BlackRock, Inc. (BLK) is a global investment management firm headquartered in New York City. It specializes in asset management and provides risk management and advisory services to a diverse client base worldwide. With offices in multiple countries, BlackRock serves institutional and individual investors through a broad range of investment products and technology solutions.

The company’s operations emphasize innovation in asset management, personalized financial advice, and global market reach to optimize client portfolios. BlackRock has a market capitalization of $157.43 billion.

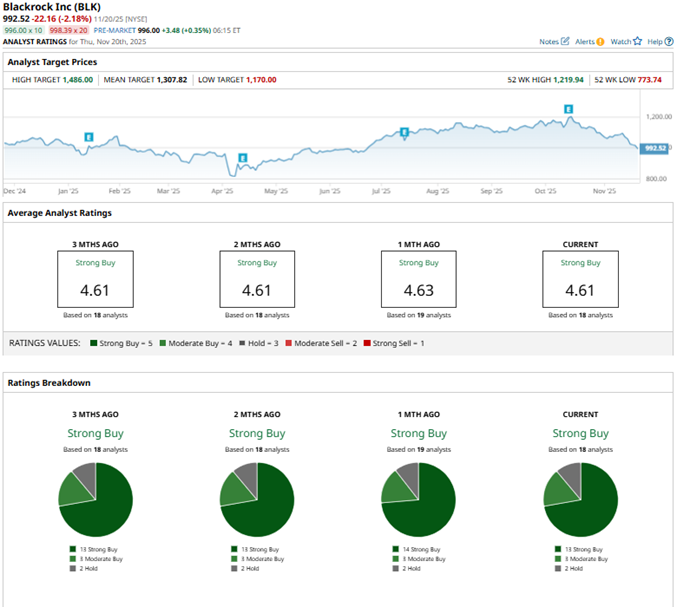

Overall macroeconomic conditions, including concerns about inflation and interest rates, have taken a toll on BlackRock’s stock. Over the past 52 weeks, the stock has declined by 3.1%, while it has been down marginally over the past six months. It had reached a 52-week high of $1,219.94 in October, but is down 18.6% from that level.

On the other hand, the S&P 500 Index ($SPX) has gained 10.5% and 10.1% over the same periods, respectively, indicating that the stock has underperformed the broader market over these periods. Next, we compare the stock with its own sector. The Financial Select Sector SPDR Fund (XLF) gained 3.2% over the past 52 weeks but dropped marginally over the past six months, indicating the stock has underperformed its sector over the past year.

On Oct. 14, BlackRock reported its third-quarter results for fiscal 2025. The company reported strong net inflows. Its quarterly total net inflows were $205 billion, driven by a record quarter for iShares ETFs. BlackRock also reported 10% annualized organic base-fee growth in the quarter, once again reflecting strength in the iShares ETFs.

The company’s quarterly revenue increased 25% year-over-year (YOY) to $6.51 billion. Its assets under management (AUM) increased 17% from the prior year’s period to $13.46 trillion. BlackRock’s adjusted EPS was $11.55, up 1% YOY and above the $11.31 analysts had expected.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect BlackRock’s EPS to grow 9.5% YOY to $47.75 on a diluted basis. Moreover, EPS is expected to increase 12.9% annually to $53.91 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

Among the 18 Wall Street analysts covering BlackRock’s stock, the consensus is a “Strong Buy.” That’s based on 13 “Strong Buy” ratings, three “Moderate Buys,” and two “Holds.” The ratings configuration is less bullish than it was a month ago, with 13 “Strong Buy” ratings, down from 14 previously.

Following the release of BlackRock’s Q3 results, analyst William Katz from TD Cowen maintained a “Buy” rating on the company’s stock, with a price target of $1,407. Similarly, Deutsche Bank analyst Brian Bedell maintained a “Buy” rating on BlackRock’s stock and gave a price target of $1,312.

BlackRock’s mean price target of $1,307.82 indicates a 31.8% upside over current market prices. The Street-high price target of $1,486 implies a potential upside of 49.7%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart