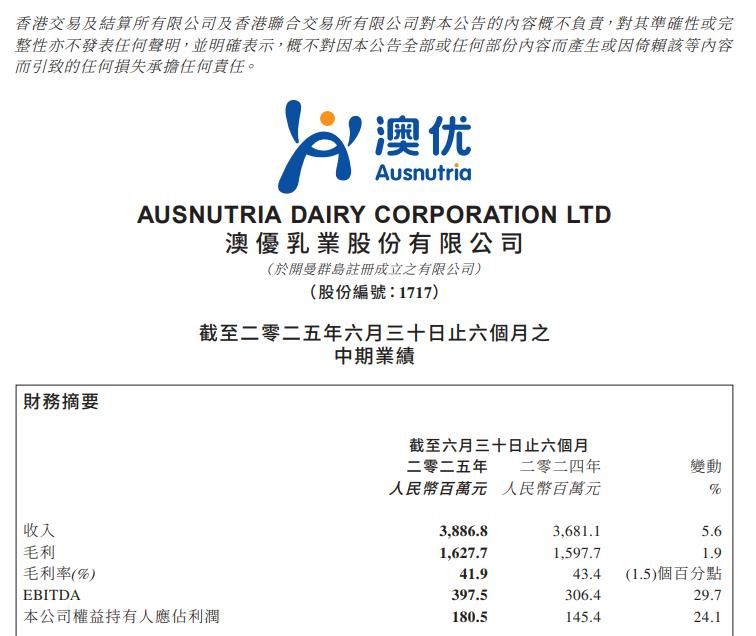

According to the announcement, in the first half of 2025, facing a complex and volatile global economic landscape and intensifying competition in China's infant milk formula market, Ausnutria steadily advanced the “milk formulas + nutrition products” family nutrition strategy, further enhancing product strength, brand power, channel capabilities, digital intelligence and organizational capacity. With consumer trust, support from all sectors of society and the collective efforts of every employee of Ausnutria, revenue and profits continued the dual growth trend. Through unwavering perseverance as well as steady and solid steps, the Company is advancing toward a new phase of high-quality development.

In terms of segmentation, Ausnutria's own-branded infant formula business recorded total revenue of approximately RMB2,826 million. Within this, the goat milk formula business delivered revenue of RMB1,865 million, up 3.1% year on year, with its market‑leading position remaining solid. According to Nielsen IQ, as of end‑June, the Company’s market share in China’s goat milk infant formula market increased by 2.8 percentage points year on year to 30.4%. In 2024, the Company also captured 84% share by both sales volume and sales value in China’s imported infant and toddler goat milk formula market and has maintained a market share of over 60% in this segment for seven consecutive years.[1] Meanwhile, Frost & Sullivan’s market research confirms that in 2024 Kabrita ranked No.1 globally in goat milk formula by both sales volume and sales value.[2] The cow milk formulas business achieved revenue of approximately RMB 961 million and the nutrition business achieved a 7.0% year-on-year increase in revenue and successfully expanded into overseas markets.

In terms of region, the goat milk formulas business of China achieved revenue of approximately RMB 1.381 billion in 2024. The international business of goat milk formulas achieved revenue of approximately RMB 483 million, representing a substantial year-on-year increase of 65.7%. With multiple growth drivers contributing to explosive expansion, the international business further elevated its share of total revenue from the Company's own-branded goat milk formulas business to 25.9%.

The announcement indicated that the Middle East continued to hold its position as Ausnutria's largest overseas sales market in the first half of 2025. Revenue in North America surged by over 138.7% year-on-year, becoming Ausnutria's second-largest revenue source of overseas markets, while revenue in the CIS region grew by 33.8% year-on-year. Ausnutria stated in the announcement that the overseas market of goat milk formulas business achieved a 65.7% year-on-year growth in the first half of the year, reaching new heights after maintaining a high double-digit compound growth rate over the past two years. The nutrition business has gained significant momentum in its strategic deployment, emerging as a key driver of the Company's development.

Data sources:

[1] NielsenIQ retail tracking data for imported infant and toddler goat milk formula. Period: 2018–2024 (seven consecutive years). Channel coverage: urban mother-and-baby specialty retail channel in the following provinces and municipalities: Shanghai, Jiangsu, Zhejiang, Anhui, Henan, Guangdong, Hunan, Hubei, Fujian, Jiangxi, Beijing, Tianjin, Heilongjiang, Jilin, Liaoning, Shandong, Shanxi, Hebei, Shaanxi, Sichuan, Chongqing, Guizhou, Yunnan and Guangxi.

[2] Frost & Sullivan, “Independent Research Report on the Global Goat Milk Formula Market” (April 2025). The confirmation is based on Frost & Sullivan’s research into the global goat milk formula market, including analysis of 2024 sales volume and sales value of major goat milk formula brands worldwide. The research data cover January–December 2024.

]]>

Copyright 2025 ACN Newswire . All rights reserved.