47% over the last year.

The company’s $779.8 million value and $1.97 billion enterprise valuation reflect its scale relative to the sector’s typical price-sales ratio of 1.25x, compared to Getty’s lower 0.89x, which suggests better value for investors.

This Aug. 8, 2025, earnings report captures the operational fundamentals. This quarter’s revenue hit $234.9 million, up 2.5%, with 1.8% growth on a currency-neutral basis. It shows creative sales dropped 5.1% to $130.8 million, while editorial gained 5.6% to reach $88.3 million. That annual subscription revenue climbed to 53.5% of total, rising from 52.9% in Q2 2024 and highlighting a strengthening recurring stream.

This quarter’s net loss reached $34.4 million, compared with a net income of $3.7 million a year ago. It reflects a $57.2 million increase in foreign exchange loss from Euro Term Loan revaluation. The results also incorporate $10.9 million less operating income, much of it linked to $14.4 million in merger expenses.

This net loss margin of 14.6% has shifted from last year’s 1.6% income margin. It was partially offset by a $22.2 million non-GAAP adjusted net income, jumping from $7.1 million last year. This adjusted EBITDA came in at $68.0 million and retains a robust 28.9% margin, ever so slightly lower than last year’s 30.0%.

It’s important that adjusted EBITDA, less capex, registered $51.9 million, with a 3.0% dip year-over-year (YOY). The company posted $6.5 million in net cash from operations, substantially less than $46.4 million last year. This quarter’s free cash flow was negative $9.6 million, after last year’s $31.1 million positive result. The cash balance at June 30, 2025, stands at $110.3 million, down from both December and June 2024 periods. It is explained by ongoing voluntary debt payments, Euro term loan amortization, and recent refinancing. The company holds $260.3 million in liquidity, supported by an undrawn $150 million revolver.

Getty’s AI and Digital Expansion

On Oct. 31, 2025, the Getty-Perplexity global multi-year licensing deal was unveiled, granting Perplexity full access to Getty’s vast library of both creative and editorial imagery through an API solution. What makes this partnership so notable is its focus on proper content attribution and creator recognition, directly responding to growing criticism of AI platforms using copyrighted content without compensation.

And yet, Getty Images hasn’t stopped there. The company is acquiring Shutterstock (SSTK) in a transformative move to create a $3.7 billion visual content giant. This merger is expected to deliver a much broader portfolio for businesses: more imagery, video, music, 3D assets, and a wider range of creative solutions.

Craig Peters, Getty’s CEO, spoke of enhanced product offerings and expanding content libraries, echoing similar optimism from Shutterstock’s CEO, Paul Hennessy. When the deal closes, Getty shareholders will own 54.7% of the new entity, while Shutterstock holders get 45.3%, solidifying Getty’s place at the forefront of the visual content ecosystem.

The company’s ambition to accelerate digital distribution was also on display in late October with Webflow Marketplace integrations. Getty and iStock rolled out branded apps enabling agencies and professionals to license images and videos directly inside Webflow’s visual development platform. This could cut asset sourcing time by up to 40%, streamline creative workflows, and open fresh licensing opportunities within the booming no-code and low-code software sector.

Getty’s Bullish Path Forward

Getty Images is heading into its next earnings release set for Nov. 10, 2025. Analysts are already setting the stage with a consensus earnings estimate of $0.04 for both the current and next quarter. For the full fiscal year, estimates stand at -$0.25, while 2026 could swing back up to $0.13.

This marks a projected YOY growth rate of +500% for the next quarter, though 2025 as a whole dips -412.5%. The following year, growth could rebound 152%, reflecting wide expectations for a turnaround.

Management guidance for 2025 sees revenue between $931 million and $968 million. So YOY, that means Getty expects a shift between -0.9% and 3.1%, with currency-neutral growth ranging from -1.0% to 3.0%.

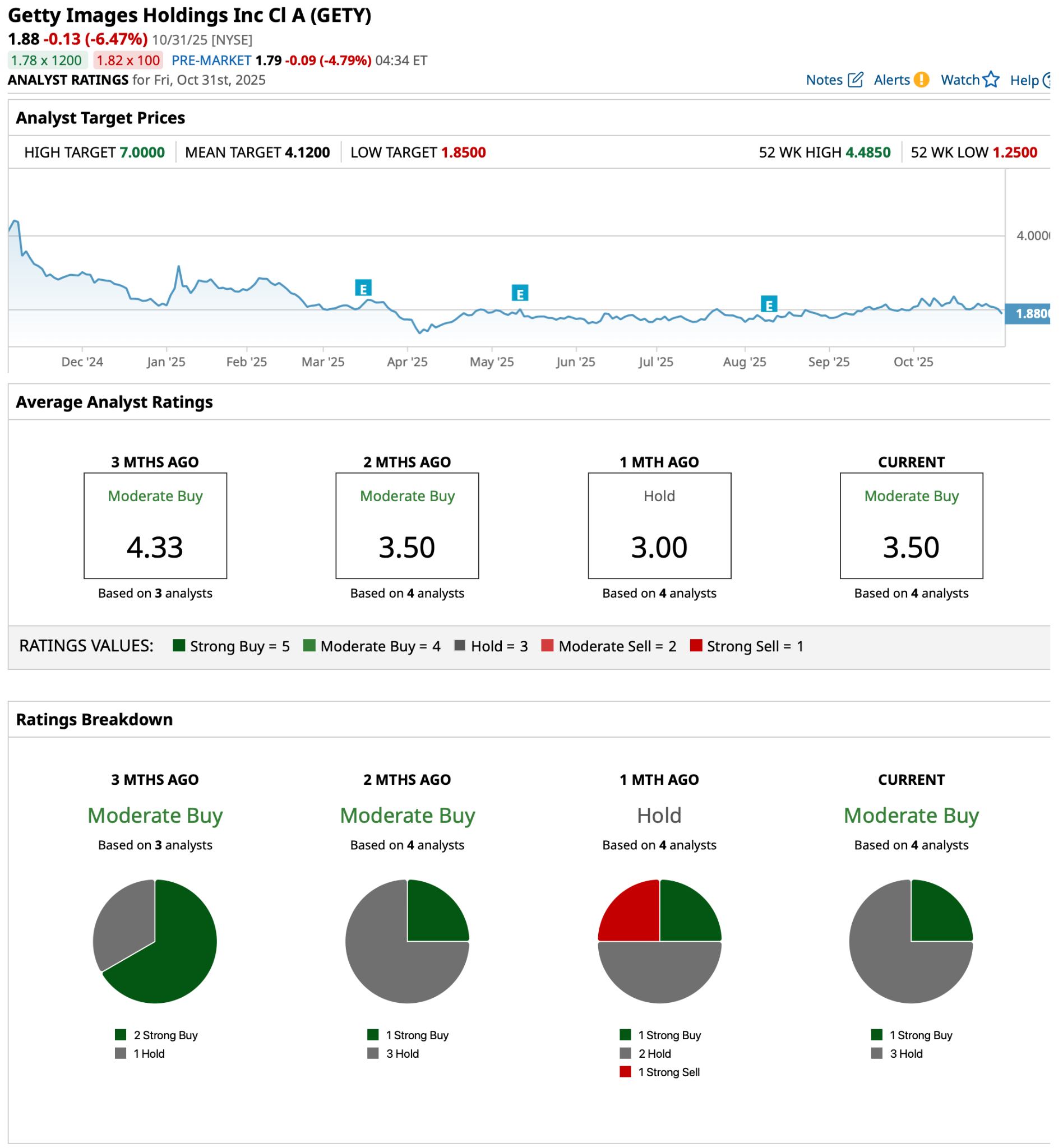

The real story, however, comes when you look at Wall Street’s reaction. All four analysts surveyed by barchart.com rate Getty as a “Moderate Buy.” The average price target is marked at $4.12, hinting at about 123% upside from the current price

Conclusion

Getty's latest AI partnership could be exactly what turns sentiment around. Most signs point to further upside, considering analysts see a potential 123% gain from here. The tech and content deals are lining up, and expectations ahead of earnings are starting to build momentum. Right now, shares look positioned to climb higher, especially if the company delivers on performance and keeps surprising with new strategic moves.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart