With a market cap of $18.2 billion, Bunge Global SA (BG) is a worldwide agribusiness and food company operating across four major segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The company processes and supplies a wide range of agricultural commodities, food ingredients, and bioenergy products.

Shares of the Chesterfield, Missouri-based company have underperformed the broader market over the past 52 weeks. BG stock has risen 3.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.7%. However, shares of the company have increased 20.9% on a YTD basis, outpacing SPX’s 13.4% rise.

Narrowing the focus, shares of the agribusiness and food company have exceeded the Consumer Staples Select Sector SPDR Fund’s (XLP) nearly 4% dip over the past 52 weeks.

BG shares recovered 1.8% on Nov. 5 as the company’s Q3 2025 adjusted EPS of $2.27 beat expectations. Investor sentiment improved as the completed Viterra acquisition sharply boosted volumes, driving a 67% increase in soy processing and refining profit and more than doubling softseed processing profit, alongside a 56% profit increase in grain merchandising and milling. Confidence was further supported by Bunge reaffirming its full-year adjusted EPS guidance of $7.30 - $7.60.

For the fiscal year ending in December 2025, analysts expect Bunge’s adjusted EPS to decline 18.5% year-over-year to $7.49. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

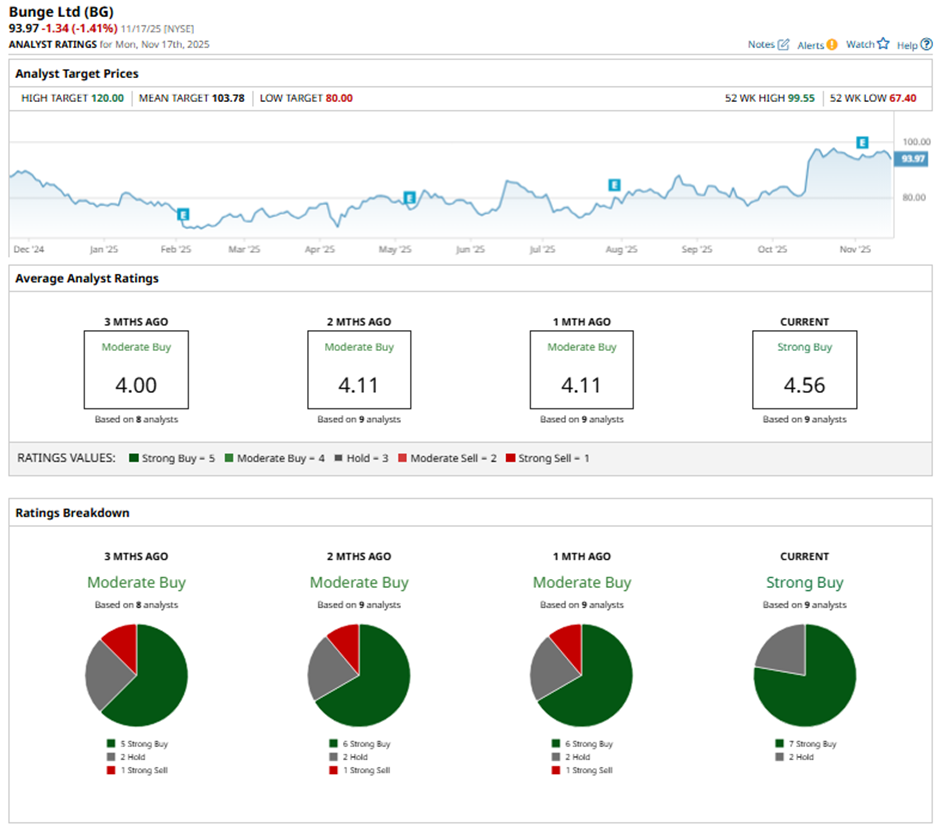

Among the nine analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on seven “Strong Buy” ratings and two “Holds.”

This configuration is more bullish than three months ago, with five “Strong Buy” ratings on the stock.

On Nov. 6, J.P. Morgan analyst Thomas Palmer maintained a “Buy” rating on Bunge Global and reaffirmed a $109 price target.

The mean price target of $103.78 represents a premium of 10.4% to BG's current price. The Street-high price target of $120 suggests a 27.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment