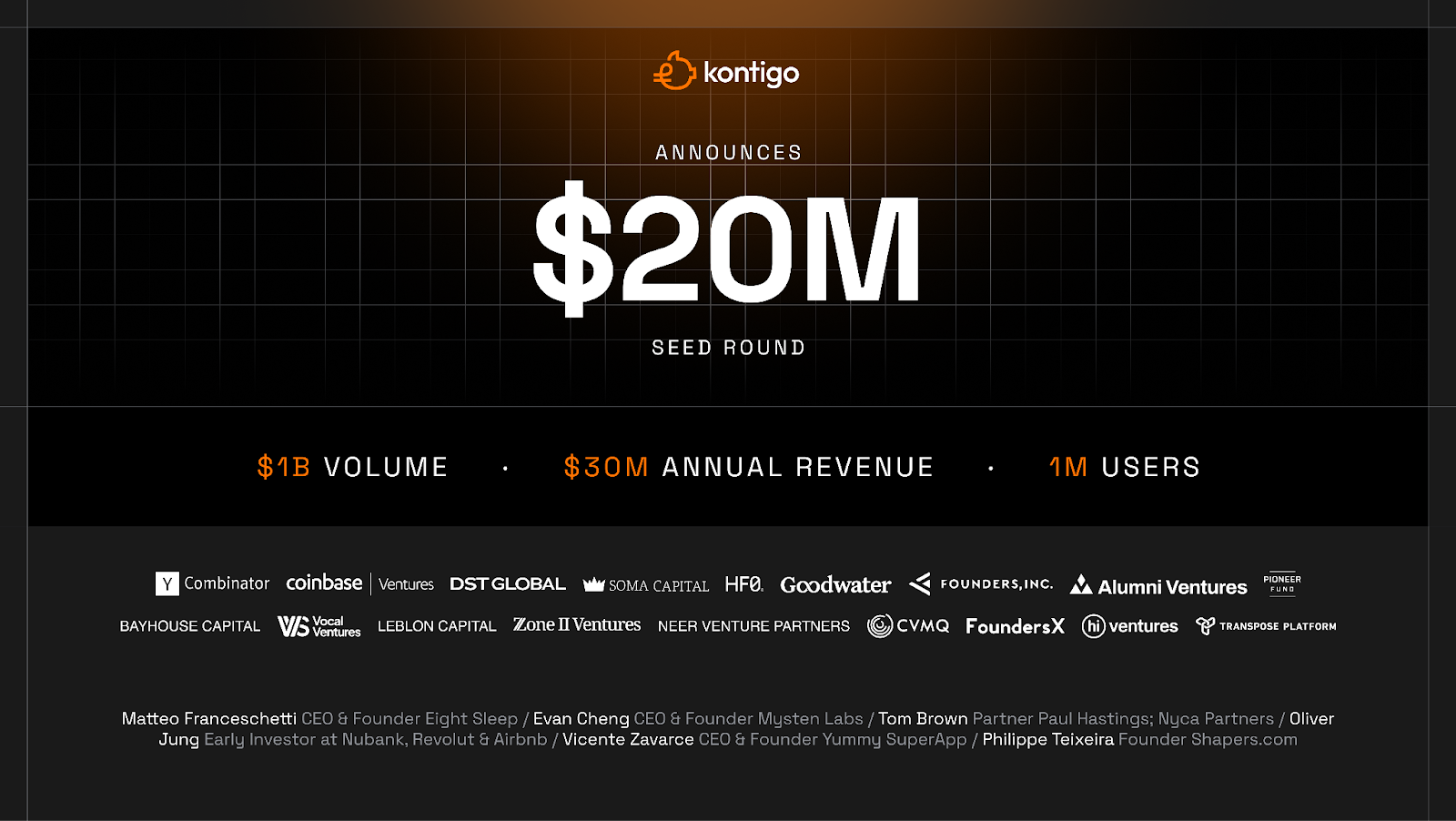

With $30M in annualized revenue, $1B in payment volume, and 1M active users in under 12 months, Kontigo is building the fastest-growing stablecoin neobank in the world.

SAN FRANCISCO, CA / ACCESS Newswire / December 22, 2025 / Kontigo, the fastest-growing stablecoin neobank targeting emerging markets, today announced the closing of a $20 million seed funding round. The investment will fuel product development, team expansion, and deeper penetration into high-growth regions where traditional banking falls short.

Launched less than 12 months ago, Kontigo has already achieved remarkable traction: $30 million in annualized revenue, over $1 billion in processed payment volume, and more than 1 million active users. Remarkably, this has been accomplished by a lean team of just seven - six engineers and one designer - leveraging blockchain infrastructure to deliver a fully self-custodial, decentralized banking experience.

Kontigo's platform allows any individual or business worldwide to access modern financial tools without the barriers of traditional banks. Users can earn up to 10% yield on USDC holdings, receive a stablecoin debit card with Bitcoin cashback rewards, activate USDT-backed credit lines, invest directly in tokenized U.S. stocks, and open international accounts instantly - at no cost. The app bridges local payment methods (banks, cards, or digital wallets) with global blockchain rails, enabling seamless, unlimited transfers across major corridors: U.S. to Latin America, Latin America to Asia, Asia to Europe, U.S. to Africa, and Europe to Latin America.

At its core, Kontigo is driving real-world cryptocurrency adoption. Everyday users - many of whom have never heard of USDC or USDT - are holding stable dollars for protection against inflation, investing in Bitcoin as a long-term wealth builder, and spending in local currencies or stablecoins. Over 1,000 businesses and 1 million individuals are already using the platform for remittances, savings, payments, and investments. This simple equation-invest in BTC, hold USDC, spend locally-is democratizing access to stable currency and financial growth for the 4.8 billion people in underserved markets who need it most.

"Normal people are using Kontigo every day without even knowing what USDC or USDT is," said Jesus Castillo, CEO and co-founder of Kontigo. "This is real-world crypto adoption: holding a stable dollar alongside Bitcoin as a wealth builder, then spending seamlessly in local currencies. We're democratizing access to basic finance for the 4.8 billion people who need stable money most."

Kontigo's blockchain-native architecture provides a decisive edge over legacy neobanks. Running entirely on decentralized infrastructure, the platform operates 24/7 with fractional costs, permissionless access, and no need for country-by-country banking licenses. This mirrors how Revolut scaled across Europe-but without the regulatory hurdles and overhead. As Castillo notes, "Just imagine how much faster Revolut would have grown if they didn't have to secure individual licenses in every market. That's the advantage Kontigo has from day one."

The company's origins add a compelling human element to its rapid rise. The founding team, shaped by experiences of economic scarcity and instability in their home regions, relocated to San Francisco and bootstrapped operations through grueling night shifts driving for Uber and delivering for DoorDash while coding during the day. That unrelenting drive transformed early struggles into explosive growth, proving the power of resilience in building a generational company.

"Kontigo is redefining banking for the next billion users in emerging markets. Their self-custodial, blockchain-powered model delivers unparalleled speed, cost efficiency, and accessibility-solving real pain points for millions facing inflation and remittance friction. Jesus and the team have demonstrated extraordinary execution, achieving massive scale with a tiny team. We're excited to partner with them as they build the defining neobank of the stablecoin era." Helen H. Liang, PhD, Founder and Managing Partner at FoundersX Ventures, which participated in the round, shared her enthusiasm.

The $20 million seed round drew support from a strong syndicate of investors, including FoundersX Ventures and other prominent funds and angels in the fintech space. Proceeds will be used to expand engineering and product teams, launch additional features like enhanced credit products and enterprise tools, and accelerate go-to-market efforts in key regions such as Latin America, Africa, and Southeast Asia-where demand for dollar stability and cross-border payments is surging.

In a world where traditional banks exclude billions due to high fees, slow transfers, and regulatory barriers, Kontigo stands out by putting users in full control of their assets. Its non-custodial approach ensures security and sovereignty, while high-yield savings and Bitcoin rewards incentivize long-term financial health. Early metrics underscore the model's resonance: from $1 million to $30 million in annualized revenue in recent months, with clear momentum toward $100 million and beyond.

Kontigo is headquartered in San Francisco and available globally via iOS and Android apps.

About Kontigo

Kontigo is the stablecoin super app for emerging markets, offering a self-custodial wallet with high-yield USDC savings, Bitcoin investments, global payments, credit lines, tokenized assets, and debit cards - all in one seamless experience. Built entirely on blockchain for borderless, low-cost finance, Kontigo bridges traditional systems and crypto to close financial gaps for billions. The platform is designed for real-life use cases, empowering users in high-inflation economies to save stably, grow wealth, and transact freely. Visit kontigo.lat or download the app to get started.

Media Contact:

Jesus Castillo

CEO & Co-founder

contact: jesus.castilloferrer@kontigo.lat

Website: https://www.kontigo.com/en

SOURCE: Kontigo

View the original press release on ACCESS Newswire