Boasting a market cap of $1.6 trillion, Broadcom Inc. (AVGO) is a global semiconductor and infrastructure software company known for powering the behind-the-scenes technology that keeps modern computing, connectivity, and enterprise systems running. The Palo Alto, California-based company designs and supplies a wide portfolio of products, including chips used in data centers, networking equipment, smartphones, broadband devices, storage systems, and cybersecurity solutions.

Companies valued over $200 billion are generally described as “mega-cap” stocks, and Broadcom fits right into that category. With a business model built on high-performance chips, long-term customer contracts, and mission-critical enterprise software, Broadcom has become one of the world’s largest and most profitable tech companies. Its products sit at the heart of growing areas like AI data centers, 5G networks, hyperscale computing, and cloud automation, helping drive steady cash flow and shareholder returns through dividends and buybacks.

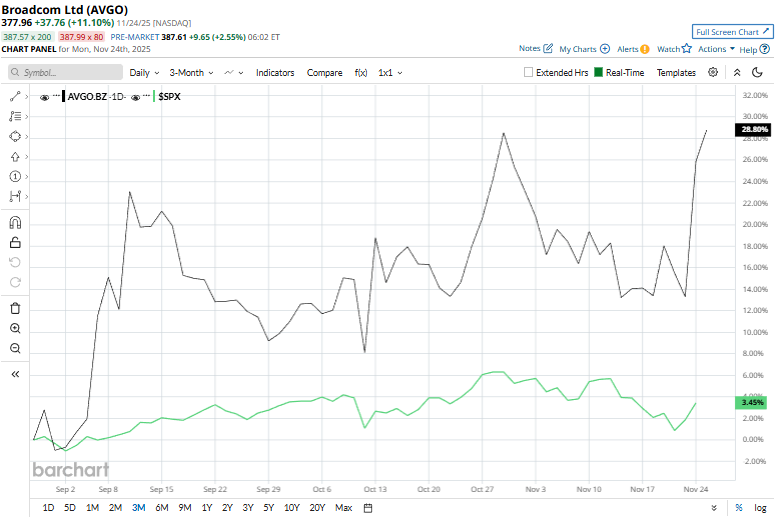

AVGO shares have dipped 2.2% from their 52-week high of $386.48 recorded recently on Oct. 30. Over the past three months, shares of AVGO have surged 28.6%, surpassing the S&P 500 Index ($SPX) 3.5% surge during the same time frame.

In the longer term, the chipmaker has risen 63% on a YTD basis, outperforming SPX’s 14% rise. Moreover, shares of AVGO have climbed 130.1% over the past 52 weeks, compared to SPX’s 11% rise over the same time frame.

Despite recent fluctuations, AVGO stock has been trading mostly above its 50-day and 200-day moving averages since the end of May, indicating an uptrend.

Broadcom has outpaced the market over the past year largely because it sits at the center of the AI-infrastructure boom. Explosive demand for its custom AI accelerators and high-speed Ethernet networking has also fueled rapid growth, with AI semiconductor sales surging and networking products widely deployed in hyperscale data centers.

On Nov. 24, shares of Broadcom surged 9% after reports showed Alphabet Inc. (GOOGL) is increasingly relying on Broadcom-co-designed Tensor Processing Units (TPUs) to power its new Gemini 3 AI model, helping it outperform rivals. Additionally, analyst sentiment added to the momentum, with HSBC boosting its price target to $535 while reiterating a “Buy” rating, and Raymond James assigning an “Outperform” rating, highlighting how AI demand continues to reshape the semiconductor industry.

In comparison with its rival, NVIDIA Corporation (NVDA) has performed weaker than AVGO, with a 35.9% increase in 2025 and 28.6% gains over the past 52 weeks.

As a result, analysts are very bullish about its prospects. The stock has a consensus rating of “Strong Buy” from 40 analysts covering it, and the mean price target of $400.78 implies a 6% upside from current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart